Key Points:

- Bitcoin ETFs See Consecutive Inflows: GBTC Records Smallest Outflow Since April.

- BlackRock IBIT Leads Top 10 with 70-Day Inflow Streak, Reflecting Institutional Confidence.

- Competitive Fee Plans Propel Interest: ETFs Accumulate $12,388.6 Billion Inflows, Holding 838,568 BTC.

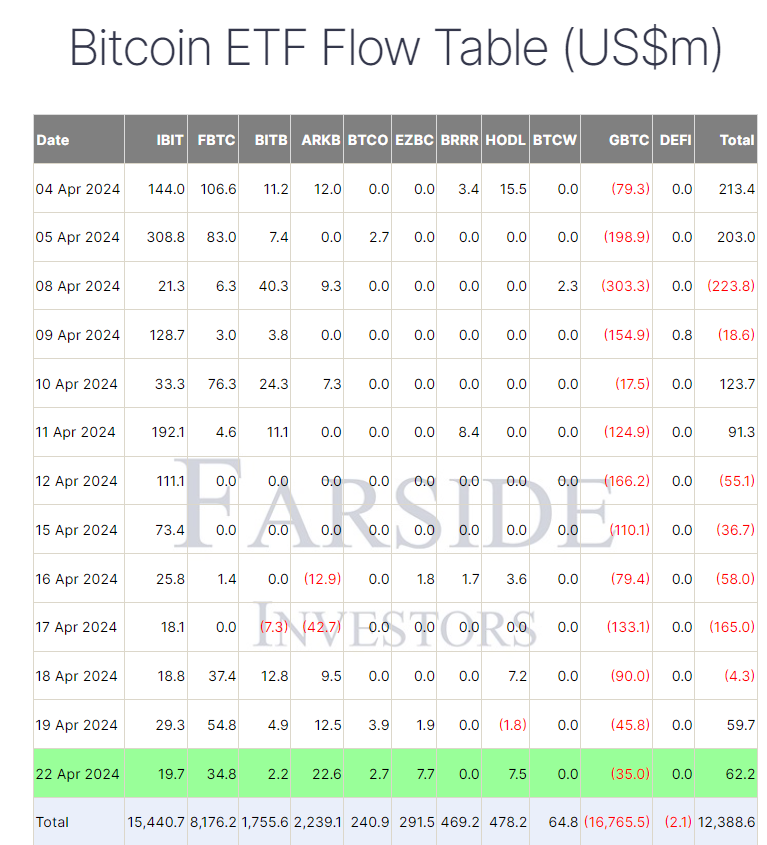

According to data from Farside, BlackRock Bitcoin ETFs witnessed a noteworthy net inflow of $62.2 million on April 22.

This marks consecutive net inflows for the first time since April 11. Meanwhile, Grayscale GBTC recorded a $35 million outflow, marking its smallest outflow since April 10. This trend might be influenced by Grayscale’s plans to introduce a mini-trust ETF with competitive fees of 0.15%, potentially contributing to the reduced outflow.

In contrast, BlackRock IBIT saw a net inflow of $19.7 million, further solidifying its position among the top 10 ETFs with an impressive streak of 70 consecutive days of inflows. The breadth of net inflows remains promising, with 7 out of 11 ETFs experiencing positive inflows. Collectively, these ETFs have accumulated a net inflow of $12,388.6 billion.

70-Day Inflow Streak Signals Institutional Trust

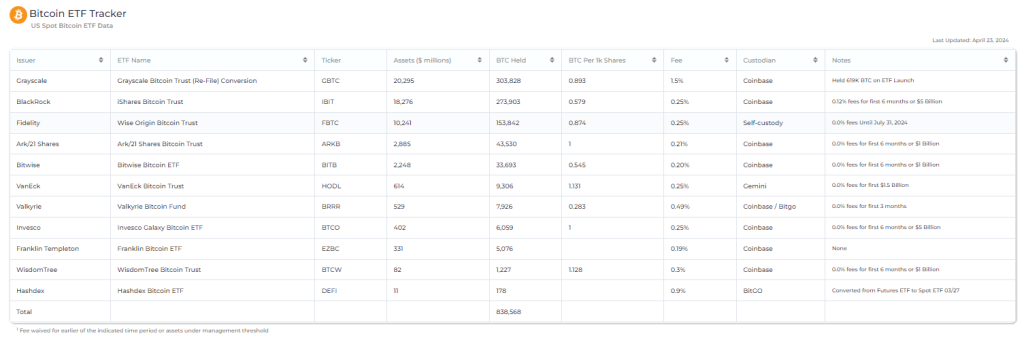

Heyapollo data reveals that the aggregate BTC holdings of these ETFs currently amount to 838,568 BTC. Specifically, GBTC holds 303,828 BTC, while IBIT holds 273,903 BTC, indicating a marginal difference of 29,925 BTC between the two.

These developments underscore the growing interest and confidence in Bitcoin among institutional investors, as reflected in the sustained inflows into Bitcoin ETFs. The competitive fee structure proposed by Grayscale for its mini-trust ETF could further stimulate investor participation and drive inflows. With BlackRock IBIT maintaining its impressive streak and a majority of ETFs experiencing positive flows, the outlook for Bitcoin ETFs remains optimistic in the near term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |