Key Points:

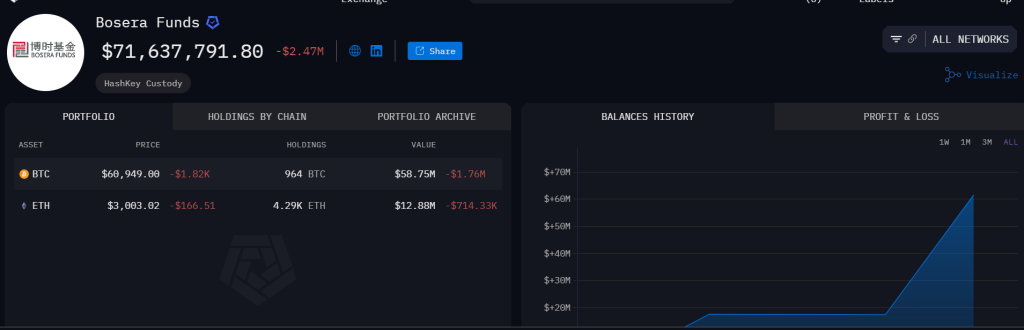

- ETF holds 964 BTC (~US$59M) and 4,290 ETH (~US$12.94M).

- Significant allocation reflects trust in Bitcoin and Ethereum’s long-term potential.

- Boshi HashKey ETF’s move highlights growing institutional interest in cryptocurrencies.

Boshi HashKey ETF has disclosed its impressive holdings, showcasing its substantial investment in Bitcoin (BTC) and Ethereum (ETH).

As of the latest report, the ETF boasts a significant portfolio, holding 964 BTC, valued at approximately US$59 million, and 4,290 ETH, with an estimated worth of US$12.94 million.

The revelation of Boshi HashKey ETF’s robust holdings underscores the growing institutional interest in cryptocurrencies, particularly Bitcoin and Ethereum. With Bitcoin serving as a digital store of value and Ethereum powering decentralized applications and smart contracts, these assets have garnered considerable attention from both retail and institutional investors seeking exposure to the burgeoning crypto market.

Boshi HashKey ETF Sets Example for Mainstream Crypto Investment

Boshi HashKey ETF’s decision to allocate a substantial portion of its portfolio to Bitcoin and Ethereum reflects its confidence in the long-term potential and value proposition of these digital assets. As cryptocurrencies continue to gain acceptance and adoption, institutional investors are increasingly recognizing their role as essential components of a diversified investment strategy.

Moreover, Boshi HashKey ETF’s sizable holdings in Bitcoin and Ethereum signal a vote of confidence in the resilience and stability of these assets amidst market fluctuations. Despite periodic volatility, Bitcoin and Ethereum have demonstrated remarkable resilience over the years, attracting investors seeking both short-term gains and long-term value appreciation.

The ETF’s significant investment in Bitcoin and Ethereum also reflects a broader trend of institutional adoption within the cryptocurrency space. As more institutional players enter the market, they bring with them a level of legitimacy and credibility that further validates the asset class and contributes to its maturation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |