Key Points:

- Bitcoin dropped 14% in April due to reduced high-risk investment interest.

- The Bitcoin halving had minimal impact; crypto mining stocks declined.

- MicroStrategy reported a Q1 loss of $53 million despite increased Bitcoin holdings.

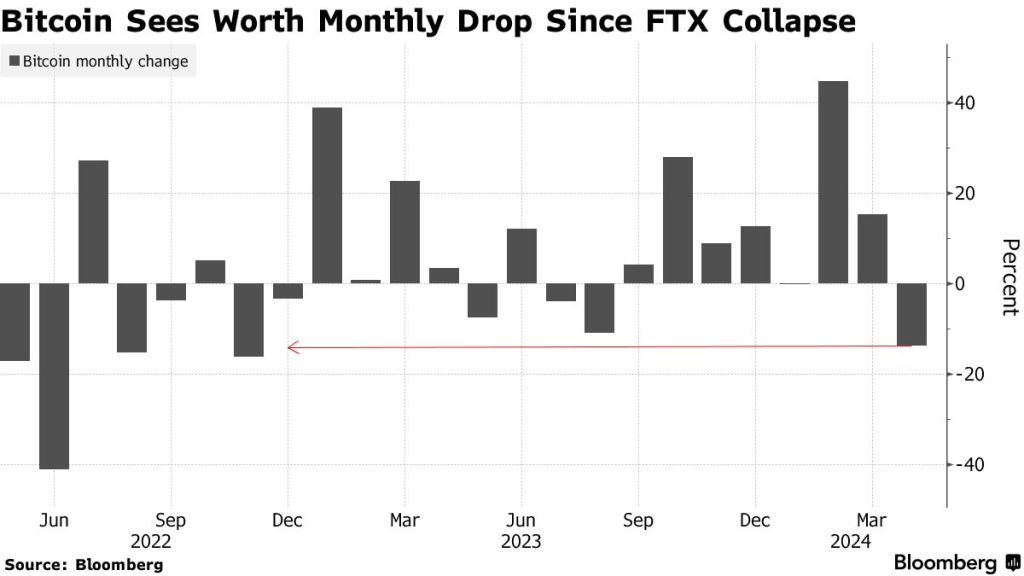

According to Bloomberg, April is reportedly the worst month for Bitcoin since FTX’s fall, declining 14% due to reduced ETF inflows and waning interest in high-risk assets.

Bitcoin is experiencing its most challenging month since the fall of Sam Bankman-Fried’s FTX, with a decline of 14% in April, the steepest drop since a 16% slump in November 2022.

Worst Month for Bitcoin: A 14% Decline in April

The surge in the original cryptocurrency, driven by US exchange-traded funds (ETFs), peaked at nearly $74,000 in March, but the enthusiasm has since diminished due to reduced interest in high-risk investments.

Consequently, inflows into these ETFs have substantially decreased, with April recording a net outflow of $182 million from the 11 US spot ETFs. In contrast, the funds reported a net inflow of $4.6 billion in March.

Readmore: Crypto Market Liquidation Surges As Bitcoin Falls To $60,000

Bitcoin Halving and Its Minimal Impact in the Worst Month

The much-awaited Bitcoin halving, a four-yearly event that typically acts as a price tailwind by reducing the supply of new coins, had little impact this time, even though it halved the amount of new Bitcoin awarded to miners.

Stocks of cryptocurrency mining companies have taken a hit, with Marathon Digital Holdings Inc., Riot Platforms Inc., Cleanspark Inc., and Cipher Mining Inc experiencing significant declines.

The Impact on Other Tokens During Bitcoin’s Worst Month

MicroStrategy Inc., which has incorporated Bitcoin purchases into its corporate strategy, reported a first-quarter loss of $53 million, despite the value of its Bitcoin holdings increasing.

Lastly, Bitcoin and Ether’s prices fell sharply in response to lukewarm demand from Hong Kong’s ETF listings, with Ether, the second largest token, down about 17% in April. The month also saw smaller, more volatile tokens like Solana, Dogecoin, and Polkadot decline even further.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |