Key Points:

- Keith Gill owns a 6.6% stake in Chewy.

- Gill’s involvement could draw investor attention to Chewy.

- A lawsuit against Gill for his social media posts is predicted to fail.

Roaring Kitty buys Chewy stake, owning 9,001,000 shares, or 6.6%. This may draw investor attention like the GameStop saga.

Keith Gill, known to most as Roaring Kitty from the GameStop saga, has disclosed a 6.6% stake in Chewy, the online retailer of pet products.

Roaring Kitty Buys Chewy: A Significant Stake Disclosure

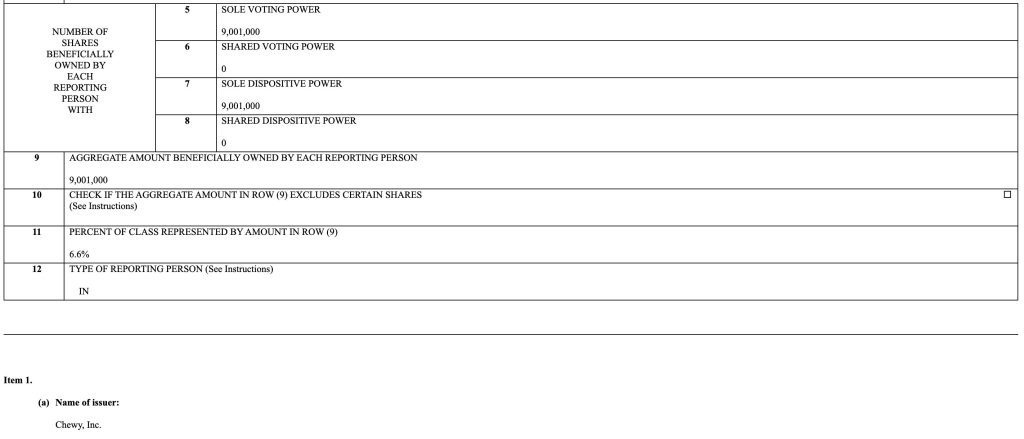

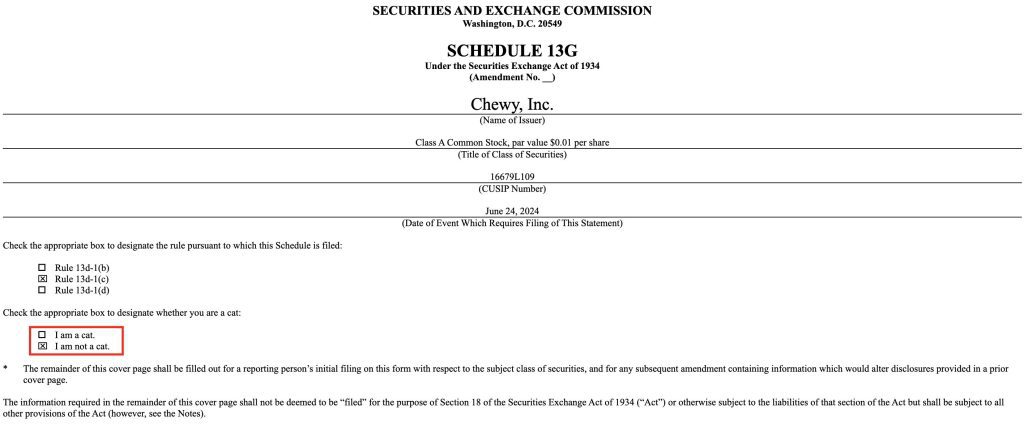

In a Schedule 13G filed with the US Securities and Exchange Commission on June 24, Gill reported owning 9,001,000 shares of Chewy’s Class A common stock as of the date above. Interestingly, he said he was not a cat in the document.

Gill’s involvement makes Chewy the probable next GameStop. The 13G is a standard filing for investors who own more than 5% of a company’s shares but do not plan to control the firm’s direction. It includes comprehensive disclosure regarding Gill’s ownership.

Gill’s strategic investment in Chewy comes as the retailer has started working on market expansion and product offerings. At worst, it may draw investor attention, similar to what transpired in the GameStop saga.

Readmore: Sony Crypto Exchange Will Be Launched In Japan To Expand $100B Portfolio

Class-Action Lawsuit Against Gill Over Social Media Posts

On May 13, Gill’s return as Roaring Kitty sent ripples across the market. GameStop stock surged from around $17.5 to $48.8 per share within a day.

Gill is the subject of a class-action lawsuit for his recent social media posts, but last week, a former federal prosecutor commented that it would not be successful. A lawsuit filed on June 28 in the U.S. District Court for the Eastern District of New York accused Gill of a “pump and dump” scheme.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |