Key Points:

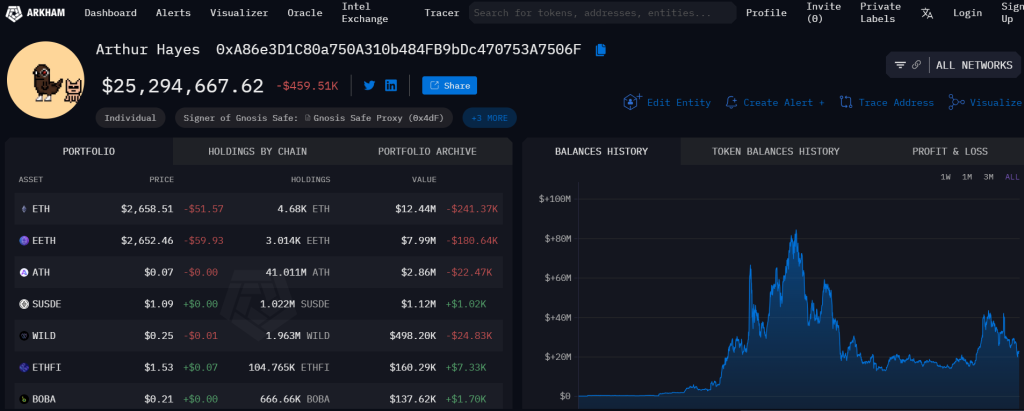

- Arthur Hayes’ wallet received 29.611M Aethir (ATH), boosting his total to $2.84M.

- The ATH influx came from OKX, KuCoin, Bybit, and HTX between 16:42-19:33 UTC+8.

- Hayes’ family office is also a significant Aethir investor, showing strong commitment.

According to Arkham, Arthur Hayes’ wallet has been preparing for action with a significant transaction involving Aethir.

Hayes’ Aethir Holdings Surge to $2.84 Million

Arthur Hayes’ wallet, which goes by the address 0xA8.506F, received an influx from OKX, KuCoin, Bybit, HTX, and other heavyweight cryptocurrency exchanges from 16:42 to 19:33 UTC +8 today, which received about 29.611 million ATH, enormously increasing Hayes’s balance in Aethir.

Arthur Hayes’ wallet currently holds 41.011 million ATHs, equivalent to about $2.84 million. That makes it his third-biggest position on-chain, revealing a strategic move within the investor’s investment portfolio. Recent activity underlines Hayes’s faith in Aethir, reflecting a remarkable expansion in his investment in the cryptocurrency space.

Hayes’ Family Office Invests in Aethir

Apart from Hayes’ holdings, his family office is also an investor in Aethir—a possible hint at further commitment to the asset. It would then become a two-layer investment approach, exhibiting a firm belief in the long-term potential of Aethir and its place within the cryptocurrency market.

Hayes recently accumulated ATH, and this move has come at a time when the cryptocurrency is gaining increasing interest. Analysts say it still has a test of its potential for investors and institutions alike. Additionally, such a big-scale movement of ATH into Hayes’ wallet could mean strategic decisions or shifts for the market, impacting the broader crypto landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |