Key Points:

- South Korea’s National Pension Service has bought $33.7M in MicroStrategy investment in Q2, enhancing its crypto exposure.

- MicroStrategy, holding $13.2B in bitcoin, saw its stock surge 92% this year, reflecting strong market interest.

- NPS’s Coinbase shares rose to $51M, though slightly down from previous levels, showcasing strategic crypto investments.

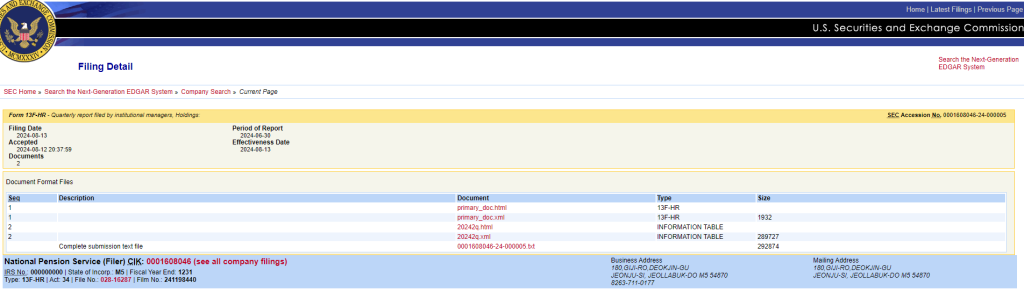

According to a filing with the U.S. Securities and Exchange Commission, South Korea’s National Pension Service, the world’s third-biggest asset pension fund, had $33.7 million in MicroStrategy investment in Q2.

MicroStrategy’s Stock Surges 95% This Year

In the period under consideration, the NPS acquired 24,500 ( total of $33.5 million) shares of MicroStrategy Inc. This strategic investment followed the NPS‘s purchase of 282,673 Coinbase shares worth $19.9 million in the third quarter of last year. It aims to enhance its indirect exposure to Bitcoin through businesses with substantial cryptocurrency assets.

MicroStrategy is the largest corporate holder of Bitcoin, holding around 226,500 BTC worth approximately $13.2 billion. It often serves as a proxy for Bitcoin exposure in traditional markets. The investment is significant in the United States alone. Thirst leveraged exchange-traded funds to track MicroStrategy investment in Q2, further raising the company’s profile in the financial world.

Read more: First Leveraged MicroStrategy ETF Approved by SEC

NPS Coinbase Holdings Rise to $51M

According to NASDAQ, Shares of MicroStrategy are up 95% year to date, easily outperforming the broad market, as shares of Coinbase rise 25% year to date. At the end of June, the NPS held 229,807 shares in Coinbase Global Inc., worth about $51 million, compared with 253,763 shares at the end of March.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |