Key Points:

- BlackRock warns market is underestimating the potential fallout from a disputed U.S. presidential election, which could lead to “messy legal battles.”

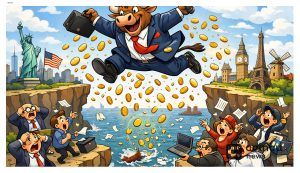

- A contested election could shake risky assets, as stocks remain near all-time highs while Treasury bonds are experiencing a sell-off.

According to Jinshi, Jean Boivin of BlackRock warns market underestimated the risk that one of the US presidential candidates would dispute the election results next month.

BlackRock Warns of Election Dispute Risks

Boivin said if one of the candidates contests the outcome, “we could be in for weeks of very messy legal battles,” adding this could significantly affect risky assets. While equity markets trade at or near all-time highs, there’s a sell-off underway in the bond market, a sign investors are beginning to diverge on expectations.

Jean Boivin characterizes trading the U.S. election as “foolish behaviour.” BlackRock warns markets to focus more on the implications of a contested election rather than speculate on trades. “What we really need to pay attention to is the scenario of a disputed election,” he said, adding that this risk has not been priced into markets yet.

Read more: BlackRock Bitcoin ETF Now Seeing Active Investor Engagement

Market Volatility Expected Amid Election Tensions

The closer the election and the more deadlocked the race, the more uncertain the voters and investors will be. Many are likely to delay decisions until election night could see any candidates challenge the vote count, especially in key swing states. In this playing-out scenario of delayed results, markets can become increasingly volatile because uncertainties related to the election outcome may trigger reactions in various asset classes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |