Market Overview (Nov 11 – Nov 17): Altcoins Surge as Bitcoin Milestones Mark a Historic Week

Altcoin market surges, led by U.S.-related coins and meme tokens. TOTAL3 index reaches new heights, surpassing March 2024 peak. Investors advised to hold positions.

Last week’s Highlights Big News (November 11 – November 17)

The Bitcoin Accumulation Bill has crossed a critical milestone, achieving official recognition. Now, it stands on the precipice of history, awaiting its turn for voting in the U.S. legislature. The legislation has the potential to cement Bitcoin’s place at the heart of the global financial system, signalling a seismic shift in the adoption of digital assets.

When it comes to Bitcoin, MicroStrategy plays in a league of its own.

- Latest Acquisition: 27,200 BTC worth $2.03 billion at an average price of $74,463 per Bitcoin.

- Total Holdings: A jaw-dropping 279,420 BTC, valued at approximately $11.9 billion.

- Average Cost Basis: A masterstroke at $42,692 per Bitcoin.

Michael Saylor’s relentless accumulation reaffirms his vision: Bitcoin is the ultimate long-term asset. His action isn’t just a bet; it’s a strategy to dominate the digital financial era.

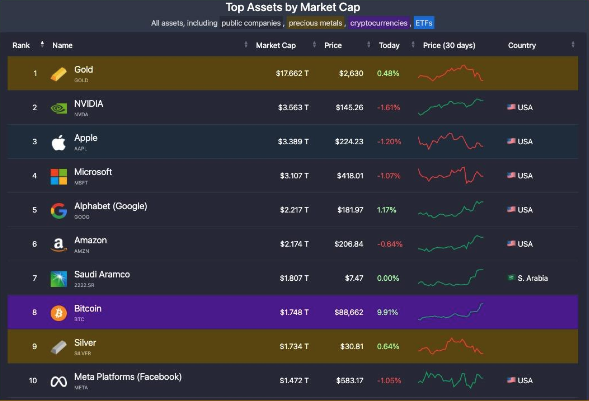

Bitcoin has officially dethroned silver, cementing its position as the 8th largest asset by market capitalization. This milestone doesn’t just affirm Bitcoin’s dominance; it’s a warning shot to traditional markets.

The courtroom drama of the decade has begun. FTX has been suing Binance and its former CEO, Changpeng Zhao, for $1.8 billion, alleging their actions hastened FTX’s collapse.

At the heart of the lawsuit:

- The Buyback: FTX repurchased Binance’s shares in 2021 for $1.76 billion, paid in FTT, BNB, and BUSD tokens.

- The Fallout: FTX claims these actions deepened financial instability as Alameda Research struggled to stay afloat.

This lawsuit could reshape the competitive dynamics between crypto titans, setting a precedent for accountability in the digital asset space.

By the end of 2025, ENS Labs will unveil Namechain, a Layer 2 network leveraging cutting-edge zero-knowledge rollups.

- Why It Matters: Namechain will dramatically enhance transaction speed and cost efficiency by compressing data before it’s submitted to Ethereum’s mainchain.

- What It Means: A scalable and cost-effective future for Web3 services, ushering in a new era for decentralized naming systems.

The Kingdom of Bhutan has entered the crypto stage in stealth mode. Data from Arkham Intelligence reveals that Druk Holdings, owned by the Bhutanese government, holds over 12,500 BTC, valued at $1 billion.

Read more: Market Overview (Nov 4 – Nov 10): Trump Victory and FED Policy Propel Bitcoin to New Heights

Macroeconomic News

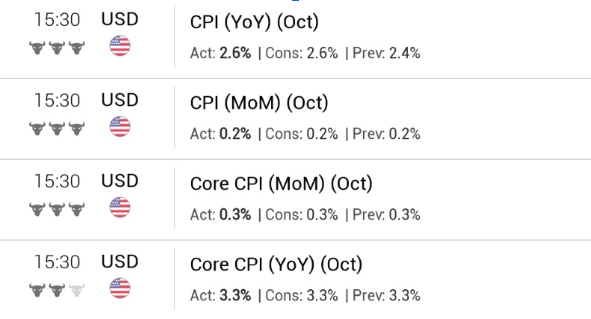

Headline CPI

- This Month: 2.6%

- Estimate: 2.6%

- Last Month: 2.4%

The slight rise in headline CPI from the previous month reflects a moderate increase in overall consumer prices, aligning with market expectations.

Core CPI

- This Month: 3.3%

- Estimate: 3.3%

- Last Month: 3.3%

Core CPI, which excludes volatile food and energy prices, remains unchanged at 3.3%, indicating stable underlying inflationary pressures.

What Does This Mean?

Persistent Core Inflation: Core CPI stability suggests that underlying inflation pressures remain steady despite headline improvements.

Inflation Moderation: Headline CPI shows inflation is still present but under control.

Key Economic Events This Week (November 18 – November 22)

This week is light on major economic data releases, with the spotlight on Federal Reserve speeches and weekly labor market updates. Here’s the schedule:

Monday, November 18

- Austan Goolsbee, Chicago Fed President, delivers a speech.

Tuesday, November 19

- Austan Goolsbee makes a second appearance, offering insights into regional and national economic outlooks.

Wednesday, November 20

- Lisa Cook, Fed Governor, speaks.

- Michelle Bowman, Fed Governor, shares her perspectives.

Thursday, November 21

- Weekly Initial Jobless Claims Report: A vital indicator of labor market conditions.

- Philadelphia Fed Manufacturing Survey: Insight into regional manufacturing activity.

- Beth Hammack, Cleveland Fed President, delivers opening remarks.

- Jeff Schmid, Kansas City Fed President, provides an economic update.

- Michael Barr, Vice Chair for Supervision, speaks on regulatory developments.

Friday, November 22

- U.S. Services PMI (S&P Flash): Gauging the health of the services sector.

- U.S. Manufacturing PMI (S&P Flash): A key indicator of manufacturing trends.

- Michelle Bowman delivers another address, closing out the week.

Market Overview

TOTAL3 Reaches New Heights

- TOTAL3, the index representing the total market capitalization of all coins except Bitcoin and Ethereum, has officially surpassed its March 2024 peak.

- This milestone reflects growing investor confidence in altcoins and signals increasing momentum in the broader crypto market.

Altcoins Surge, Led by U.S.-Related Coins and Meme Tokens

- In the past 48 hours, U.S.-related coins such as XRP have seen significant gains fueled by market optimism.

- Meme tokens like DOGE and PEPE have also experienced strong pumps, contributing to the altcoin rally.

Altcoins Respond to Key Resistance Levels

- The altcoin market is reacting to resistance levels last seen in March 2024, suggesting a pivotal moment for traders.

- With this in mind, holders of spot altcoins are advised to maintain their positions and wait for the market to unfold.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |