Will Bitcoin Crash?” seems to be one of the most controversial questions, as the price of the king of cryptocurrency has just hit $99,000. Some express concerns that the collapse of BTC could be repeated, reminiscent of 2022, while others disagree with the thereof.

KEY TAKEAWAYS

- Bitcoin shows no signs of crashing, as bullish momentum propels it closer to the $105K milestone in 2024.

- BTC trades above key moving averages; RSI and MACD confirm sustained bullish activity as volume surges significantly.

- Wait for $100,000 confirmation before entering; $95,000 pullbacks offer reentry opportunities. Use trailing stop-losses for risk management.

As we sit on the cusp of an unprecedented move, Bitcoin (BTC) shows bullish momentum, unlike anything we’ve seen in recent months. The market is alive with excitement, and every indicator suggests that we’re marching steadily toward the psychological milestone of $105,000.

Current Price Action

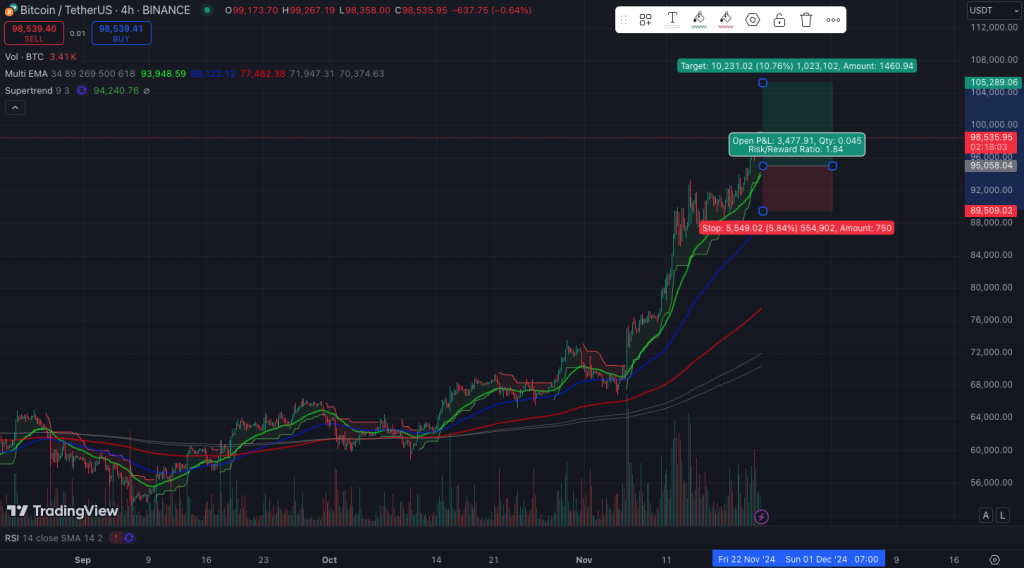

- BTC is trading near $99,162, just shy of the critical $100,000 resistance level, with a daily gain of +0.86%.

- Recent price movements indicate a strong bullish breakout from its previous consolidation phase, particularly after breaking through the $90,000 level earlier this month.

Key Observations from the Chart

“The charts don’t lie.” Bitcoin’s price action has been nothing short of extraordinary. Here’s what we’re seeing:

- Volume Surge: BTC’s trading volume stands at 12.54K BTC, reflecting robust market activity. Bulls are clearly in control as buyers continue to overwhelm sellers.

- Moving Averages: The price is decisively above its 50-day and 200-day moving averages, a classic signal of sustained bullish momentum. Shorter-term EMAs converge upward, creating a perfect alignment for a continued surge.

- Momentum Indicators: The RSI is nearing overbought territory at around 70, which is typical in an explosive breakout phase. Meanwhile, the MACD histogram remains green, signalling no immediate slowing in upward pressure.

- Resistance Breaks: BTC shattered key resistance levels at $90,000 and is now poised to challenge the critical $100,000 psychological barrier.

“The volume isn’t just there. It’s roaring, screaming that Bitcoin isn’t done yet.”

What to Expect

“This isn’t high—it’s a calculated move.” While $100K may seem like an emotional threshold for some, this is a natural progression in Bitcoin’s cycle. Here’s what to anticipate:

- A Battle at $100,000: Expect some hesitation as the market grapples with this key psychological level. Short-term profit-taking may create temporary dips but don’t mistake this for a reversal.

- Breaking Through: Once BTC clears $100K, the next target lies at $105,000, where minor consolidation could occur before the next leg is higher.

- Pullback Potential: A healthy correction back to $95,000 wouldn’t be surprising, offering opportunities for reentry.

Trade Strategy

- Entry Points:

- Wait for a clean break and retest $100,000 before entering long positions.

- A retracement to $95,000 offers an excellent buying opportunity for those who missed earlier moves.

- Exit Points:

- Take partial profits at $105,000, but leave room for further upside if momentum holds.

- Avoid FOMO: Do not chase the price blindly above $100K. Confirmation is key.

- Patience: Use trailing stop-losses to lock in profits while allowing the trade to breathe.

Wait for confirmation, not guesses. Patience will separate winners from emotional traders.

Long-Term Outlook

The $105K target isn’t just a fantasy; it’s grounded in Bitcoin’s historical patterns and macroeconomic trends. Institutional accumulation, global economic uncertainties, and diminishing supply due to halving create the perfect storm for sustained growth.

In the broader picture:

- The upcoming halving in 2028 will continue to reduce BTC’s new supply, setting the stage for the next bull cycle.

- MicroStrategy has significantly increased its Bitcoin holdings, now possessing approximately 331,200 BTC valued at around $31 billion.

- The recent U.S. presidential election has introduced a more crypto-friendly administration. President-elect Donald Trump has strongly supported cryptocurrencies, pledging to make the U.S. a leading hub for digital assets.

- Analysts have observed that Bitcoin’s price has surpassed key resistance levels, with trading volumes reaching record highs. The Relative Strength Index (RSI) indicates strong bullish momentum, suggesting the potential for further gains.

Consider $105K just another milestone on Bitcoin’s journey to rewriting financial history.

Final Note

“Stand firm and unwavering.” Bitcoin’s path is clear—it may wobble, it may dip, but the trend is up, so the answer is Bitcoin will not crash under the current conditions. As you trade, remember that the fundamentals remain stronger than ever. Allow me to emphasize: This is Bitcoin’s world, and we’re just living in it.

So buckle up, stay disciplined, and prepare to witness Bitcoin conquer $105K. Because when it comes to BTC, the only limit is what you believe it can achieve.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |