Key Points:

- Bitcoin spot ETF inflows reached $494M, continuing a 14-day streak.

- Ethereum spot ETF inflows totaled $145M on December 17, extending 17 days.

Bitcoin spot ETF inflows hit $494M on December 17, continuing a 14-day streak, while Ethereum spot ETF inflows reached $145M, extending for 17 days.

Bitcoin Spot ETF Inflows Surge to $494M in 14-Day Streak

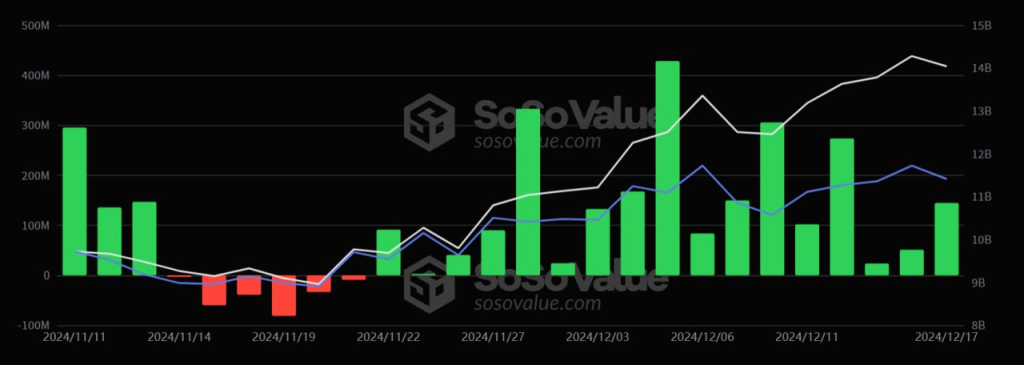

Bitcoin spot ETFs recorded $494 million in net inflows on December 17, marking 14 consecutive days of positive momentum. BlackRock’s IBIT ETF stood out with a single-day inflow of $741 million, highlighting its dominance in the sector. This steady trend demonstrates growing investor confidence in Bitcoin spot ETFs as an essential crypto asset.

As the inflow streak continues, Bitcoin spot ETFs’ total net asset value is climbing, reflecting broader market interest. With institutions like BlackRock leading the way, Bitcoin ETFs are becoming a significant driver of institutional adoption and global crypto-market activity, according to Sosovalue.

Read more: Bitcoin Spot ETFs See $637M Inflow, BlackRock Leads with $418M Surge

Ethereum Spot ETFs Extend Streak with $145M Inflows

Ethereum spot ETFs saw a net inflow of $145 million on December 17, maintaining an impressive 17-day streak of continuous inflows. BlackRock’s ETHA ETF contributed significantly with $135 million in a single-day inflow, underscoring its leading role in Ethereum-related investment products.

This trend reflects the increasing institutional focus on Ethereum, solidifying its position as a key player in the digital asset space. The consistent inflows indicate rising demand for Ethereum ETFs as part of diversified investment strategies in the evolving crypto landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |