Key Points:

- Hut 8 Purchase Bitcoin strategy includes acquiring 990 BTC at an average price of $101,710 and raising its reserve to 10,096 BTC.

- This move places Hut 8 among the top 10 public companies holding Bitcoin, with its reserves now valued at $1 billion.

The Hut 8 Purchase Bitcoin strategy boosts its reserves to 10,096 BTC, valued at $1 billion, solidifying its position as a global top public Bitcoin holder.

Hut 8 Purchase Bitcoin: $100M Allocated to Strengthen Reserve

Hut 8, a leading Bitcoin mining company, recently announced that it has purchased 990 BTC for $100 million in cash, at an average price of $101,710 per coin.

This Hut 8 purchase Bitcoin follows the company’s announcement earlier this month of a $500 million share offering. The proceeds from this offering will be used to purchase Bitcoin on the open market and for other corporate finance purposes.

According to CEO Asher Genoot, the company will utilize strategies such as options, collateralization, and selling to manage its Bitcoin reserves. He emphasized that accumulating BTC not only helps reduce capital costs but also strengthens the company’s financial position.

Read more: Bitcoin Spot ETF Inflows Reach $275 Million on December 18

Hut 8 Purchase Bitcoin Brings Reserve to 10,096 BTC, Worth $1B

This latest purchase has increased Hut 8’s total Bitcoin holdings to 10,096 BTC, equivalent to $1 billion in market value. This places Hut 8 among the top 10 publicly traded companies with the largest Bitcoin holdings globally.

Hut 8’s move is seen as following the strategy of MicroStrategy and MARA Holdings, which have been consistently buying BTC regardless of price. Currently, both MicroStrategy and MARA hold 439,000 BTC and 40,435 BTC respectively, ranking first and second on the list of publicly traded companies with the largest Bitcoin holdings globally.

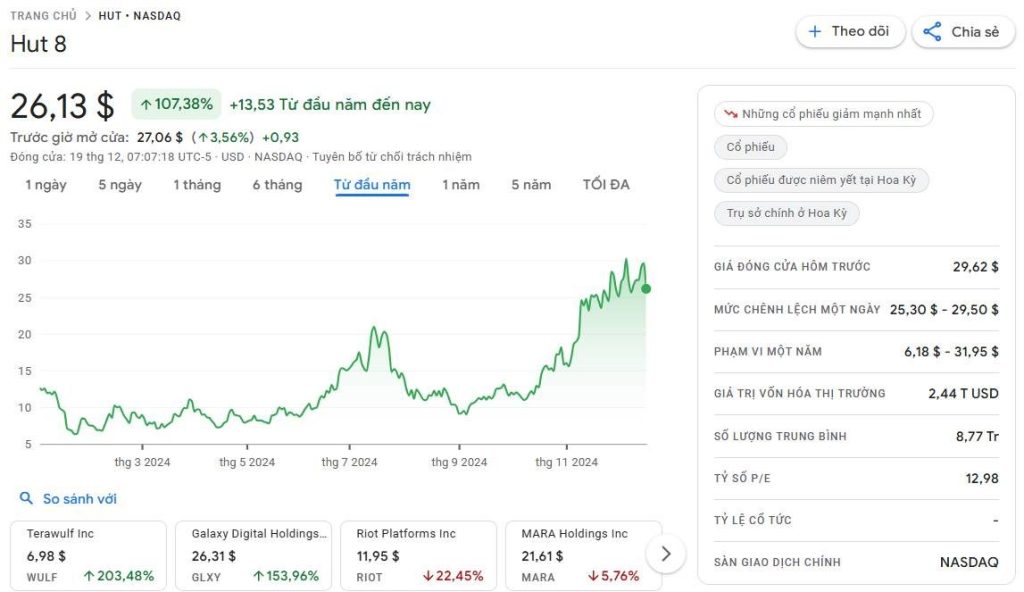

Hut 8’s stock (HUT) has increased by 107.38% year-to-date, demonstrating that this strategy is yielding positive results for the company.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |