Bitcoin price on Christmas days have always been about “trick or treat” for traders and investors. Traditionally, Bitcoin has performed spectacularly well during the holiday season, especially in halving years, while Bitcoin Dominance usually declines to allow altcoins to rally.

With the arrival of Christmas 2024, one is left with the question: Is this going to be yet another sweet rally, or will this be a year when the market tricks such expectations?

Key Takeaways

- Historically, Bitcoin has shown significant gains during Christmas week in halving years, with average increases of 18.44%, as seen in 2016 and 2020.

- BTC.D typically drops after Christmas, creating opportunities for altcoins to rally and gain market share.

Does Bitcoin Go up During Christmas?

Since 2024 is a halving year for Bitcoin, we should take a look at how Bitcoin performed during previous halving years like 2016 and 2020.

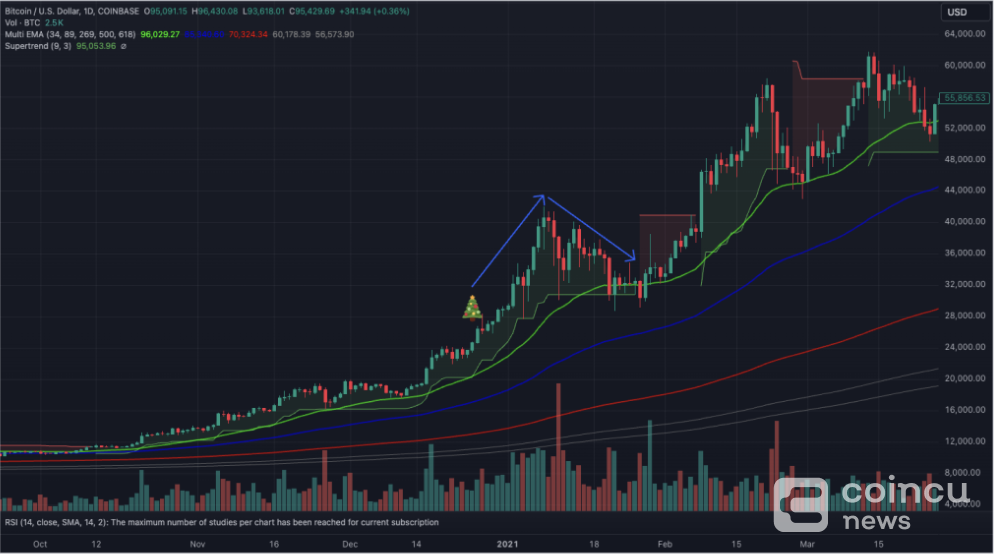

Bitcoin has had pretty impressive returns during Christmas week in halving years, with notable double-digit gains:

- 2016: Bitcoin climbed 11.25%

- 2020: Bitcoin surged 25.63%

On average, Bitcoin recorded an 18.44% increase during Christmas in halving years. This period tends to benefit from bullish market sentiment, increased buying activity, and the seasonal optimism associated with the holiday season.

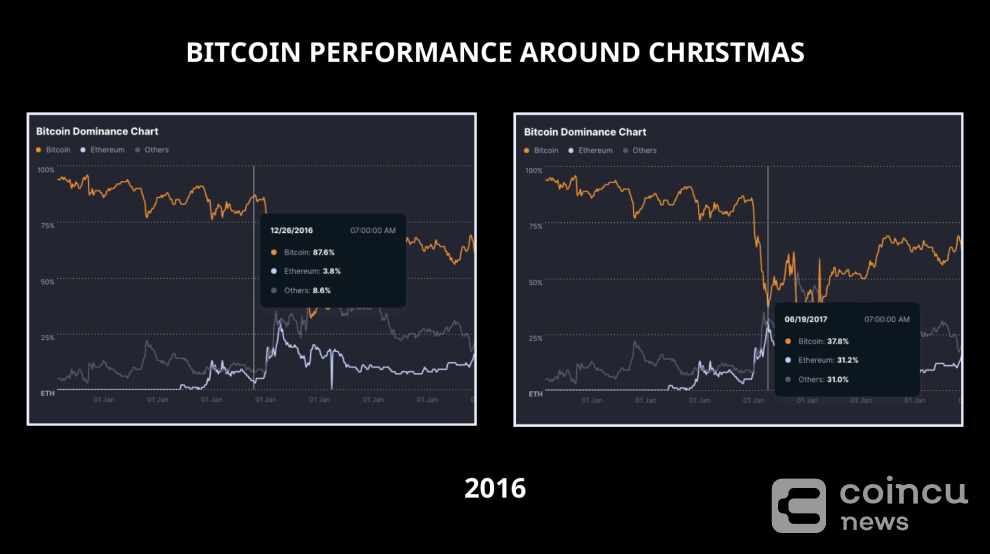

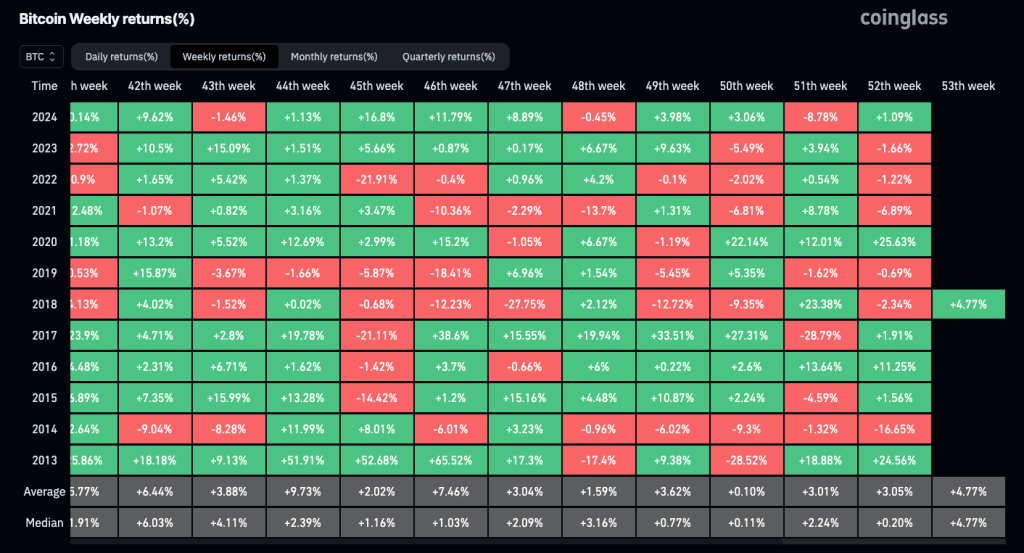

2016 (Halving Year)

Bitcoin Dominance (BTC.D):

- 87.6% on December 25, 2016, showcasing Bitcoin’s significant market share.

- Dropped to 85% by January 30, 2017, indicating a gradual shift towards altcoins.

- Further declined to 37.8% by June 19, 2017, marking a major transition to an altcoin-dominated market.

Price Action:

- Bitcoin’s price broke above $900 in December 2016 and climbed steadily to over $1,000 by January 2017.

- The bullish trend continued, with Bitcoin eventually surging to $3,000 by mid-2017, marking a historic rally fueled by growing retail and institutional interest.

2020 (Halving Year)

Bitcoin Dominance (BTC.D)

- 67% on December 25, 2020, reflecting a strong yet slightly declining position.

- Decreased to 61% by January 30, 2021, signalling an ongoing altcoin rally.

- Plummeted to 41% by May 17, 2021, reinforcing a powerful altcoin season as capital flowed away from Bitcoin.

Price Action

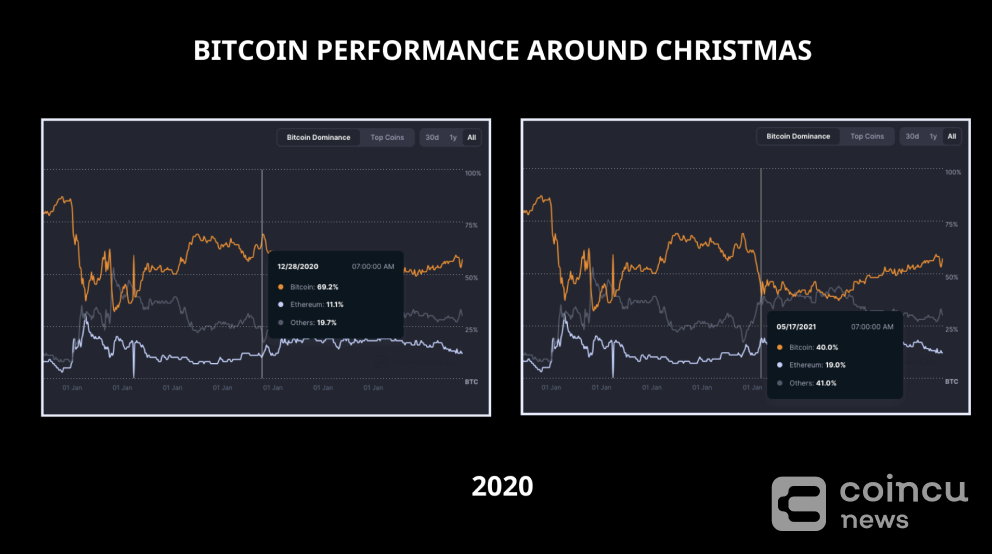

- Bitcoin’s price was around $24,000 on Christmas Day 2020 and surged to $30,000 by the end of the year.

- The upward momentum continued, pushing Bitcoin to an all-time high of $64,000 by April 2021.

Quick Take

Bitcoin Dominance often declines after Christmas, creating favourable conditions for altcoins to thrive.

According to data from Coinglass, during the 2016 halving year, Bitcoin soared by 11.25% in Christmas week (the 52nd week). Likewise, in 2020, BTC increased by 25.63%.

On the daily chart, Bitcoin’s price appears to follow a similar circuit to the one that propelled it past $73,810 on 14 March. During that time, BTC surged by 84% in under three months. Since November 5, the cryptocurrency has already risen by 43%.

Why Bitcoin Dominance (BTC.D) Declines During Christmas

What is Bitcoin Dominance?

Bitcoin Dominance (BTC.D) measures Bitcoin’s share of the total cryptocurrency market capitalization. A decline in BTC.D indicates a capital shift from Bitcoin to altcoins, often signalling an “altcoin season.”

Seasonal Trends

- During the holiday season, investors often explore altcoins for their potential higher returns.

- Retail investors seek opportunities in cheaper altcoins with high-growth potential.

- End-of-year profit-taking from Bitcoin shifts funds toward altcoins.

Historical BTC.D Data

| Year | BTC.D on December 25 | BTC.D by January 30 | BTC.D by Mid-Year | Significant decline, signalling a major altcoin rally. |

|---|---|---|---|---|

| 2016 | 87.6% | 85% | 37.8% (June 19, 2017) | Significant decline, signaling a major altcoin rally. |

| 2020 | 67% | 61% | 41% (May 17, 2021) | Steady drop, reinforcing strong altcoin market growth. |

The data confirms that BTC.D typically declines during and after Christmas, creating favourable conditions for altcoin growth.

Key Observations for Christmas 2024

Current BTC.D Trends and Bitcoin’s Performance

As of mid-December 2024, Bitcoin’s year-to-date (YTD) performance has been impressive, with a 125% increase, recently crossing the $108,000 mark before a slight pullback.

BTC.D remains steady but gradually declines, indicating potential capital rotation into altcoins. With Bitcoin already recording an 8% increase in December, analysts predict the cryptocurrency could edge closer to the $110,000 mark during Christmas week.

Comparison with Previous Halving Years (2016, 2020)

- 2016: BTC rose 13.32% during Christmas week, accompanied by a BTC.D decline from 87.6% to 85% by January, creating opportunities for altcoins.

- 2020: BTC rallied 16.13% during Christmas week, with BTC.D falling from 67% to 61% by late January, marking the start of a strong altcoin season.

- 2024: With Bitcoin already in a bullish phase, the market resembles previous halving years. If the trend holds, BTC may surge during Christmas while BTC.D continues to decline.

Predictions for BTC.D and Potential Impact on Altcoins

- BTC.D is likely to dip further as altcoins gain traction, aligning with historical trends in halving years.

- Analysts expect Bitcoin to trade between $108,000 and $110,000 if buying pressure increases, further fueling altcoin momentum.

Opportunities for Traders and Investors

Bitcoin Investors

- Historical Christmas trends suggest moderate to significant gains, with analysts predicting a potential rally to $108,000–$110,000.

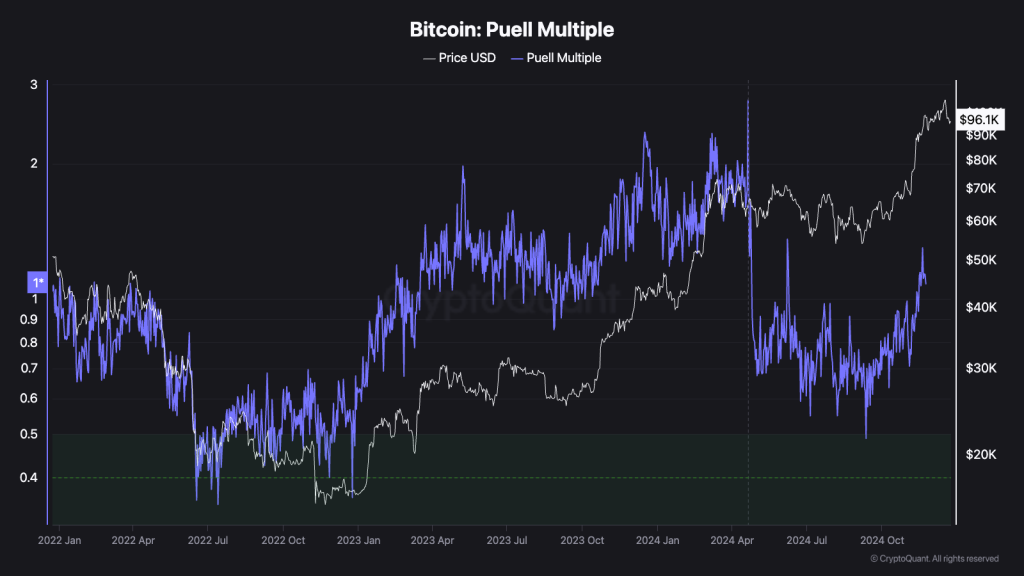

- Watching on-chain metrics like the Puell Multiple (currently 1.08) can provide insights into whether Bitcoin is approaching a cyclical top.

Altcoin Traders

A declining BTC.D historically paves the way for strong altcoin rallies.

Strategies:

- Focus on altcoins with strong fundamentals, active development, or significant market interest.

- Utilize spot trading opportunities during BTC.D declines to capitalize on altcoin momentum.

Frequently Asked Questions (FAQs)

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |