Sonic (formerly Fantom) is an advanced EVM Layer 1 blockchain that combines high-performance features, strong incentives, and a secure gateway to Ethereum, enabling seamless decentralized application development and scaling.

What is Sonic?

Sonic (formerly Fantom), the scalable EVM Layer 1 blockchain, offers a high-performance venue for distributed application development. Sonic offers over 10,000 TPS and sub-second finality to give flawless user experiences.

Sonic is compatible with EVM and supports Vyper and Solidity. Customers can easily access large liquidity via Sonic Gateway, a safe gateway to Ethereum.

Read More: Dymension Review: Layer 1 Blockchain Promotes Interaction With Cosmos

Why choose to build on Sonic?

Sonic is a Layer 1 that lets developers expand their applications by supporting 10,000 TPS, sub-second finality, and complete EVM compatibility. On the platform, Fee Monetization (FeeM) enables developers to make up to 90% of app fees.

Apart from performance and incentives, Sonic’s Innovator Fund offers up to 200 million S tokens to onboard apps and helps newly founded businesses. This funding starts interesting Sonic ecosystem projects and stimulates creativity. Sonic is also urging Opera and Sonic chain users to use and interact with the platform by doing an Airdrop of 200 million S tokens.

Tokenomics and Use Case

Sonic has not yet announced tokenomics after the switch from Fantom to Sonic.

Token metrics

- Ticker: $S

- Total supply: 3,175,000,000 $S

Use Cases

- Transaction fees

- Staking

- Governance

Read More: The Open Network Review: The Most Potential Layer 1 Today

Airdrop

To reward Opera and the new Sonic chain users, Sonic intends to airdrop 190,500,000 S tokens. Sonic Points and Sonic Gems will be used for the airdrop. Using a linear decay process, the airdrop progressively reduces and burns tokens over time, therefore avoiding abrupt fluctuations in the circulating supply.

Day one sees 25% of a user’s token allocation become accessible and the rest 75% vested over 270 days via NFT positions. Early claimants will pay a penalty including some burned tokens. If users would want not to wait, they might trade their airdrop allocation on a speculative NFT market.

For instance, Andrew brings in 1,000 S from the Sonic airdrop. He can immediately claim 250 S (25%), and within 90 days he can claim 249.75 S (33.3% of the remaining amount). 500.25 S (66.7% of the locked allocation) will be burnt to do so, though.

Sonic Points

Users of the Sonic ecosystem gain Sonic Points for active involvement within it. They honour early adoption, loyalty, asset ownership, and interaction with distributed apps. Sonic Points will be spread over several seasons; the first will end by June 2025.

Users of the Sonic ecosystem must interact with whitelisted assets through approved apps to accrue Sonic Points. The platform shows the Season 1 assets; further assets will be added during the season.

Sonic Gems

Developers of apps get Sonic Gems depending on their performance and user involvement. Developers can give S tokens—which these Gems can be exchanged for—rewards to their users. Using constant participation and interaction, Sonic Gems helps foster app development and user retention, therefore guaranteeing long-term engagement. Gems’ distribution fits a seasonal pattern; the first season ends in June 2025.

Team and Investors

Team

- Michael Kong (CEO & CIO): Michael is the CEO and CIO of Sonic, overseeing technical leadership and project development.

- Andre Cronje (Co-Founder, Director & Core Contributor): Andre is a well-known blockchain figure and a major contributor to the Fantom ecosystem, continuing his involvement despite stepping away from broader DeFi.

Investor and partners

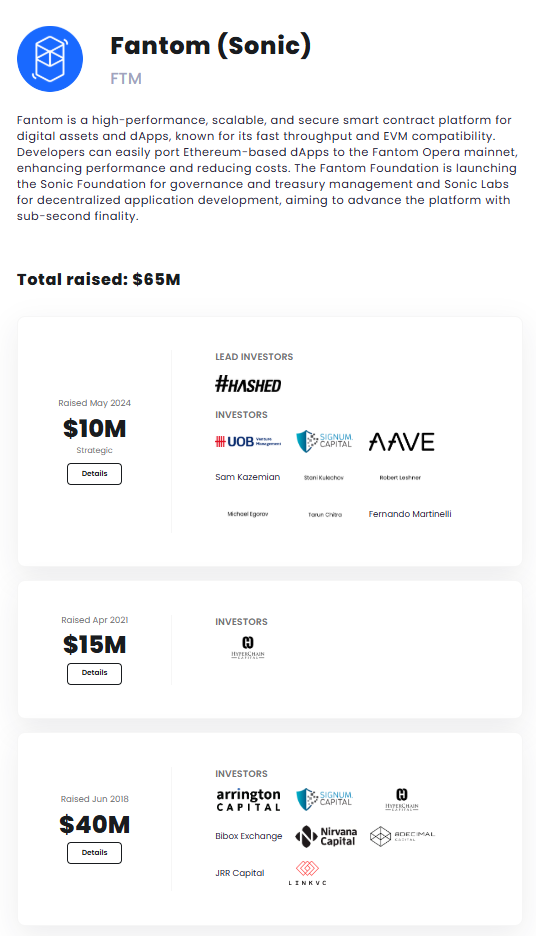

Sonic has attracted significant investment from blockchain-focused VCs, including HyperChain Capital, Signum Capital, and others. Recently, Sonic raised $10M from VCs like Hashed, along with notable figures like Sam Kazemian (Founder of Frax Finance) and Stani Kulechov (Founder of Aave), which further supports its growth and development.

Roadmap

Sonic is in the process of transitioning fully from Fantom to Sonic, with the following milestones:

- December 18, 2024: Migration of Opera block rewards to Sonic.

- March 18, 2025: Transition to one-way swap from FTM to S.

- June 18, 2025: S token supply increases as new tokenomics are implemented.

Conclusion

Sonic is a promising Layer 1 blockchain offering superior performance, scalability, and strong incentives for developers and users. With its EVM compatibility, robust tokenomics, and focus on long-term ecosystem growth, Sonic is well-positioned to be a key player in the decentralized application space.

CoinCu believes that Sonic’s advanced features and incentives make it a platform to watch, and its evolution could set new standards for Layer 1 blockchain scalability and user participation.

FAQs

1. What makes Sonic different from other Layer 1 blockchains?

Sonic stands out with its high transaction throughput (10,000 TPS), sub-second finality, and full Ethereum compatibility, which provides a powerful and efficient environment for decentralized applications.

2. Can I upgrade my FTM tokens to S?

Yes, FTM holders can easily upgrade their tokens to S on a 1:1 basis.

3. What is the purpose of Sonic Points and Gems?

Sonic Points reward user engagement, while Sonic Gems incentivize developers based on their app performance. Both mechanisms drive growth and long-term participation within the Sonic ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |