Among all other cryptocurrencies, XRP has carved its name as a great choice for fast, affordable, and scalable cross-border transactions.

Indeed, 2025 could prove an important year with the breakthroughs being recorded in Ripple’s regulations, the launch of its RLUSD stablecoin, and increased institutional interest through spot ETF filings.

Is XRP a Good Investment? This article will try to discuss if XRP is a wise choice of investment in the fast-evolving crypto landscape.

Key Takeaways

- XRP is a compelling investment opportunity as it enables fast, low-cost cross-border payments with growing real-world use cases through Ripple’s partnerships.

- Ripple’s 2023 legal win and spot XRP ETF filings by major firms like WisdomTree increase confidence.

- Ripple USD (RLUSD) launch and XRP’s price rise to $2.73 set the stage for potential highs of $3.84 to $24.

Is XRP a Good Investment?

XRP is the native cryptocurrency on the XRP Ledger for fast, low-cost, cross-border payments. Ripple has positioned it as a bridge asset for financial institutions.

The solutions resolve some of the inefficiencies in global transactions. As of 2025, several outcomes are poised to make XRP a compelling investment opportunity.

Key Factors Supporting XRP as a good Investment

| Key Factor | Details |

|---|---|

| Regulatory Clarity | SEC ruling in 2023 clarified XRP is not a security for retail investors. |

| Ripple USD (RLUSD) | Dollar-backed stablecoin launched in December 2024, increasing XRP utility. |

| Spot XRP ETFs | Filings by WisdomTree and 21Shares, with BlackRock possibly joining. |

| Global Adoption | Ripple partnered with banks and payment providers. |

| Market Performance | XRP surpassed $2.73 in 2024, with targets of $3.84 to $24 for 2025. |

Regulatory Clarity

In 2023, Ripple secured a partial legal victory against the SEC, which ruled that XRP is not a security when sold to retail investors. This decision removed a major regulatory overhang and paved the way for greater adoption.

The crypto-friendly stance expected under President-elect Donald Trump’s administration in 2025 further enhances XRP’s investment case.

Launch of Ripple USD (RLUSD)

Ripple’s RLUSD stablecoin, launched on December 17, 2024, is a dollar-backed stablecoin designed to facilitate cost-effective cross-border payments.

Spot XRP ETFs

The filing of spot XRP ETFs by WisdomTree and 21Shares in late 2024, with speculation of BlackRock entering the fray, highlights growing institutional interest in XRP.

ETFs have historically boosted adoption and liquidity for cryptocurrencies, as seen with Bitcoin. Similar outcomes for XRP could lead to significant price appreciation in 2025.

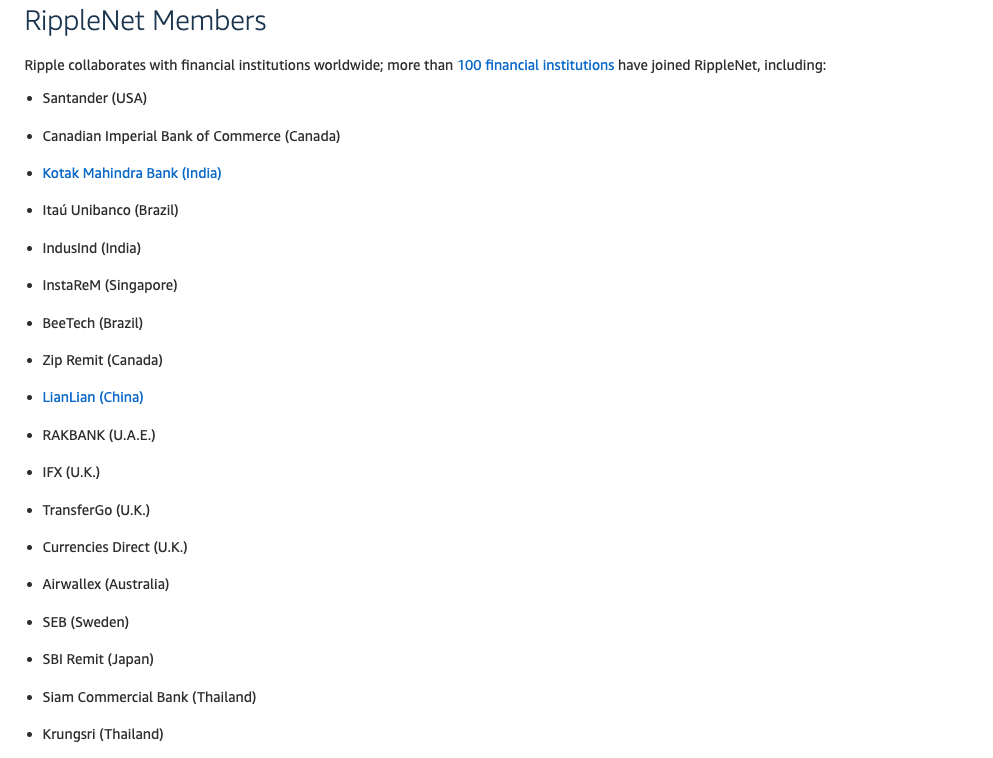

Institutional and Global Adoption

Ripple’s partnerships with banks and payment providers for cross-border payment solutions have driven real-world use cases for XRP.

Ripple’s focus on 95% of its business outside the U.S. reduces its dependence on domestic regulations and strengthens its global appeal.

Market Performance

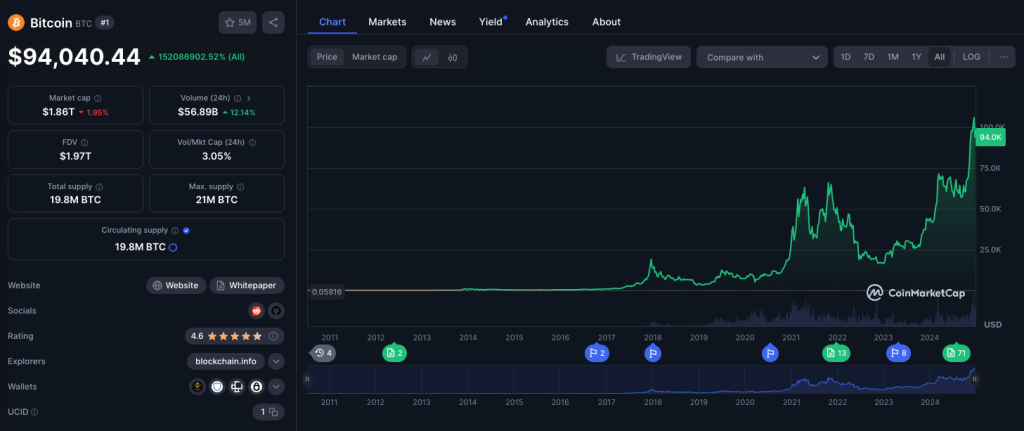

XRP’s price momentum as of late 2024, with its value surpassing $2.73, reflects renewed investor confidence.

Analysts predict XRP could reclaim its $3.84 all-time high or even achieve super-bullish targets of $20-$24, depending on ETF approvals, adoption of RLUSD, and global market dynamics.

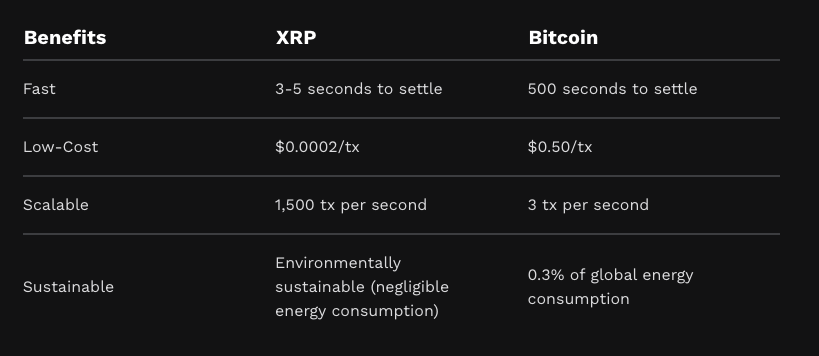

What is XRP?

XRP is a cryptocurrency designed for fast, low-cost cross-border payments. Created by Ripple in 2012, XRP plays a dual role as both a bridge currency and a tool for decentralized applications.

Ripple vs. XRP

- Ripple: A fintech company providing payment solutions for financial institutions.

- XRP: The native cryptocurrency of the XRP Ledger (XRPL), used for transactions and liquidity.

| Key Feature | Description |

|---|---|

| Speed | Transactions settle in seconds. |

| Low Cost | Minimal fees make it ideal for high-frequency use. |

| Scalability | Supports 1,500 transactions per second. |

| Energy Efficiency | Uses a consensus mechanism, avoiding the energy-intensive processes of proof-of-work. |

Core Use Cases

- Cross-Border Payments: Reduces transaction costs and eliminates the need for pre-funded accounts.

- Bridge Currency: Facilitates currency exchange in a seamless and cost-efficient way.

- Stablecoin Support: Ripple’s RLUSD stablecoin adds to XRP’s utility by using it as a bridge asset for liquidity.

Ripple’s established partnerships with global financial institutions and its focus on solving real-world problems make XRP a strong contender in the crypto and payment ecosystems.

Key Catalysts for XRP’s Growth in 2025

1. XRP Spot ETFs

Recent Outcomes

On December 2, 2024, WisdomTree, a major investment firm, filed for a spot XRP ETF with the SEC. In November 2024, 21Shares also filed for a spot XRP ETF, demonstrating strong institutional interest in the asset.

Speculation is mounting that BlackRock, a $10 trillion asset manager and the firm behind the iShares Bitcoin Trust, may file for an XRP ETF in 2025.

Market Implications

Spot ETFs provide institutions with a regulated and accessible way to invest in XRP. As seen with Bitcoin ETFs, this could lead to significant inflows of capital.

Bitcoin ETFs, which launched in 2024, quickly became the fastest-growing ETFs in history. XRP ETFs could follow a similar circuit, encouraging XRP’s liquidity and price.

2. Launch of Ripple USD (RLUSD) Stablecoin

Overview of RLUSD

Ripple launched RLUSD, a dollar-backed stablecoin, on December 17, 2024. RLUSD is issued on both the Ethereum blockchain and the XRP Ledger, targeting cost-effective solutions for cross-border payments.

Initially, RLUSD was available on select global exchanges but is not yet supported by Coinbase or Robinhood.

RLUSD competes directly with dominant stablecoins like USDT, which holds 70% of the stablecoin market, and USDC, which accounts for 20%. Ripple’s focus on institutional use cases strengthens its position as a viable alternative in the stablecoin space.

3. Ripple‘s Lawsuit Victory

On July 13, 2023, Ripple achieved a partial victory in its legal battle with the SEC. The court ruled that XRP is not a security when sold to retail investors on exchanges.

Under the leadership of President-elect Donald Trump, the crypto industry is optimistic about friendlier and clearer regulations in 2025.

In December 2024, European Parliament member Sarah Nafo proposed an EU Bitcoin Strategic Reserve, citing Bitcoin’s status as “digital gold” and advocating for alternatives to a digital Euro.

Price Predictions for XRP in 2025

1. Technical and Historical Analysis

XRP’s all-time high of $3.84 was achieved in January 2018 during a crypto bull market. As of December 2024, XRP is trading at $2.73, nearing critical resistance levels. The upward trend is driven by:

- Positive market sentiment.

- News of spot ETF filings.

- Ripple’s RLUSD stablecoin launch.

Analysts identify key resistance zones at:

- $3.00

- $3.50

- The all-time high of $3.84

Read more: XRP (XRP) Price Prediction | XRP Forecast

2. Bullish Scenarios

| Scenario | Details |

|---|---|

| Reaching $3.84 | – XRP could reclaim its $3.84 all-time high in 2025. – Driven by spot ETF approvals and ongoing regulatory clarity. |

| Super-Bullish Case ($20-$24) | – Peter Brandt predicts XRP could reach $24, a 7x increase from current levels. – Relies on institutional adoption, ETF success, and global regulatory support. |

3. Factors Influencing Price

Growing Adoption of RLUSD

- Launch Date: December 17, 2024.

- Enhances XRP’s use case as a bridge asset.

- RLUSD:

- Backed by the U.S. dollar.

- Designed to streamline cross-border payments.

Fast Check

Ripple positions RLUSD as a competitor to USDT and USDC.

Institutional Interest

- Spot XRP ETF filings:

- WisdomTree and 21Shares were filed in late 2024.

- Potential BlackRock participation.

- Spot ETFs historically:

- Increase liquidity.

- Drive adoption (e.g., Bitcoin’s precedent).

Global Regulatory Actions

- Ripple’s 2023 legal win against the SEC clarified XRP’s non-security status for retail investors.

- The supportive environment created by:

- A crypto-friendly U.S. administration under President-elect Donald Trump.

- International initiatives like Europe’s proposed Bitcoin Strategic Reserve.

FAQs About XRP

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |