Key Points:

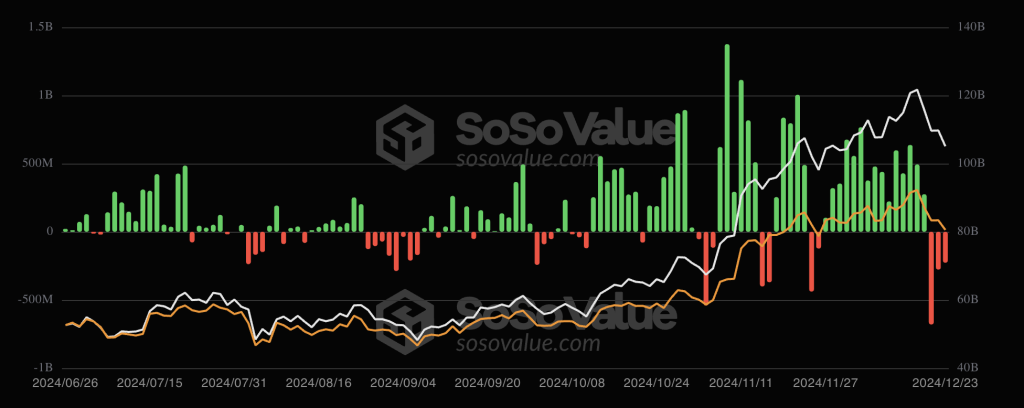

- Bitcoin Spot ETF outflows reached $338.4M on Dec. 19, extending a four-day streak.

- BlackRock’s IBIT led outflows, with $188.7M leaving the fund.

Bitcoin spot ETF outflows hit $338.4M on Dec. 19, marking the fourth consecutive day of net outflows, with total withdrawals reaching $1.52B during this streak.

Bitcoin Spot ETF Outflows Reach $1.52 Billion Over Four Days

December 19 saw Bitcoin spot ETF losses of $338.4 million. Negative net flows persisted for the fourth day, reaching $1.52 billion since the trend started. Following 15 days of consistent inflows bringing $6.7 billion to the funds, this notable decline points to changing investor perception.

With $188.7 million, BlackRock‘s IBIT fund led outflows; Fidelity’s FBTC was next at $83 million. ARKB listed $75 million taken out. Bitwise’s BITB fund had $8.5 million in inflows, suggesting mixed investor interest even if the market is down, according to Sosovalue.

Read more: BTC Spot ETF Outflows Continue With $227M Lost Over Three Days

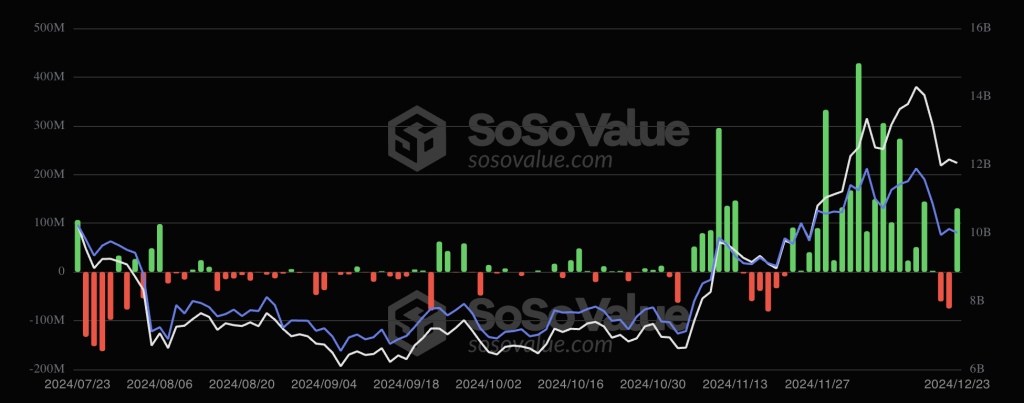

Ethereum Spot ETFs Record Strong Inflows Amid BTC Outflows

Ethereum spot ETFs collected $53.5 million unlike Bitcoin ETFs on December 19. With $43.9 million, BlackRock’s ETHA fund topped inflows; followed by Bitwise’s Ethereum fund with $6.2 million and Fidelity’s FESH with $3.45 million.

Ethereum spot ETF net inflows reaching $2.51 billion have been fueled by investor excitement. On December 19, ETH spot ETFs’ trading volume surpassed $262 million, proving their growing impact in the crypto ETF ecosystem despite Bitcoin fund withdrawals.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |