Key Points:

- Binance Proof of Reserves data reveals an $8 billion decline in non-customer assets, marking the lowest level in nearly two years.

- Speculations arise regarding regulatory settlements, asset sales, or internal restructuring, but Binance has yet to provide clarification.

Binance Proof of Reserves data signals an $8B decline in non-customer holdings, raising questions about asset movements and Binance’s financial strategies.

Binance Proof of Reserves Show $8B Asset Decline

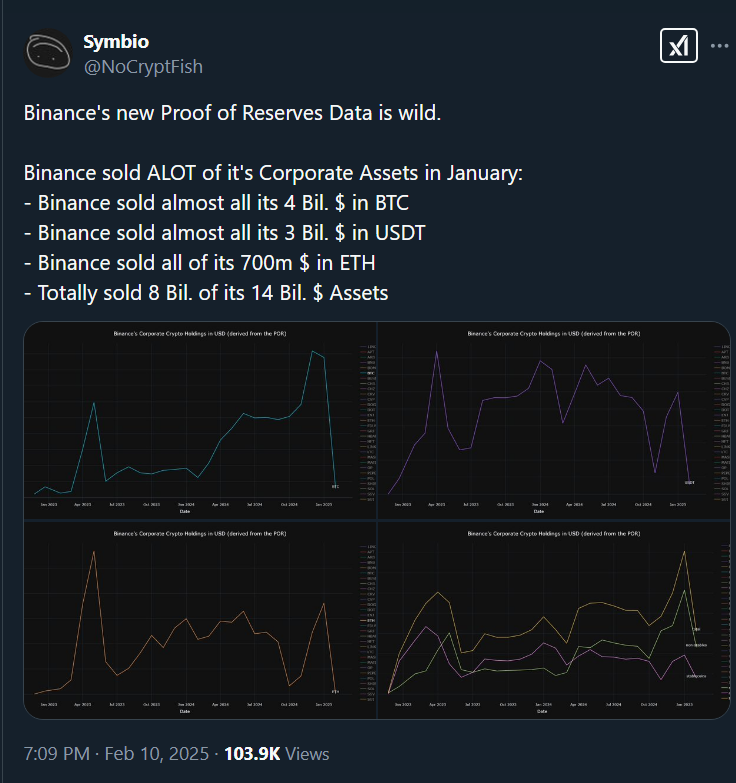

The crypto community is buzzing about a substantial decrease in Binance’s non-customer assets. The Proof of Reserves (PoR) data published at the beginning of 2025 is no longer accurate, revealing a significant drop in the exchange’s holdings.

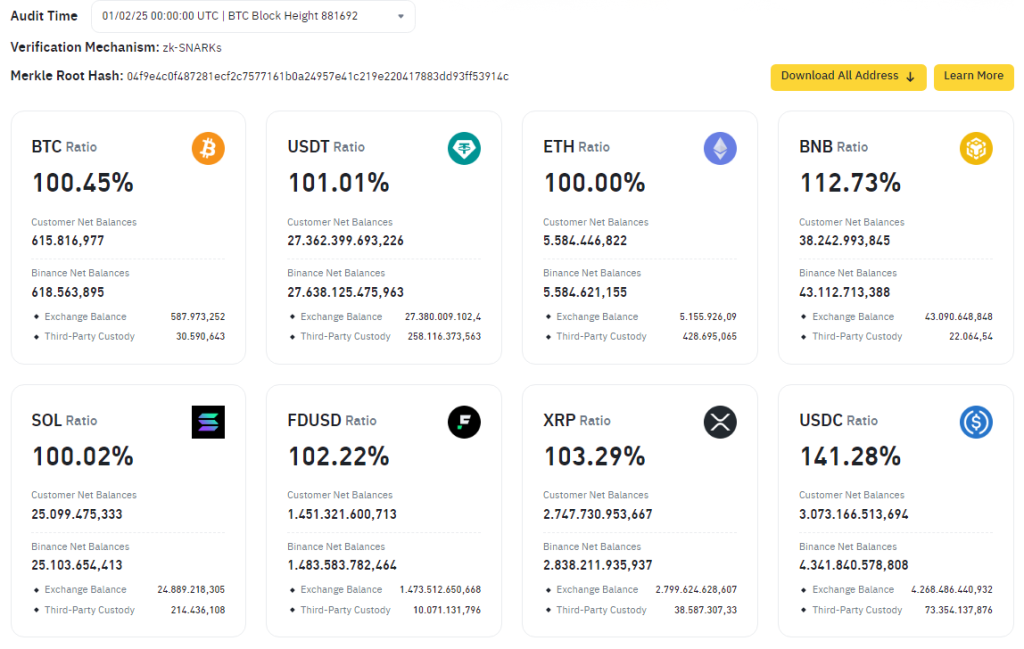

Binance’s PoR provides two critical pieces of information: customer crypto balances (Customer Net Balances) and the amount of crypto Binance holds (Binance Net Balances). As of the end of January 2025, Binance reported non-customer asset balances, including:

- 2,746 Bitcoin (BTC);

- 275,725,782 Tether (USDT);

- 174 Ethereum (ETH);

- 4,869,719 BNB;

- 4,179 Solana (SOL).

However, according to @NoCryptFish, these numbers have decreased sharply compared to December 2024, when the world’s largest exchange held significantly larger quantities:

- 46,896 BTC;

- 2,989,902,855 USDT;

- 216,312 ETH;

- 5,839,372 BNB;

- 442,234 SOL.

This decline has pushed Binance’s total non-customer assets to their lowest point in nearly two years. Converted to USD, the loss amounts to a staggering $8 billion, raising questions about where these funds have gone.

Some industry insiders speculate that this decrease may be related to settlements with regulators or FTX clawbacks. Another theory suggests that Binance may have sold or reallocated assets for investment or business expansion.

Read more: Binance Proof of Reserves Shows $120B in Assets Across 34 Tokens

Binance Remains Silent on Proof of Reserves Discrepancy

At the time of reporting, neither founder Changpeng Zhao (CZ) nor CEO Richard Teng had issued any comment on the matter.

Despite the decrease in non-customer assets, Binance asserted in its latest PoR disclosure that it maintains 100% of user assets in the form of 34 cryptocurrencies, with a collateralization ratio always at or above 1:1 compared to customer balances.

This is not the first time Binance has faced scrutiny regarding its reserves. In May 2023, a user on the X platform pointed out a sharp drop in Binance’s reserves in its public wallet, raising suspicions that the exchange had moved its reserves to new wallets or sold some of its cryptocurrency holdings. CZ later denied the rumors.

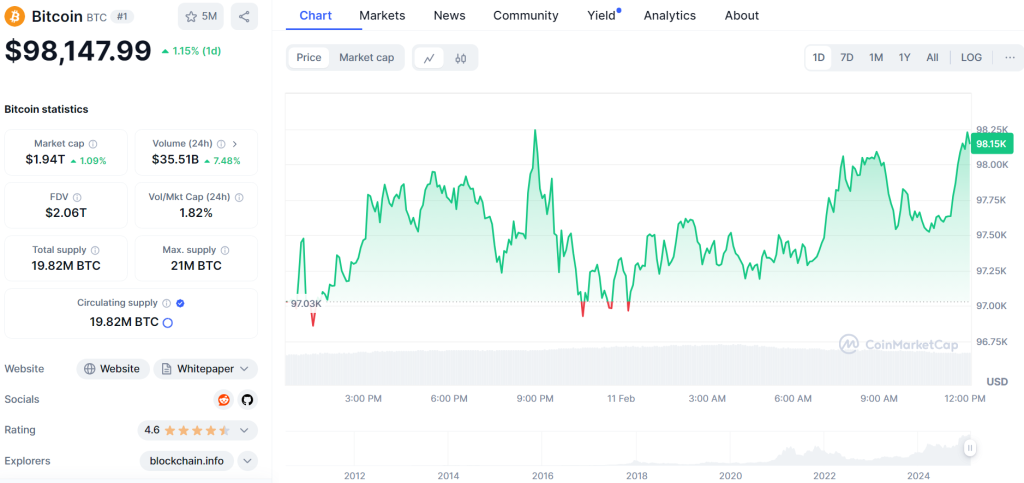

Crypto exchanges introduced Binance Proof of Reserves mechanisms after FTX’s collapse in 2022, which triggered a liquidity crisis and market turmoil. With Bitcoin now recovering to nearly $98,150, scrutiny over Binance’s financial transparency continues to grow.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |