Key Points:

- Metaplanet just acquired 497 BTC, bringing its total holdings to 2,888 BTC at an average price of $84,000 per coin.

- The company is now the 2nd largest BTC-holding public firm in Asia and has become one of the fastest-growing stocks on the Tokyo Stock Exchange.

Metaplanet has made another bold move in the Bitcoin market, acquiring 497 BTC for $44 million, bringing its total holdings to 2,888 BTC. This latest purchase was executed at an average price of $88,800 per coin, slightly higher than the potential entry price had the order been placed just a day earlier when Bitcoin dipped below $83,000 following former U.S. President Donald Trump’s tariff announcement.

Metaplanet Bitcoin Investment 497 BTC, Holdings with $44M

Bitcoin’s price has been on a roller-coaster ride, fueled by geopolitical and economic shifts. Under Trump’s influence, global markets experienced significant turbulence; the Bitcoin price is near $88,000 amid talks of Canada renegotiating tariffs with the U.S.

This unpredictability highlights the challenge of perfect timing in crypto investing, leading companies like MicroStrategy (formerly Strategy) and Metaplanet to rely on dollar-cost averaging (DCA) to secure a balanced entry price over time.

With this latest acquisition, Metaplanet’s average purchase price is $84,000 per BTC, meaning the company currently holds its Bitcoin without losses or gains.

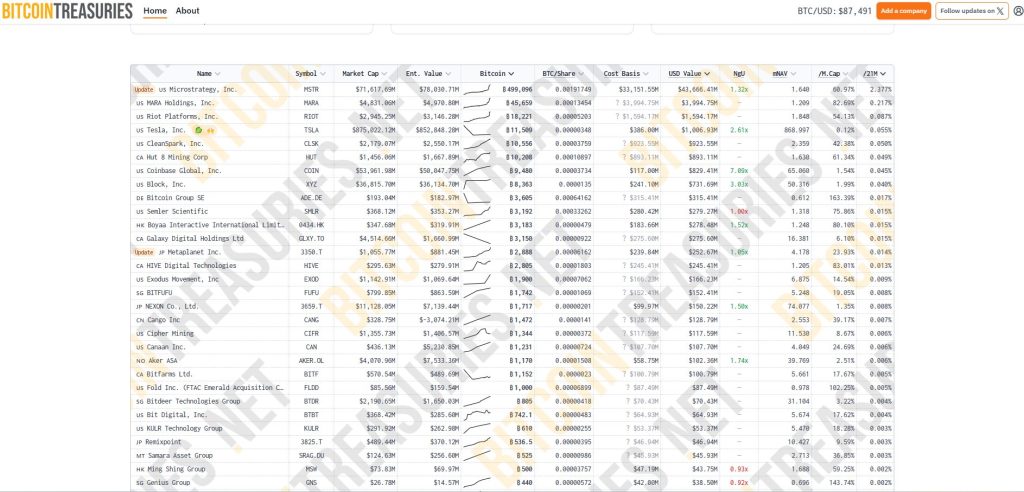

This disciplined accumulation strategy has positioned Metaplanet as the 13th largest public company in the world by BTC holdings and the 2nd largest in Asia, following China’s Boyaa Interactive, the nation’s biggest poker game company.

Metaplanet Bitcoin Investment Fuels Market Rebound

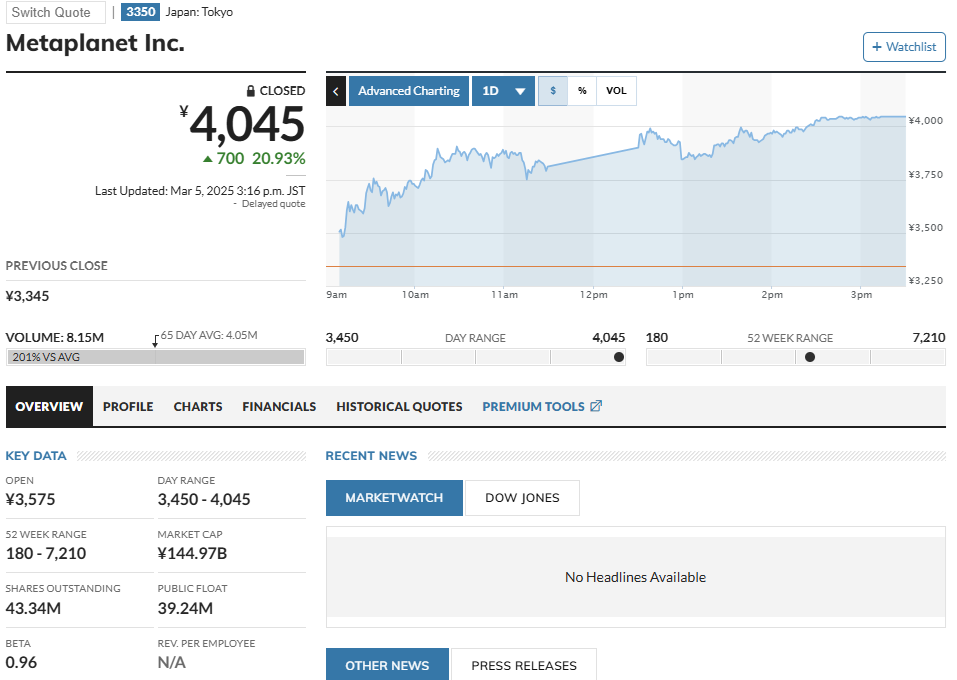

Metaplanet’s aggressive Bitcoin strategy is paying off, not just in asset accumulation but in stock performance. Once considered an obscure entity in Japan, the company’s pivot to Bitcoin has revived its market presence, making it one of the fastest-growing stocks on the Tokyo Stock Exchange, now priced at 4.045.

The company’s turnaround story is a testament to Bitcoin’s growing appeal among public firms seeking alternative asset strategies. Inspired by success stories like Metaplanet Bitcoin investment, other corporations, including Semler Scientific (medical equipment), KULR Technology (energy), and Gumi (Japanese game),…, are exploring Bitcoin investments as a hedge against economic uncertainty.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |