| Key Points: – Sol Strategies doubles its staked SOL to 3.3M with the acquisition of Laine, Solana’s 65th largest validator. – The SIMD-0228 proposal to reduce Solana validator rewards is 72% approved, but CEO Wald sees SOL staking demand growing with potential Solana ETFs on the horizon. |

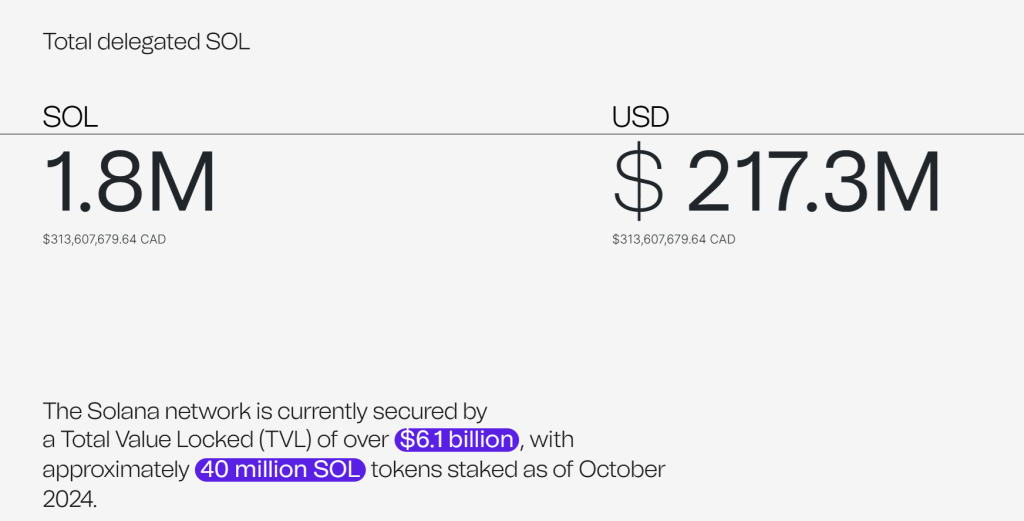

Solana-focused holding company Sol Strategies has announced its latest strategic move, acquiring Laine, Solana’s 65th largest individual validator. This acquisition significantly boosts Sol’ total staked SOL, adding 1.5 million delegated SOL to its existing 1.8 million, nearly doubling its position in Solana’s validator ecosystem.

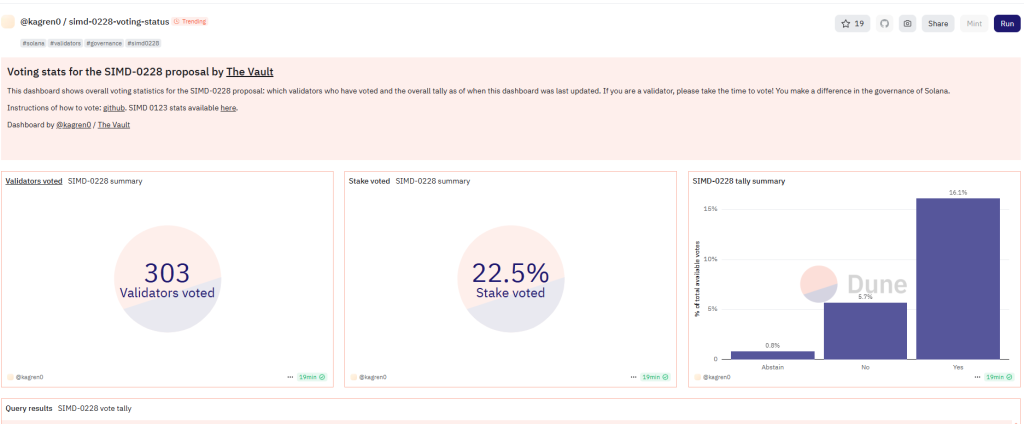

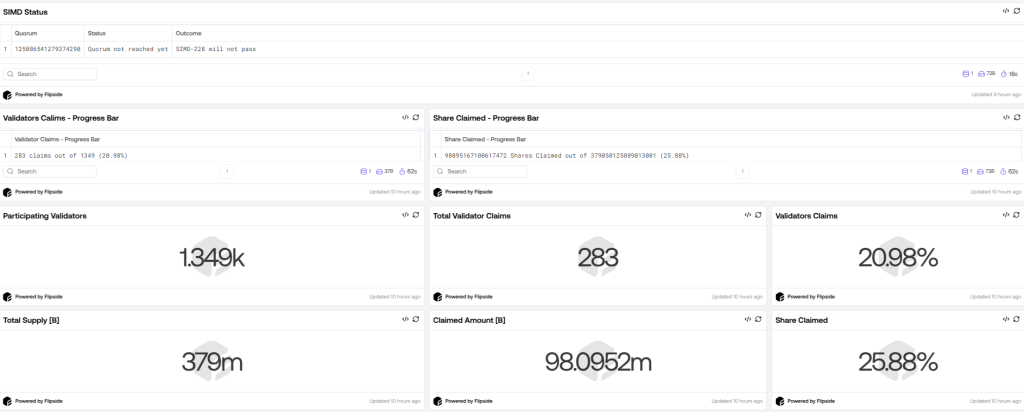

The deal marks Sol’ third acquisition of a Solana validator since its pivot toward Solana in September 2024. The timing is noteworthy, as a significant governance vote, SIMD-0228, which aims to adjust Solana’s inflation mechanism, appears poised to pass. The proposal would reduce validator rewards, reinforcing the need for scale and efficiency in the validator business.

Laine’s Acquisition Brings Strategic Talent and Resources

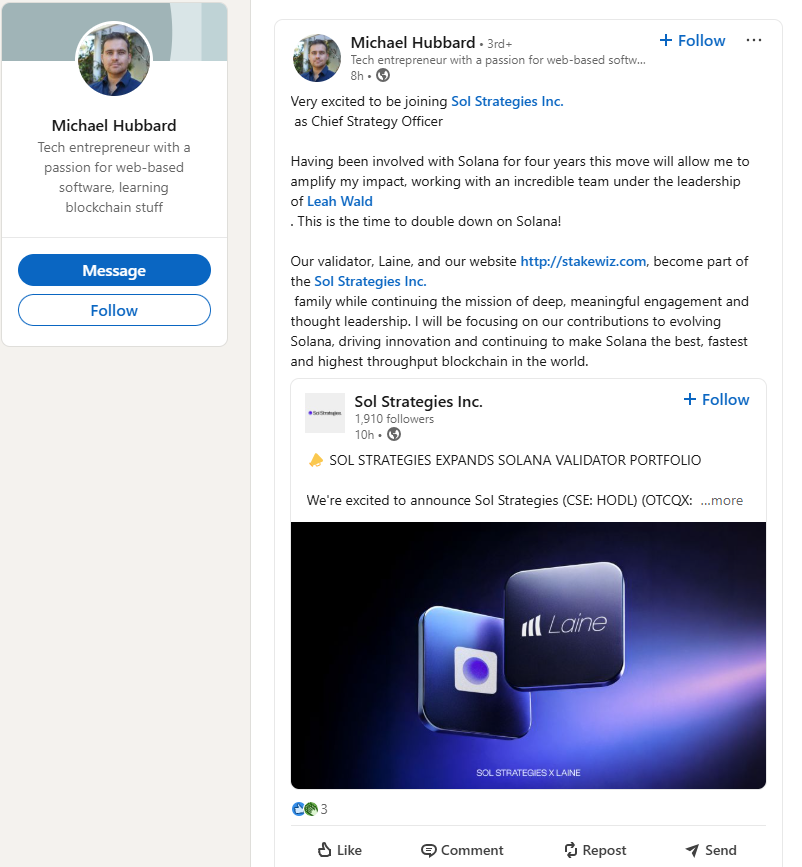

Laine’s founder, Michael Hubbard, was hired as Sol Strategies’ chief strategy officer. Hubbard, an influential figure in Solana’s validator community, confirmed the transition via Linkedin, describing it as an opportunity to “amplify [his] impact” within the ecosystem.

Sol Strategies also gains control of Stakewiz.com, a widely-used Solana validator data platform, further solidifying its role in Solana’s staking landscape.

Governance Vote: What’s at Stake for Validators?

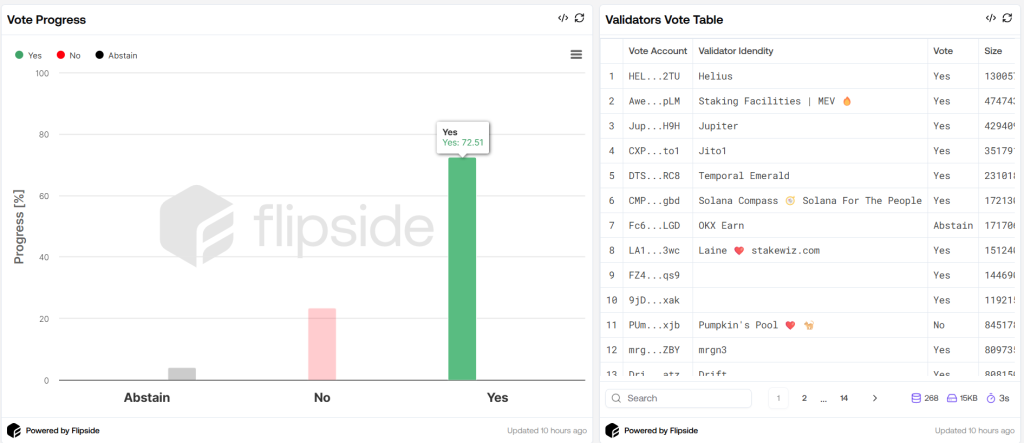

With 72% of Solana validator votes already in favor, SIMD-0228 is ready for approval. The proposal introduces a market-based inflation mechanism to optimize validator rewards and prevent Solana from overpaying for network security.

While validator revenue may decrease, Sol Strategies CEO Wald remains optimistic, stating that demand for SOL staking will persist, and potential approval of Solana ETFs could inject fresh institutional capital.

As Sol Strategies continues its aggressive expansion, its growing validator footprint and strategic acquisitions position it as a major force in Solana’s evolving ecosystem.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |