- Bitcoin’s dominance may delay altcoin season, influencing investor strategies.

- Bitcoin payment features to expand with Block Inc.’s new rollout.

- Market anticipates Fed rate cuts amid weak U.S. economic data.

U.S. Treasuries rose following economic contraction data, triggering expectations of Federal Reserve interest rate cuts. In parallel, Bitcoin’s market leadership poses challenges for altcoin progression. Block Inc. leads Bitcoin integration efforts, aiming to redefine its financial utility and boost adoption.

Traders anticipate impact from these actions, with anticipated Fed interest rate cuts potentially supporting cryptocurrency growth. Block Inc. plans a strategic enhancement of Bitcoin payments, expected to launch in late 2025, aims to reduce operational costs involved in cryptocurrency transactions.

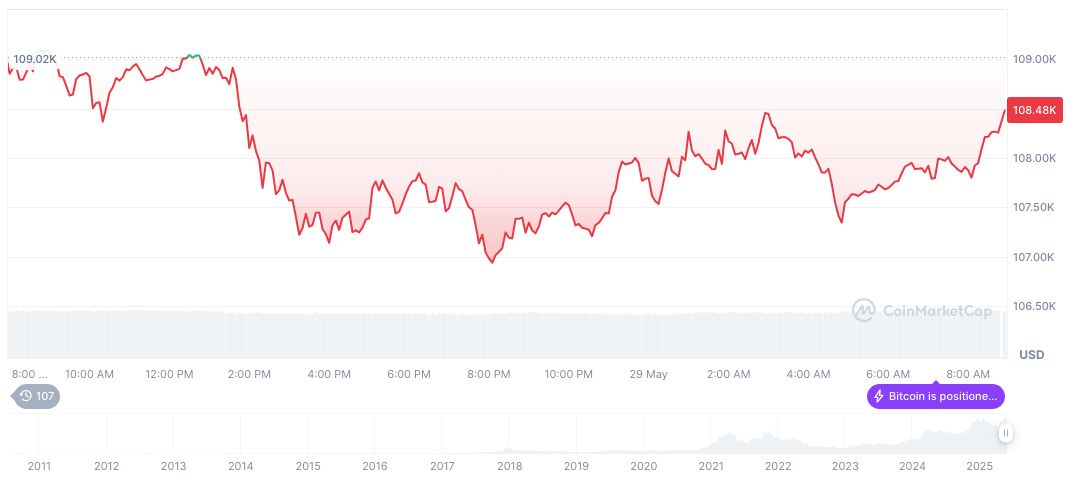

Bitcoin Dominates Market Amid Economic Fluctuations

Market observers forecast short-term volatility as Bitcoin’s market dominance strengthens. At the Bitcoin 2025 Conference, Miles Suter of Block stressed the evolution of Bitcoin from a store of value to an integral digital currency standard.

The revised U.S. GDP figures reveal economic weakness, prompting speculations on Federal Reserve’s monetary policy adjustments. Blockchain stakeholders are closely monitoring this potential rate cut, which could influence investment movement in digital currencies.

“Bitcoin should transition from merely a store of value to being the internet’s native currency.” – Miles Suter, Bitcoin Product Lead at Block, emphasized during his keynote at the Bitcoin 2025 Conference. Bitcoin Magazine

Block Inc.’s Bitcoin Payment Strategy Set for 2025 Launch

Did you know? In previous economic slowdowns, Federal Reserve’s interest rate cuts often precede market recoveries, historically benefiting risk-sensitive assets like Bitcoin.

Bitcoin’s lead role as a digital asset is reinforced by current metrics. CoinMarketCap data notes Bitcoin’s price at $106,296.75, with market capitalization reaching $2.11 trillion. Despite a 7.73% rise in 24-hour trading volume, Bitcoin experienced a 1.29% price dip over the same timeframe.

The Coincu research team recognizes a probable influx of investments into Bitcoin, following anticipated financial adjustments like Federal rate cuts. Data suggests Bitcoin’s potential to ride economic waves, amplified by historical yields on similar assets.