What is Suilend? Leading the Future of Lending and DeFi on the Sui Blockchain

Suilend is the leading decentralized lending and borrowing protocol on the Sui blockchain, offering high-speed transactions, low fees, and advanced DeFi features. Built by the team behind Solend on Solana, it supports assets like SUI, USDT, USDC, and wrapped tokens such as ETH and SOL. Key innovations include dynamic NFTs for position tracking, integrated swaps, and cross-chain bridges.

Backed by top investors including Robot Ventures, Delphi Ventures, and Mechanism Capital, Suilend’s 2025 roadmap features the STEAMM mainnet launch, a token launchpad, perpetual futures, DAO expansion, and cross-chain integration. This review explores what Suilend is, its core functions, tokenomics, investor backing, and its bold vision to spearhead the next wave of DeFi growth on Sui.

| Key Takeaways – Suilend is the top lending and borrowing protocol on the Sui blockchain. – The $SEND token drives with a community-focused tokenomics model. – Suilend’s roadmap includes STEAMM, Launchpad, Perpetual Futures, and cross-chain integration. |

What is Suilend?

Overview of Suilend

Suilend is a Lending & Borrowing protocol aiming to become a leading platform within the Sui ecosystem. Beyond just facilitating loans, it is positioning itself as a central hub for DeFi activities.

According to DefiLlama, Suilend was listed in December 2024 and reached a TVL of $35 million within just one month. As of August 12, 2025, it has surged to $673.45 million. Leading in Sui Network’s TVL, contributing to Sui Network’s TVL reaching a new milestone amid market activity.

The relationship between Suilend and Solend

This protocol is developed by the same group behind Save (formerly Solend on Solana), a well-established protocol that formerly hit an all-time high TVL of $900 million. Going live on the Sui network is a strategic step for the team into a new environment, leveraging the high transaction volume and low fee of Sui.

How Suilend Works

Suilend enables users to easily deposit lending and begin borrowing, like other lending/borrowing platforms.

Lending

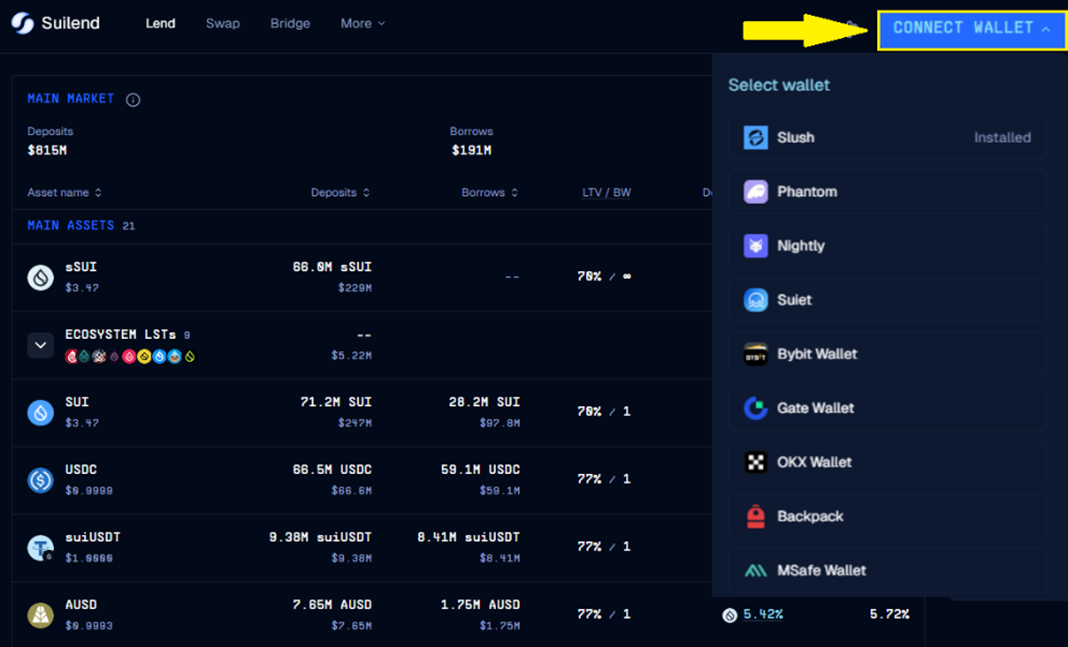

Step 1: Users visit the website at Suilend.fi. Then, click on “Connect Wallet” to link a Web3 wallet.

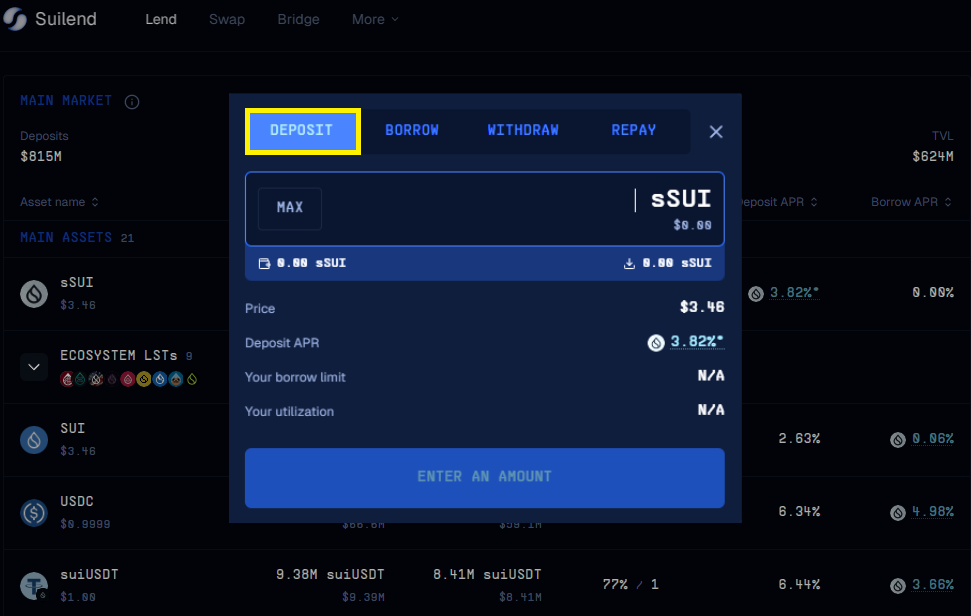

Step 2: Choose the type of asset user wants to use as collateral, click “Deposit” and type in the amount user wants to lend.

Borrowing

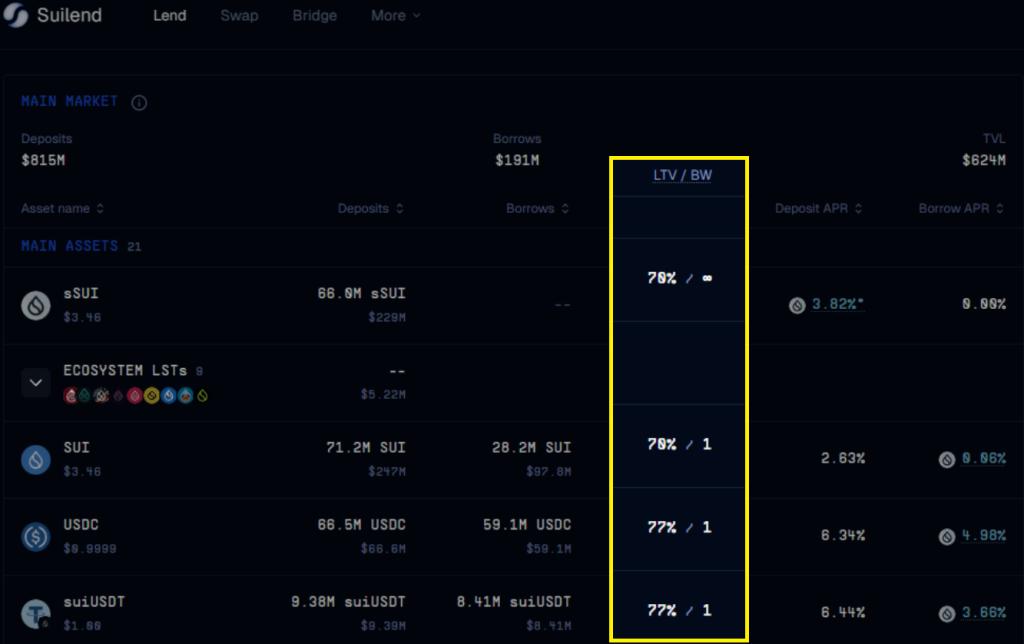

After successfully lending, switch to the “Borrow” tab. Users can borrow an amount based on the maximum Loan-to-Value (LTV) ratio offered for that specific asset.

For example, with the asset sSUI shown in the image, which has an LTV of 70%, users can borrow up to 70% of the value they have deposited in that asset.

Loan-to-Value (LTV): Markets can be unpredictable. If the LTV exceeds the safe threshold, a portion of the collateral is automatically liquidated to reestablish a safer LTV ratio. Users can also leverage borrowed funds by re-lending. To reduce liquidation risk, users should carefully assess the LTV before borrowing.

Key Features

Suilend offers a variety of features tailored to DeFi users’ needs

- Transaction Speed and Network Fees: Built on the Sui blockchain, Suilend offers exceptional transaction speeds (~250ms for simple transfers) and minimal network fees ($0.001–$0.01), ensuring that lending and borrowing activities are fast, cost-effective, and efficient.

- Wide Asset Support: Suilend enables lending and borrowing of leading assets such as SUI, USDT, and USDC. Through its integration with Wormhole, users can also access wrapped assets like ETH and SOL, enhancing flexibility despite the Sui network’s initially limited native asset pool.

- Wormhole Integration: By leveraging Wormhole, Suilend bridges assets seamlessly from major blockchains like Ethereum and Solana to Sui, making cross-chain participation easy for users.

- Advanced Lending Features: Suilend supports both Main Assets (low-risk, rigorously vetted) and Isolated Assets (high-volatility, one asset type per account). Lending positions are represented by dynamic NFTs, enabling easy tracking and even transfer through NFT marketplaces.

- Swap and Bridge Partnerships: Through collaboration with Aftermath DEX, Suilend facilitates the swapping of most Sui-based tokens. It also works with Wormhole and Sui Bridge to enable smooth asset transfers between Ethereum, Solana, and Sui.

Tokenomics

Introduction to the $SEND Token

According to CoinMarketCap, $SEND token was listed by Suilend on December 14, 2024, with a total supply of 100 million $SEND. Its all-time high (ATH) reached $3.7677. As of August 12, 2025, $SEND is priced at $0.5922 with a market capitalization of $28.85 million.

Token Distribution

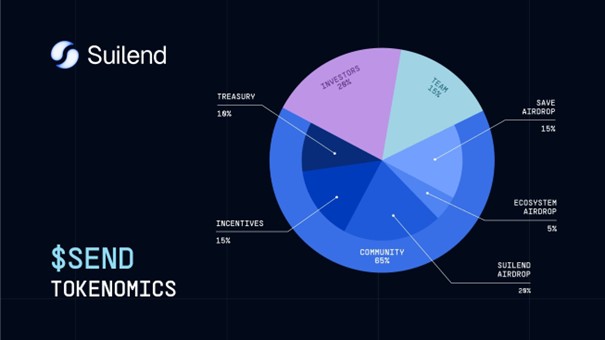

$SEND tokenomics are designed to put the community first

- Community: 65%

- Investors: 20%

- Team: 15%

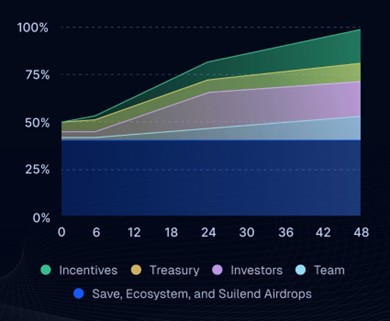

Unlocks of tokenomics are as follows

- Community is unlocked on day 1

- Investors unlock over 2 years

- Team unlocks over 4 years

Use Cases and Utility

| Function | Description |

| Governance | Voting on changes within the DAO |

| Staking/Reward | Earn rewards from revenue and staking incentives |

| Incentives | Rewards for active users (supply/borrow/LP) |

| Ecosystem Benefits | Boosted APY, reduced fees, and future IDO unlocks |

Team

The team consists of prominent X platform accounts such as @0xodia (Technical Lead) and founder Rooter, who has also developed other projects like Dumpy, SpringSui, and Steamm. However, the team is identities remain anonymous and are only verified through strategic partners such as Robot Ventures, Pyth Network, and Bluefin.

Investors and Backers

Pyth Network and Bluefin are notable names that have announced strategic partnerships with Suilend. Additionally, according to Dropstab and Chaincatcher, Suilend has raised a total of $6 million across two funding rounds. Prominent investors and participating funds include

- Robot Ventures (Lead Funding Round)

- Delphi Ventures

- Big Brain Holdings

- Figment Capital

- Mechanism Capital

- Alliance DAO

- Quantstamp

Roadmap and Future Plans

Roadmap

- March 2024: Suilend Mainnet Launch

- October 2024: SpringSui Launch

- December 2024: SEND TGE

- January 2025: Suilend Protocol achieves $1B in total TVL (Suilend + SpringSui)

- February 2025: STEAMM Beta launch

- Q2 2025: STEAMM Mainnet Launch + Launchpad

Future Plan

| Development Milestone | Key Details | Estimated Timeline |

|---|---|---|

| STEAMM Mainnet | AMM + Lending integration for liquidity and yield optimization | Q2/2025 |

| Launchpad Release | Platform to launch new tokens within the Suilend ecosystem | Q2/2025 |

| Perpetual Futures | Decentralized derivatives product (perp trading) | H2/2025 |

| Expanded Suilend DAO | On-chain voting, product & tokenomics governance | H2/2025 |

| Cross-chain & Bridges | Integration of assets from other blockchains via bridges | Late 2025 |

| Ecosystem Partnerships | DeFi, oracles, wallets, and data platform integration | Ongoing |

Conclusion

Suilend is a highly promising project in the DeFi space on Sui, offering modern features such as low interest rates, a rewards points system, and broad asset support. Suilend is also on track extremely well, constantly striving to achieve its vision to lead the future of lending and DeFi on the Sui Blockchain.