Key Insights:

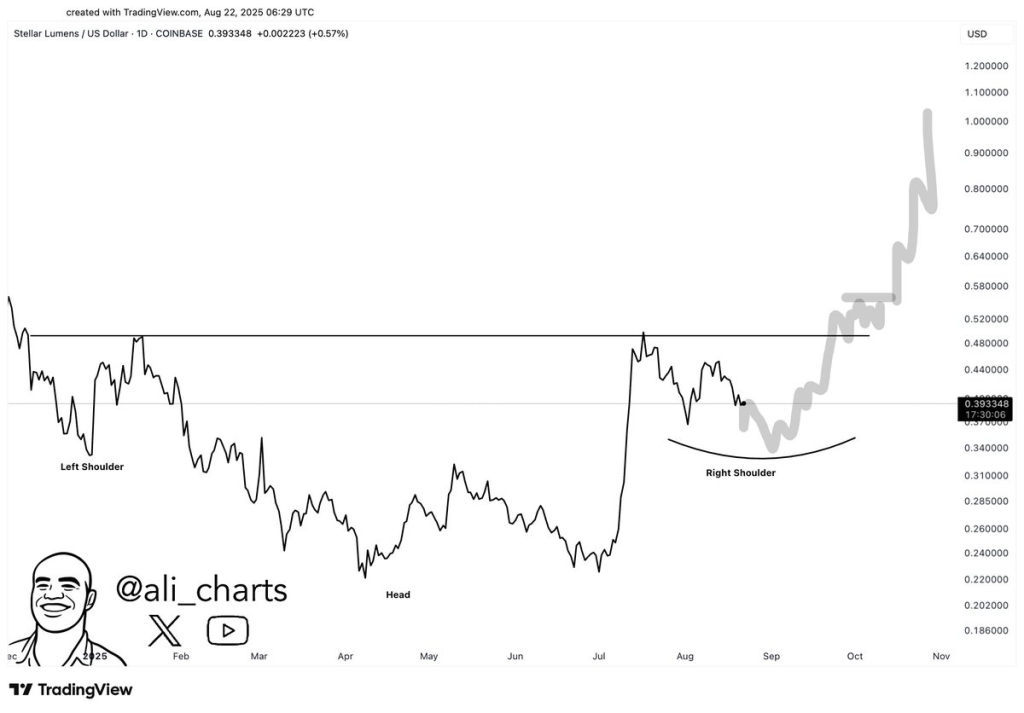

- XLM forms a head-and-shoulders pattern with neckline resistance at $0.48–$0.50, signaling possible reversal if breakout holds.

- Short-term breakdown sent XLM 16% lower, testing support near $0.38–$0.40 with sellers controlling momentum.

- Daily bullish structure clashes with intraday bearish signals, leaving traders watching $0.38 support for the next move.

Stellar (XLM) was trading at $0.41 at press time, showing a 1% decline in the past 24 hours and a 3.63% drop over the past week. Daily trading volume stands at $380.46 million, reflecting continued activity while the token consolidates near key price levels.

Analyst Ali shared that XLM is forming the right shoulder of a head-and-shoulders pattern, a structure often seen as a possible reversal signal. On the daily chart, the left shoulder developed earlier this year, followed by a deeper low forming the “head.” The current upward bounce and pullback suggest the right shoulder may now be taking shape.

Ali commented,

“Stellar XLM is forming the right shoulder of a head-and-shoulders pattern!”

The neckline of this structure sits around $0.48–$0.50, which remains a critical resistance zone. A confirmed breakout above this level would validate the pattern and open the door for higher targets, potentially extending toward $0.70 and beyond $1.00.

Breakdown and Short-Term Pressure

On shorter time frames, analyst Franklin noted that XLM recently faced a breakdown after failing to hold the $0.46 resistance zone. Price fell by about 16%, providing profits for short positions during the move. He stated,

“$XLM Breakdown in Action! Short position ripping with +16% profit. Secure profits or trail your stop-loss.”

The 4-hour chart shows XLM falling back into the $0.39–$0.40 area, where it is currently consolidating. Key resistance remains unchanged at $0.44–$0.46, while immediate support sits near $0.38. If this level breaks, the next downside target could shift toward $0.35.

Technical Outlook

The contrasting views from daily and intraday charts highlight a split market picture. On the higher timeframe, the head-and-shoulders setup points to the potential for a bullish reversal if resistance near $0.50 is cleared. On the lower timeframe, bearish pressure remains active, with sellers maintaining control below resistance zones.

For now, traders are closely watching the $0.38–$0.40 range. Holding this support could allow the right shoulder to complete and build momentum toward a neckline test. A failure to hold would keep the bearish bias intact and delay any chance of reversal.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |