- Bitcoin mining difficulty increases to 136.04 T, a new high.

- Increases favor large miners, affecting smaller operators.

- Record hash rate fuels intensified competition among miners.

Bitcoin mining difficulty set a new record, increasing by 4.89% to 136.04 T at block height 913,248 as reported by CloverPool data on September 7, 2025.

The increase signifies intensified competition among miners and rising hash power, impacting profitability and favoring large-scale mining operations.

Bitcoin Difficulty Surge as Major Miners Dominate

The latest adjustment to Bitcoin’s mining difficulty was recorded on September 7, 2025, raising difficulty by 4.89% to 136.04 T. Major players such as Foundry USA, AntPool, and ViaBTC continue to dominate with over 60% of the global hash rate.

The increase signals strong network hash power at 975.41 EH/s as of September 5, 2025. Miners are experiencing heightened competition, which continues to pressure smaller operations, favoring larger, more capitalized entities.

“No direct quotes found from major Bitcoin KOLs or executives on this mining difficulty adjustment.”

There have been no significant public comments from key industry influencers like Arthur Hayes or CZ regarding the recent difficulty adjustment. Market responses suggest miners are adjusting to profitability pressures and the evolving landscape.

Bitcoin’s $2.2 Trillion Market Cap and Miner Challenges

Did you know? The current Bitcoin mining difficulty of 136.04 T surpasses last month’s record of 129.7 T, underlining intensified global mining competition.

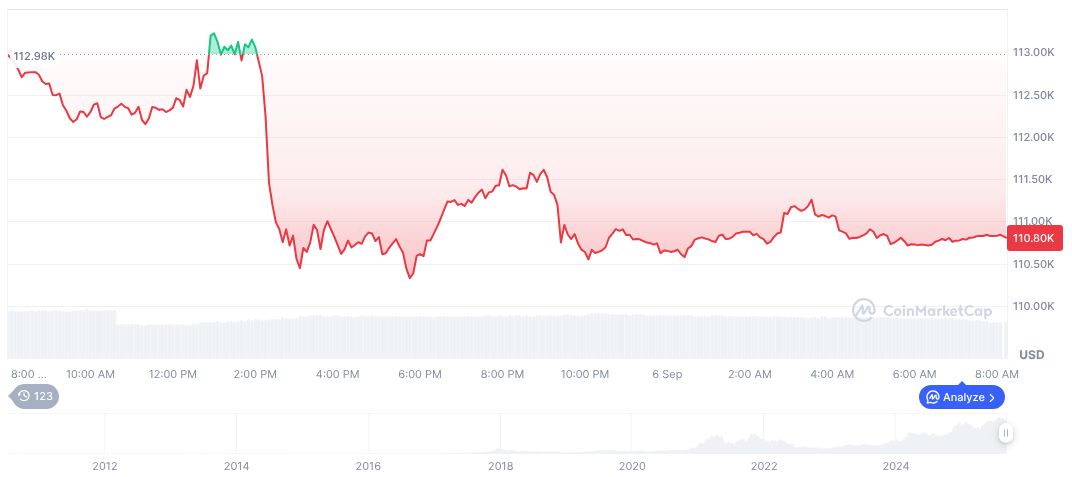

Bitcoin’s current price is $110,269.64, with a market cap of $2.2 trillion and a market dominance of 57.87%, as reported by CoinMarketCap. Its recent movements include a 0.41% decrease in the last 24 hours, but a 4.2% increase over 90 days. Trading volumes have decreased by 62.64% in 24 hours.

Industry experts suggest large miners have a competitive edge due to efficient ASIC machines and cheap energy. Market centralization may continue as small-scale miners face profitability pressures amid the rising difficulty trends.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |