Key Insights:

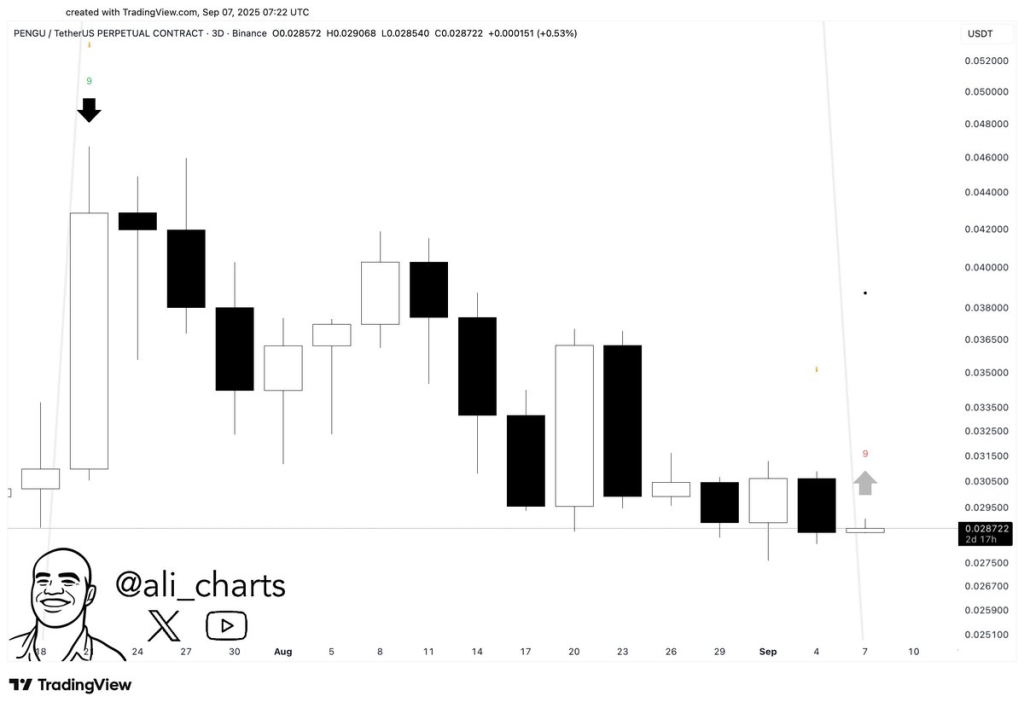

- PENGU completes TD Sequential 9-count near $0.028, signaling a potential end to the downtrend.

- Price breaks above $0.031 resistance with volume, pointing to a possible 30–40% short-term rally.

- Trading above 4H 200 EMA at $0.0311 suggests an early trend shift backed by strong volume support.

Pudgy Penguins (PENGU) token is showing early signs of a potential trend reversal. The token recently triggered a buy signal based on the TD Sequential indicator, drawing attention from multiple market analysts.

TD Sequential Signals Potential Rebound

The TD Sequential indicator on PENGU’s 3-day chart has issued a completed 9-count. According to analyst Ali_charts, this could signal the end of the recent downtrend.

The chart places the count near the $0.028 mark, a level where reversals are often expected during extended bearish periods. From its recent high of around $0.052, PENGU has dropped over 44%, reaching as low as $0.028722.

The ongoing setup aligns with standard TD Sequential methodology, which traders use to identify possible trend exhaustion. This setup shows a textbook 9-count, which often leads to a price bounce if supported by volume.

Breakout Above Key Pattern and Resistance Levels

However, Technical analyst CryptoBull_360 noted that PENGU may be preparing for a short-term rally. The token recently broke above its Point of Control (PoC) and also exited a descending triangle pattern on the 4-hour chart.

This breakout, supported by increasing volume, puts the next resistance level at around $0.031. A sustained move above this price could trigger a price increase of 30–40%, targeting the $0.042 area.

If the consolidation holds above $0.031, the structure supports further upward movement. The volume chart shows a strong node under the current price, suggesting buyer support.

Current Price and Price Testing 200 EMA Resistance

Meanwhile, PENGU is also attempting to stay above the 4-hour 200 EMA, which is currently near $0.0311. Analyst MacroCRG stated that PENGU is now trading at around $0.0314, slightly above this key trend level.

A close above the 200 EMA often suggests early strength in shorter timeframes. The 200 EMA has acted as a long-term resistance, and holding above it may confirm a trend change if supported by continued buying interest.

As of the latest update, the price of PENGU stands at $0.032844, reflecting a 13.78% rise in the last 24 hours. The 24-hour trading volume reached $489.8, showing vigorous market activity and investor engagement.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |