- Bitcoin’s market cycle is influenced by institutional reshuffle.

- Institutional demand initiates segmented selling by long-term holders.

- Expectations for peak flag indicator, suggesting potential Bitcoin peak in 2025.

CryptoQuant analyst Axel Adler Jr. reports Bitcoin, 504 days post-halving, is in a mature bull market segment with institutional-driven waves over recent months, hinting at potential peak signals through 2025.

Institutional absorption of Bitcoin suggests a more sustainable market, with key indicators hinting at a potential peak by late 2025, possibly altering financial strategies.

Institutional Demand Reshapes Bitcoin Market Dynamics

Expectations for the peak flag indicator emerge as pivotal, traditionally occurring when spot price reaches approximately 11 times realized long-term holder price, suggesting a potential peak between October and November 2025. This comes alongside mild market corrections within 10-18%, supporting a consolidation phase.

Reactions from analysts highlight the shift in market composition. Adler Jr.’s insights underscore the emphasis on institutional roles, contrasting with previous retail-heavy cycles. No comments were made by other key figures in current Bitcoin distribution contexts.

Market Stability and Institutional Strategy Boost Bitcoin

Did you know? Bitcoin’s price history shows that significant peaks often correlate with institutional buying patterns.

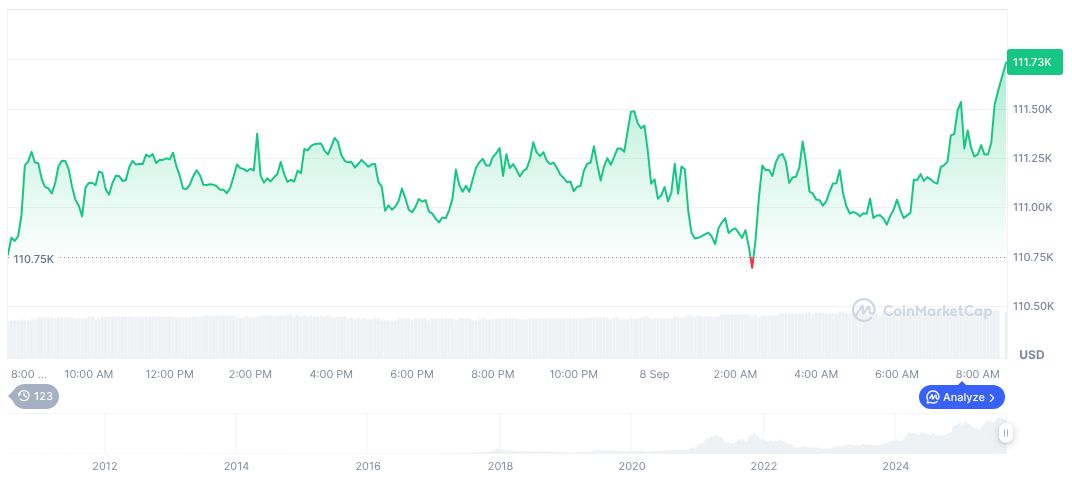

Bitcoin maintains its spot with a 1.60% increase in 24 hours, reaching $113,048.63 according to CoinMarketCap. With a market cap of $2.25 trillion, Bitcoin’s dominance stands at 57.47%, reflecting stability amidst evolving market dynamics. Mild price adjustments mark a 3.22% rise over 90 days, maintaining an institutional-centered strategy.

Insights from Coincu Research Team suggest emerging regulatory frameworks and technological advancements could extend Bitcoin’s evaluation period, influencing potential outcomes. The market anticipates transformative financial structures, reflecting the growing institutional backbone.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |