Key Points

- XRP tests $3.13 resistance with support at $2.77 and $2.67

- Bollinger Bands squeeze signals potential sharp price move

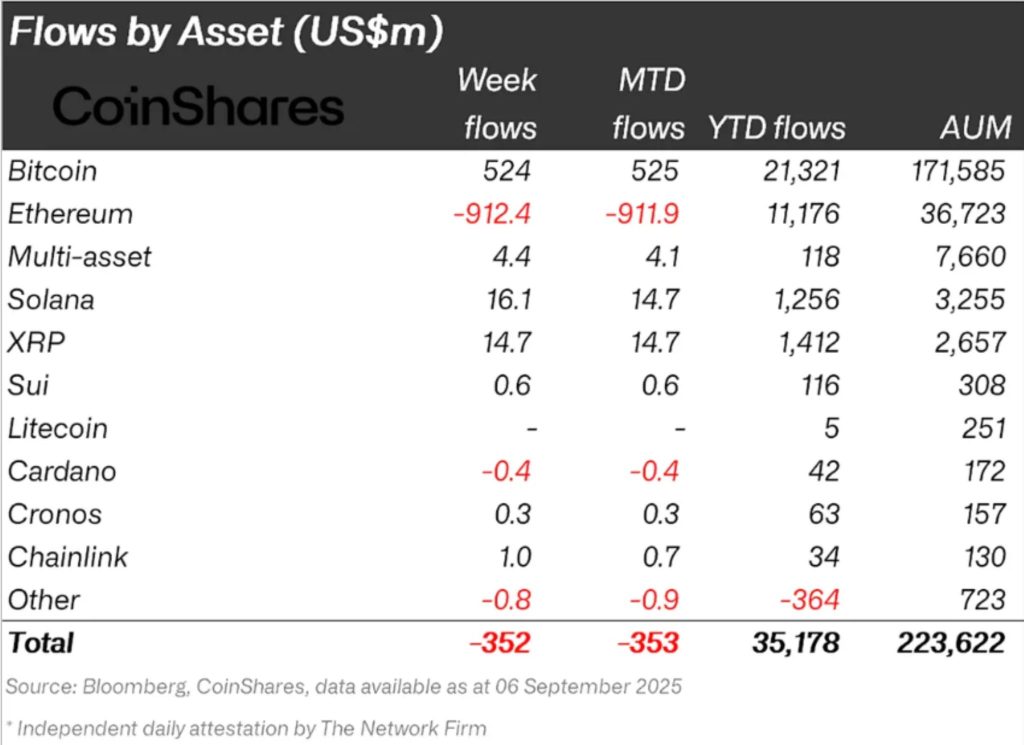

- Institutional inflows hit $14.7M, boosting market confidence

XRP is trading near $3.00 as bulls test a falling wedge pattern, with resistance at $3.13. Immediate support sits at $2.77 and $2.67, forming a crucial base for the next move.

A breakout above $3.13 could trigger bullish momentum, opening the path toward higher price levels in the coming sessions. Analysts emphasise that this setup reflects long-term opportunity as the wedge nears resolution.

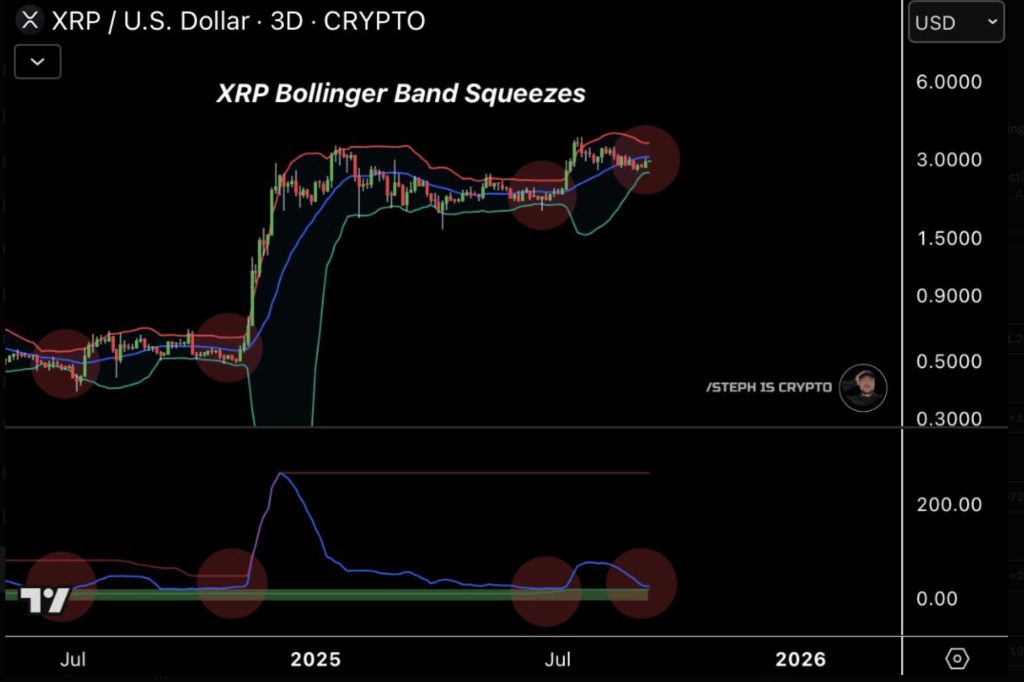

Bollinger Bands and Historical Moves Point to Volatility

On the three-day chart, XRP’s Bollinger Bands are tightening, showing reduced volatility and hinting at a sharp price movement. Historically, these squeezes have preceded major breakouts in XRP’s price cycles.

Past rallies included gains of 57.32%, 31.57%, and 67.65% following consolidation phases. The current Stochastic RSI reading of 17.26 also shows oversold conditions, suggesting that momentum may be preparing to shift upward.

Institutional Demand and Exchange Listings Boost Market Confidence

Institutional inflows into XRP reached $14.7 million last week, ranking second among altcoins after Solana’s $16.1 million. Year-to-date, XRP has accumulated $1.41 billion in inflows, confirming strong demand from professional investors.

At the same time, Backpack exchange has introduced XRP spot trading pairs, expanding its crypto offerings and providing more access for retail users. This addition strengthens liquidity and highlights rising interest in XRP across both institutional and retail markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |