- An estimated $3.047 million USDC was stolen and laundered into Tornado Cash.

- Immediate laundering obscured asset trails through Ethereum’s Tornado Cash.

- Significant on-chain losses in 2025 have exceeded $1.5 billion.

An unidentified individual lost approximately 3.047 million USDC on the Ethereum network yesterday, which was converted to ETH and moved through Tornado Cash, ZachXBT reports.

With the rising frequency of Ethereum-based hacks, this incident underscores ongoing security risks and challenges affecting the network’s perception and the digital asset market’s stability.

$3.05 Million USDC Stolen and Laundered

The hack involved a yet-to-be-identified attacker who breached the Ethereum network, stealing 3.047 million USDC. The attacker converted the USDC to ETH and deposited it into Tornado Cash using address 0xf0a6c5b65a81f0e8ddb2d14e2edcf7d10c928020. On-chain losses in 2025 have reached nearly $1.5 billion, underlining persistent security risks.

The immediate implications showed a lack of response from high-profile figures in the crypto sector. No official comments have been issued on this breach, demonstrating a need for enhanced community alertness.

As of now, there are no direct quotes related to the hack from prominent figures in the cryptocurrency industry. The information gathered indicates a lack of official statements or commentary regarding this specific incident.

Systemic Vulnerabilities and Potential Reforms in Focus

Did you know? In 2025, numerous Ethereum exploits have contributed to on-chain losses exceeding $1.5 billion, illustrating systemic security vulnerabilities.

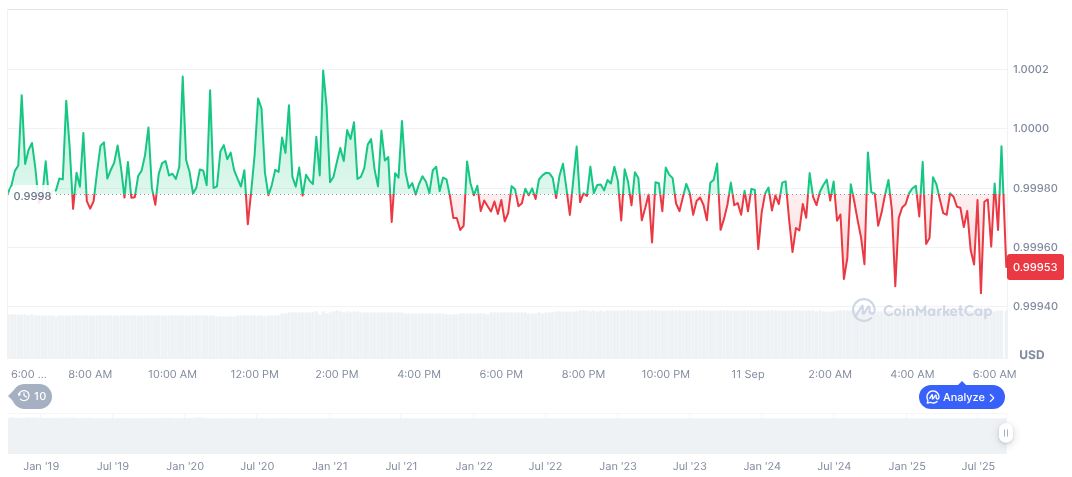

According to CoinMarketCap, USDC maintains a $1.00 price and a market cap of approximately $72.22 billion. 24-hour trading volume was $15.98 billion, with a 9.13% change. Price fluctuations were noted with -2.11% in the past day and -4.29% for the last 60 days. Circulating supply stands at 72.24 billion.

Experts from Coincu suggest potential regulatory reforms might emerge due to mounting on-chain losses. Technological advancements are crucial to mitigate future vulnerabilities and reinforce blockchain security. Financial impacts remain localized but significant for affected parties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |