Key Points

- BlackRock buys 10,000 ETH for $44.66M via Coinbase Pro.

- ETHA adds 140K ETH, now holds 3.8M ETH worth $17.11B.

- Whale wallets rise past 1,000 as ETH holds $4,400 support.

BlackRock has executed a major Ethereum acquisition, purchasing 10,000 ETH worth approximately $44.66 million via Coinbase Pro. The transfer was recorded just 17 minutes before monitoring, signaling an active and deliberate market move.

This action highlights the increasing involvement of institutional entities in the Ethereum ecosystem. Coinbase Pro is known for serving professional and institutional clients, suggesting this purchase was strategic.

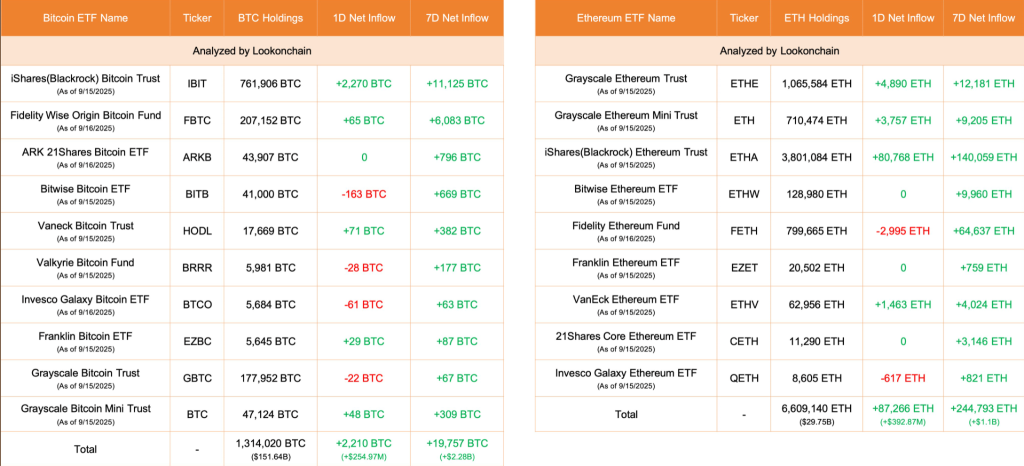

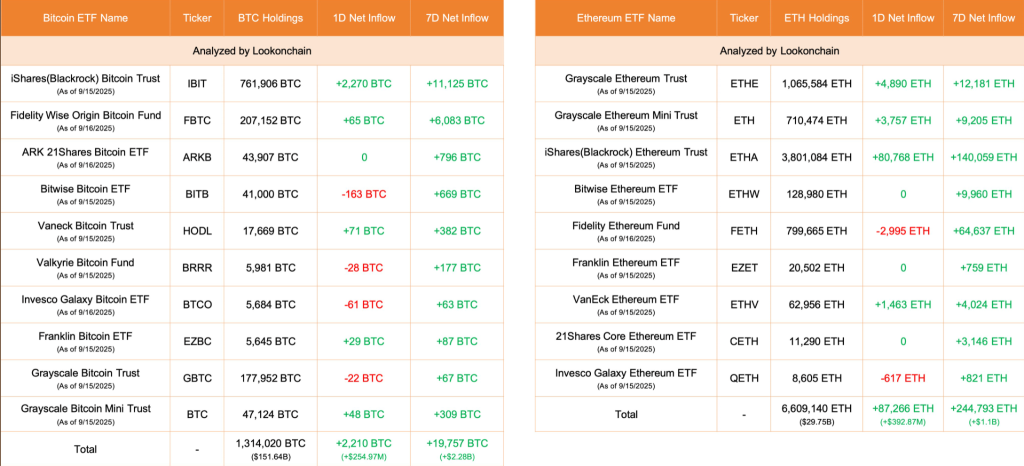

ETF Inflows Reinforce Confidence in Crypto Assets

BlackRock’s Ethereum and Bitcoin ETFs have posted strong inflows, showing rising institutional appetite for crypto-based investment products. iShares Ethereum Trust (ETHA) received 80,768 ETH in daily inflows, totaling $363.62 million.

Over the week, ETHA added 140,059 ETH, bringing its total holdings to 3,801,084 ETH worth about $17.11 billion. Simultaneously, iShares Bitcoin Trust (IBIT) gained 2,270 BTC daily, with $262 million in inflows.

Bitcoin & Ethereum ETF Net inflows | Source : Lookonchain

Across all nine Ethereum ETFs, holdings now stand at 6.6 million ETH valued at $29.75 billion. Seven-day ETH ETF inflows totaled 244,793 ETH, translating to $1.1 billion.

Bitcoin ETFs also showed strength, accumulating over 1.3 million BTC worth $151.64 billion. BlackRock’s IBIT remains the leader with 761,906 BTC in assets, now valued at $87.92 billion.

Whale Activity and Technical Support Zones Signal Volatility

Ethereum whale wallets holding 10,000 to 100,000 ETH have surged, rising from under 900 addresses to over 1,000. This rapid rise points to increasing large-holder confidence during a period of short-term price volatility.

Ethereum Addresses with Balance between 10k and 100k | Source : Alphractal

Ethereum is now trading around $4,444.99, down 1.42% in the last 24 hours amid a broader bullish weekly trend. Support is holding near $4,400–$4,450, which analysts mark as a critical area to maintain.

A drop below this zone may trigger a liquidity flush, potentially pushing ETH to $4,107 or even $3,900. However, some analysts consider these levels ideal for strategic accumulation amid continued institutional interest.

The broader data shows a sustained bullish outlook, with high open interest at $63.11 billion and bullish long/short ratios on key exchanges. Ethereum’s market cap stands at $537.02 billion, confirming its strong position among digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |