- SEC delays Truth Social Bitcoin ETF decision to October 2025.

- Spot Bitcoin and Ethereum impacted by delay.

- Market reactions remain mild with muted trading volumes.

The U.S. SEC has deferred its decision on the Truth Social spot Bitcoin and Ethereum ETF until October 8, 2025, citing the need for further evaluation.

This delay affects market outcomes for Bitcoin and Ethereum, impacting ETF applications and sparking mild hesitancy but limited immediate price reactions.

SEC Postpones Crypto ETF Decisions Until 2025

The SEC has delayed its decision regarding the approval of the Truth Social spot Bitcoin and Ethereum ETF until October 8, 2025. This delay, alongside other cryptocurrency ETF applications, stems from extended evaluations of proposed rule changes and associated concerns. Truth Social, initially launched by Trump Media & Technology Group, files along with Grayscale and CoinShares, facing similar deferrals.

Bitcoin and Ethereum ETFs face postponements, directly influenced by the SEC’s decision. This move introduces regulatory uncertainty but fails to create substantial market disruptions, with trading volumes showing no abrupt declines. Other ETF applications for XRP and Litecoin have also been postponed, aligning with the broader regulatory theme.

Public sentiment reflects frustration over the regulatory inertia, yet lacks panic. According to SEC Chair Gary Gensler, “The Commission requires time to review proposal intricacies.” Despite concerns from the blockchain community, on-chain data post-announcement remains, with leading figures issuing no major statements. No new funding or institutional capital shifts have resulted from this postponement, indicating a wait-and-see approach by market participants.

Bitcoin Exhibits Stability Amid Regulatory Delays

Did you know? The SEC often extends review periods for crypto ETFs. In previous years, delay patterns for Solana and Polkadot ETFs led to short-term price hesitance without serious disruptions.

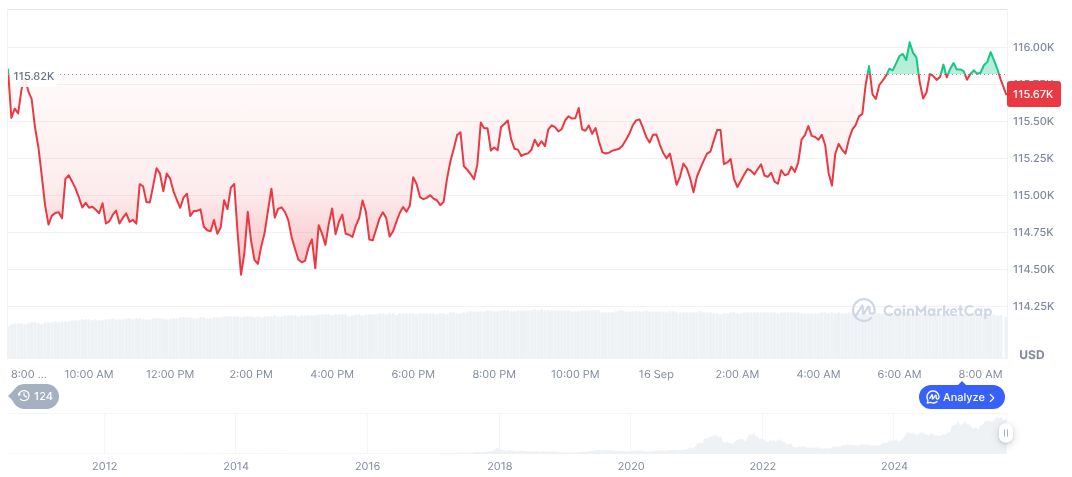

As of September 17, 2025, Bitcoin (BTC), according to CoinMarketCap, is priced at $117,235.28. With a market cap of 2.34 trillion, it holds 57.53% dominance. Bitcoin exhibited a 1.15% increase today, with trading volumes down 8.84%. Over 90 days, it recovered 11.84%, indicating resilience amid regulatory pressures.

Coincu Research indicates that while regulatory delays may cool speculative inflows, systemic price drops are rare without rejections. Historical delay reactions often lead to short-lived price hesitance but minimal long-term impacts. As the SEC seeks more time, watching market reactions and trends will be essential for stakeholder strategy.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |