- UK FCA announces tailored crypto regulations for 2025.

- Focus on consumer protection, operational risks.

- Exemption from traditional financial rules.

The UK’s Financial Conduct Authority will introduce a tailored regulatory framework for crypto-asset companies in 2024, exempting them from certain traditional rules while addressing operational risks.

These changes aim to align the evolving crypto market with financial regulations, potentially impacting market stability and operational standards for UK-based crypto companies.

FCA’s Tailored Rules Exclude Standard Finance Obligations

The FCA’s upcoming rules for crypto-asset companies are, according to the Financial Times, tailored and seek to address specific crypto-industry risks rather than merely applying existing financial principles. The FCA will exclude requirements like “good faith” and “customer interests first” which are standard in traditional finance, and there will be no obligation for companies to offer a cooling-off period.

The new framework will focus on operational risks. According to the FCA, additional controls may be introduced to mitigate issues like cyberattacks. Public feedback is being solicited to consider including these issues in consumer protection mandates, suggesting an inclusive approach in rule-making. As an FCA spokesperson noted, “Our regulatory framework will focus on operational risks and tailored consumer protection for crypto-asset firms.”

Stakeholder responses have largely focused on how the tailored approach may balance innovation with regulation. Although no major statements from key figures like crypto influencers have emerged, the upcoming public consultation indicates room for diverse stakeholder input, potentially impacting the final shape of regulation.

Regulatory Clarity Attracts Institutional Investment

Did you know?

The FCA’s approach to crypto parallels the EU’s MiCA framework, which also tailors financial regulations for industry-specific risks, including prudential controls and consumer protection.

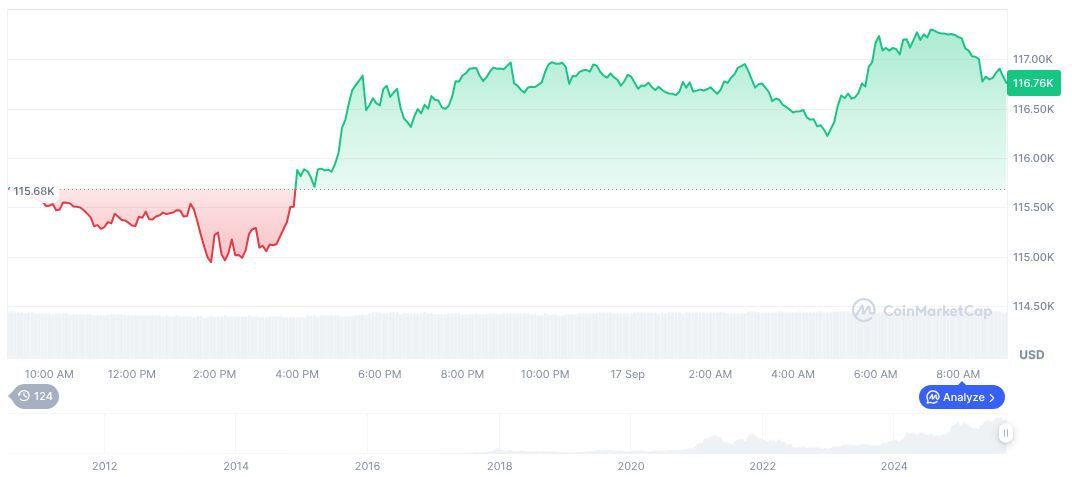

As of 11:05 UTC on September 17, 2025, Bitcoin (BTC) is priced at $116,339.11 with a market cap of $2.32 trillion, dominating 57.54% of the market. A 0.89% rise in the last 24 hours complements a 10.89% increase over 90 days, highlighting sustained growth per CoinMarketCap.

Coincu’s research team suggests that, with these regulatory measures, the UK’s crypto market may see increased stability and credibility. Historically, regulatory clarity has attracted more institutional investors, potentially resulting in greater market maturity and investment inflows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |