- BlackRock shifts focus to U.S. stocks with increased AI sector exposure.

- Billions flow into ETFs post allocation change.

- U.S. stock market surge correlates with AI investments.

BlockBeats News reports that BlackRock, the world’s largest asset management firm, is increasing its exposure to U.S. stocks and artificial intelligence sectors, signaling confidence in their growth.

This strategy reflects BlackRock’s optimism about U.S. market performance, driven by strong AI sector gains and anticipated Federal Reserve rate cuts, boosting fund flows into related ETFs.

BlackRock’s Strategic Shift: AI and U.S. Stock Surge

BlackRock, the largest asset management company, revised its model investment portfolios, increasing U.S. stock exposure by 2% and expanding into the AI sector. This action aligns with the recent surge in AI investments and expected economic growth.

The adjustment led to significant fund flows into BlackRock’s ETFs, underscoring confidence in U.S. stock stability. This shift arises as the S&P 500 Index reaches historical highs, driven by U.S. companies’ robust performance.

“Our increased investment in U.S. stocks, especially within the AI sector, signifies our confidence in the upcoming market trends largely driven by technological advancements.” — Larry Fink, CEO, BlackRock

Tech-Driven Economic Growth: Past and Present Insights

Did you know? BlackRock’s U.S. stock allocation adjustment mirrors past trends where major asset reallocations have historically influenced market dynamics, emphasizing AI’s rising importance.

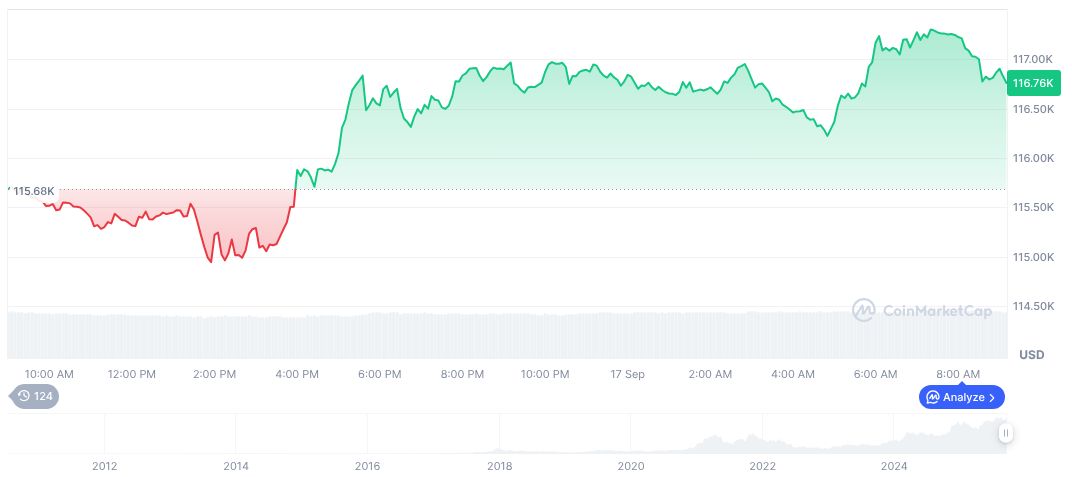

CoinMarketCap data shows Bitcoin (BTC) priced at $115,650.53, with a 24-hour trading volume of $49.28 billion, marking a 0.46% price increase in 24 hours. The market cap stands at $2.30 trillion, highlighting continued investor interest.

The Coincu research team observes that these shifts indicate potential regulatory adaptations in response to technological advancements in AI. Such movements underline the growing significance of tech-driven sectors in bolstering economy-wide gains. The BlackRock Investment Institute Outlook further details how strong U.S. earnings, especially in AI, provide a solid foundation for strategic shifts towards U.S. equities.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |