- Mass validator exit increases Ethereum PoS queue to 2.5 million ETH.

- Withdrawal delays exceed 43 days, increasing market uncertainty.

- SwissBorg hack influences Kiln’s withdrawal of validator nodes.

Ethereum’s Proof-of-Stake network faces a significant challenge as validator exits surpass 2.5 million ETH, valued at over $11.3 billion, with withdrawal delays of over 43 days.

The surge in Ethereum’s exit queue, intensified by Kiln’s withdrawals, highlights potential liquidity concerns and market volatility within the DeFi ecosystem.

Ethereum Queue Exceeds $11B Amid Kiln Withdrawal Crisis

The Ethereum PoS network has encountered a marked increase in its exit queue, influenced by Kiln’s withdrawal of around 1.6 million ETH after a security incident at SwissBorg. Validator queue surpasses 2.5 million ETH, elevating the total value above $11 billion.

Significant withdrawal delays now extend over 43 days, complicating liquidity dynamics. The potential for market fluctuations is heightened should exited ETH flood into alternative investment protocols, especially given the ongoing demand signified by the 479,000 ETH waiting for staking.

Market and community responses remain muted, as no official updates have been disseminated from the Ethereum Foundation or key blockchain figures. Despite this, the situation continues to spark discourse within developer communities regarding protocol vulnerabilities.

“Due to the hacking incident involving SwissBorg, Kiln began an orderly exit of all its Ethereum validator nodes to ensure the integrity of the staked assets.” – Kiln Spokesperson, Kiln

Historic Queue Growth and Liquidity Concerns Analyzed

Did you know? The current Ethereum exit queue surpasses previous records by over 300%, eclipsing the previous high of 617,000 ETH during prior market volatility.

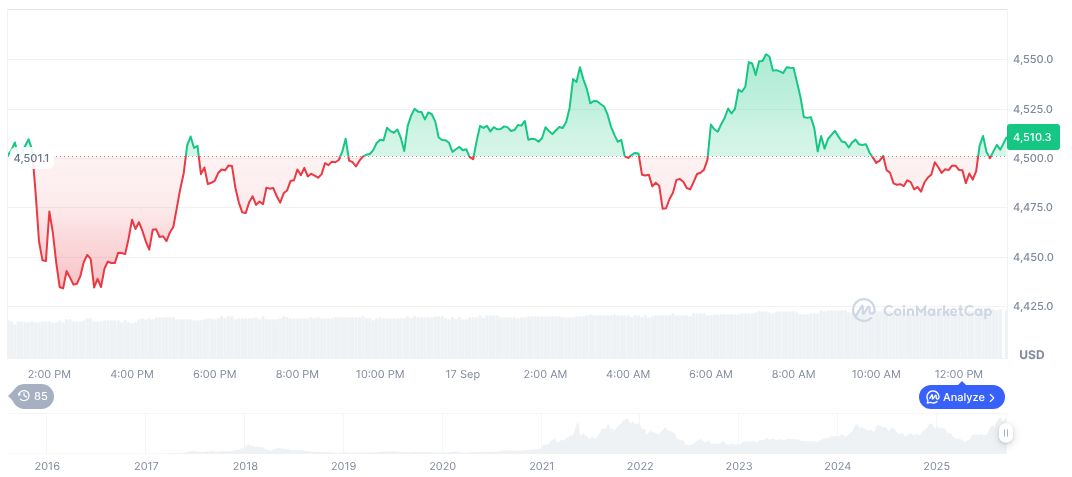

Based on CoinMarketCap data, Ethereum (ETH) is currently priced at $4,486.21, with a market cap of $541.50 billion. ETH’s 24-hour trading volume reached $31.96 billion. The asset has seen a 0.50% price increase over the past day and a 79.43% increase over 90 days.

Analysis by Coincu reveals potential risks of major price fluctuations if the exited Ethereum reintegrates into markets too quickly. Continued monitoring of validator dynamics and staking practices is essential to anticipate further liquidity shifts or regulatory adjustments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |