Key Points

- Bitcoin ETFs added +11,308 BTC ($1.31B) in 7 days, led by Fidelity and BlackRock, despite a broad crypto market decline.

- Ethereum ETFs saw +195,993 ETH ($881.97M) in weekly inflows, with Fidelity and BlackRock topping the list of institutional buyers.

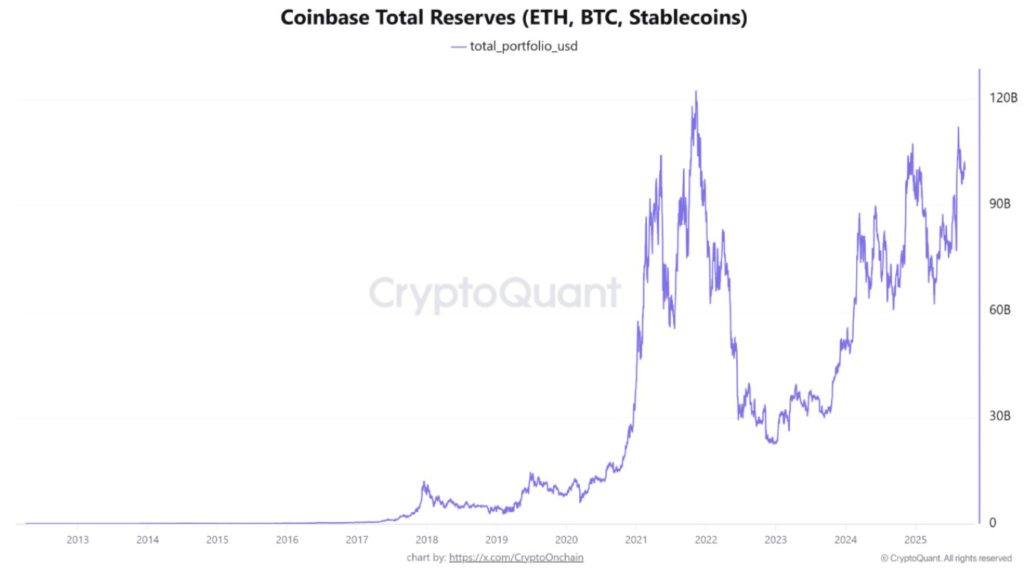

- Coinbase reserves reached $112B in BTC, ETH, and stablecoins, the highest in four years, pointing to rising market liquidity.

Bitcoin and Ethereum ETFs recorded significant inflows on September 19, 2025, even as the broader crypto market declined sharply. Despite a $102 billion market-wide loss, institutional interest in crypto exposure remained firm through ETF channels.

Bitcoin ETFs now hold a combined 1,317,560 BTC, equivalent to approximately $152.84 billion in assets under management. Net inflows reached +1,205 BTC ($139.75 million) in the past 24 hours and +11,308 BTC ($1.31 billion) over the past 7 days.

Fidelity’s Wise Origin Bitcoin Fund led daily inflows with +828 BTC ($96.09 million), pushing its total holdings to 207,370 BTC ($24.05 billion). Other notable contributors included ARK 21Shares Bitcoin ETF with +213 BTC, Bitwise with +109 BTC, and VanEck with +175 BTC.

Grayscale Bitcoin Trust saw the largest daily outflow of -549 BTC, bringing its total to 177,389 BTC. However, BlackRock’s iShares Bitcoin Trust remained dominant, holding 764,993 BTC, supported by a strong +17,629 BTC weekly inflow.

Ethereum ETFs Outpace Bitcoin in Weekly Growth

Ethereum ETFs posted higher inflows than Bitcoin over the same 7-day period, highlighting growing interest in ETH-based products. Combined holdings reached 6,636,396 ETH, totaling about $29.86 billion in value.

Daily inflows into Ethereum ETFs stood at +41,150 ETH ($185.17 million), while weekly inflows totaled +195,993 ETH ($881.97 million). Fidelity’s Ethereum Fund led all ETH ETFs, adding +34,688 ETH ($156.1 million) in one day.

That brought its total to 817,134 ETH ($3.68 billion) under management. BlackRock’s iShares Ethereum Trust remained the largest ETH ETF, holding 3,802,294 ETH, after a +117,674 ETH weekly increase.

These flows suggest Ethereum is attracting increased institutional attention, possibly in anticipation of future developments or upgrades. The trend may indicate a diversification strategy among investors balancing Bitcoin and Ethereum exposure.

Market Pullback Highlights Fragility as Coinbase Reserves Climb

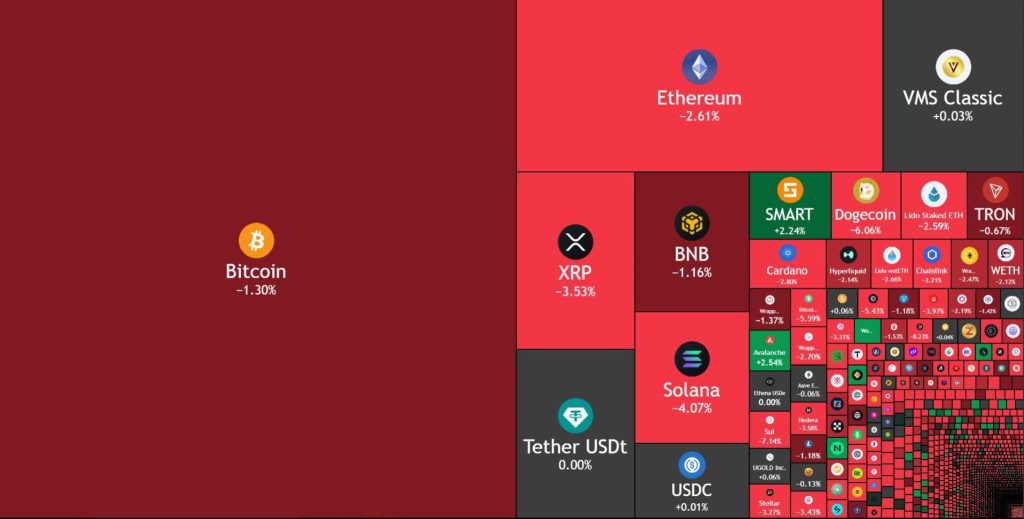

Despite ETF inflows, the crypto market saw broad-based losses, with Bitcoin dropping 1.30% and Ethereum falling 2.61% in 24 hours. Altcoins underperformed, with XRP down 3.53%, Solana 4.07%, and Dogecoin 6.06%.

Stablecoins such as USDT and USDC remained stable, offering liquidity during market stress. Notably, Avalanche and SMART defied the trend with modest gains of +2.54% and +2.24%, respectively.

Meanwhile, Coinbase reserves reached $112 billion in BTC, ETH, and stablecoins, the highest in four years, according to CryptoQuant. Historically, rising exchange reserves have signaled stronger liquidity and potential bullish momentum.

Although short-term sentiment remains cautious, the sustained ETF accumulation and rising exchange reserves reflect long-term institutional confidence. Investors appear to be preparing for eventual market recovery while navigating near-term volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |