- U.S. House passes stopgap funding bill to prevent shutdown.

- Senate may reject due to healthcare spending issues.

- Immediate political contention impacts legislative processes.

The U.S. House of Representatives passed a stopgap bill on September 19, 2025, to avert a government shutdown on October 1, amidst expected Senate contention.

The bill’s implications for non-defense spending have sparked political divisions, with potential spillover effects on U.S. market volatility, affecting major risk assets like Bitcoin and Ethereum.

House Passes Bill with 217-212 Vote Amidst Tensions

House Speaker Mike Johnson successfully guided the passage of a stopgap spending bill after negotiations within the Republican caucus. This funding measure seeks to prevent a government shutdown set for October 1. A voting tally of 217 in favor and 212 against highlighted the division in the House.

The Senate is expected to challenge the bill, primarily due to demands for increased healthcare spending. Democrats oppose the current terms, raising prospects for more contentious debates. Differences on non-defense and healthcare budgetary allocations are central to this political struggle.

“Unity is crucial as we navigate these challenging budget discussions.” — JD Vance, Vice President of the United States

Fiscal Uncertainty and Its Impact on Crypto Markets

Did you know? In past U.S. shutdown debates, fiscal uncertainty often translated to spikes in broader market volatility, impacting sentiment. Potential USD devaluation fears influence both traditional and digital assets.

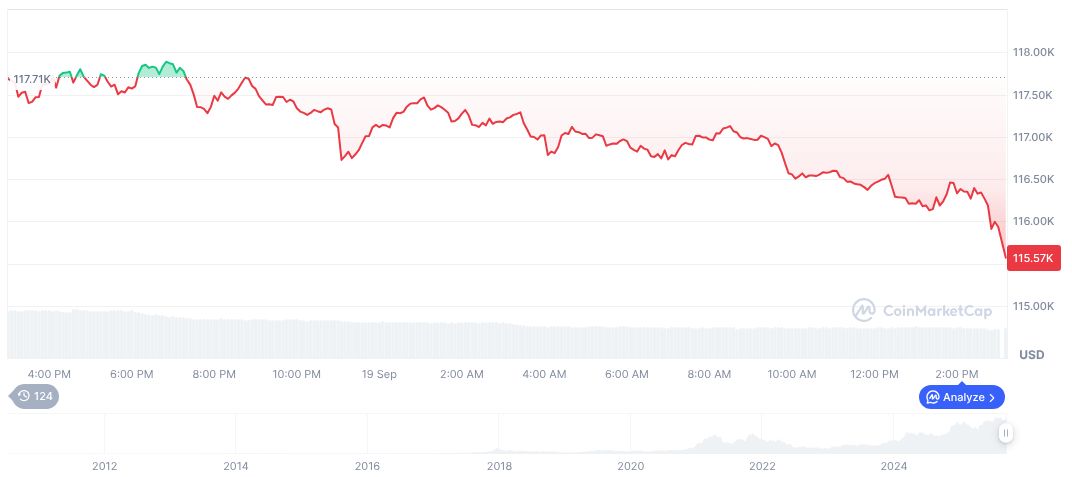

Bitcoin (BTC) trades at $115,420.44 with a market cap of $2.30 trillion per CoinMarketCap. The trading volume decreased by 26.12% over 24 hours, reflecting a 1.99% price drop. The circulating supply stands at 19,923,250 out of a max 21 million.

Research from Coincu suggests that fiscal uncertainty historically leads to increased volatility in risk assets like cryptocurrencies. Senate and regulatory decisions could impact future market trends, particularly influencing stablecoin and macro-asset prices if fiscal instability persists.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |