Key Points

- XRP price trades near $2.77 as key support and 50 EMA converge, signaling potential volatility.

- Weekly close below $3 shifts market bias toward short-term bearish momentum.

- Over $1B in long liquidations increases pressure, with XRP accounting for nearly $55M.

XRP price is trading at $2.81, sliding 6.25% in the last 24 hours and 7.20% over the past week. The price is approaching a critical technical level near $2.77, where the 50 EMA on the 3-day chart is aligning.

This confluence area could trigger a decisive move, especially if XRP breaks below it, increasing downside risks in the short term. The $2.65 level remains the most crucial support, as a breakdown could signal the end of the ongoing bullish structure.

Weekly Close Below $3 Signals Shift Toward Bearish Bias

Moreover, XRP price failed to reclaim $3.02 on the weekly chart, reinforcing a short-term bearish trend after a multi-week rejection. The Relative Strength Index (RSI) rejection, flagged earlier, accurately predicted this downward pressure and continues to weigh on momentum.

If XRP fails to hold above $2.65, the next support zones at $2.37 and $1.85 may come into focus quickly according to the weekly timeframe. Moreover, the monthly Fibonacci level now sits at $2.63, and a red close for September could turn market sentiment more cautious.

XRP Price Reacts to Heavy Liquidations and Market Volatility

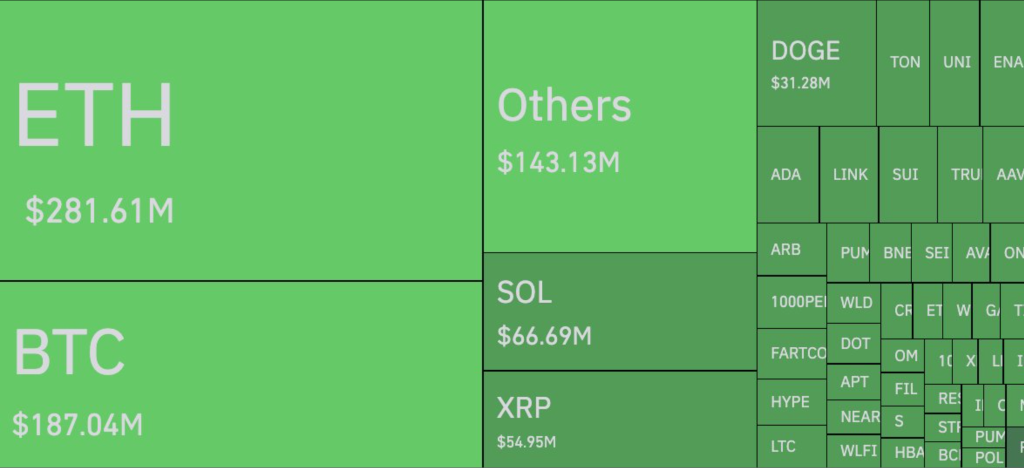

Meanwhile, over $1 billion in long positions were liquidated in just one hour, with XRP accounting for nearly $55 million. The massive shakeout reflects extreme volatility, further amplified by the current imbalance in long/short ratios.

Binance data shows a 3.76:1 long bias, while OKX reports 2.46:1, exposing the market to further liquidation risks. XRP futures volume reached $8.56 billion, spot volume hit $1.30 billion, and open interest stood at $7.78 billion.

Despite short-term weakness, XRP is still up 29.91% in 90 days and 370.50% over the past year. However, with traders leaning heavily long, continued price pressure may intensify unless $2.65 holds as firm support.

The outlook for October hinges on the monthly close, which may provide fresh direction after the recent rejection. For now, traders remain cautious, watching $2.77 and $2.65 as key markers for the next major move.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |