Key Insights:

- BNB soared 74% from $580 to $1,050, surpassing its previous all-time high near $700.

- Analysts say BNB remains bullish if daily closes stay above the critical $900 support level.

- BNB shows strength during broader market drops, keeping steady above key moving averages and $1,000 support.

BNB trades at $989.01 after a 6% drop over 24 hours, while remaining 8% higher over the past week. Trading volume stands at $3.32 billion, showing steady market activity during the latest pullback.

The strong advance lifted BNB from about $580 to near $1,050, marking a 74% rise from the breakout zone. This move pushed price beyond the previous all-time high near $700, setting a new market peak and confirming heavy buying during the surge.

Breakout and Key Technical Levels

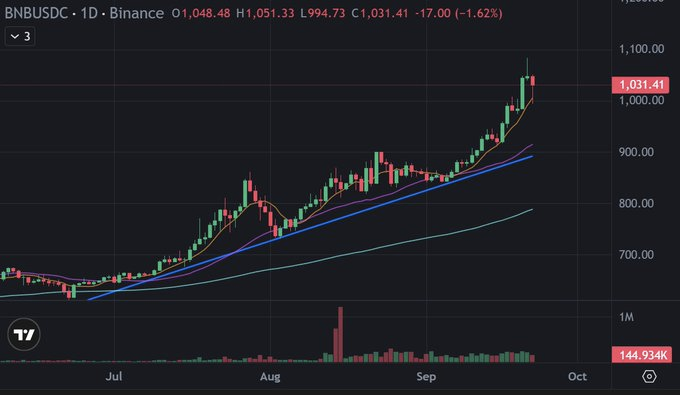

The daily BNB/USDT chart shows a broad accumulation phase under the earlier ATH. After building support, price broke out and climbed directly to the target zone near $1,050.

Analyst Cipher X noted,

“The breakout played out perfectly, the target I mentioned has now been hit after a powerful +74% move from the breakout zone.”

Cipher X added, “Structure remains strong as long as price holds above ~$900.” The $900 area now acts as key support. Holding daily closes above this point keeps the bullish pattern intact. A fall through this level could lead to a retest of the $700–$750 breakout base.

Strength During Wider Market Drop

BNB has shown firmness while many digital assets faced selling.

BATMAN stated,

“$BNB barely flinched during this market drop, it’s so strong.”

Charts support this view, with price staying well above short- and medium-term moving averages.

Even during recent market softness, BNB’s decline stayed shallow and quickly found support near $1,000. Trading volume remained steady, underscoring the strong upward trend that has held since midsummer.

Outlook and Support Zones

As long as BNB remains above $900, the market structure stays upward. Immediate resistance sits near the recent $1,050 peak, with room to revisit or surpass this level if demand continues.

If sellers push prices below $900, traders may watch the $700–$750 range for the next strong demand area. For now, charts show that buyers continue to defend key levels and that the 74% advance remains intact.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |