Plasma’s Mainnet Beta Launches with Record Stablecoin Liquidity

- Main event: Plasma’s mainnet beta launch with record stablecoin liquidity.

- Plasma becomes 8th largest blockchain by stablecoin liquidity.

- USDT’s phased migration aims to sustain DeFi ecosystem growth.

Plasma is set to launch its mainnet beta on September 25, 2025, extensively deploying stablecoin liquidity across DeFi partners.

This marks an unprecedented day-one liquidity scale, with implications for DeFi’s growth and stability affecting key blockchain ecosystems.

Plasma’s Mainnet Beta Launches with Record Stablecoin Liquidity

Plasma’s mainnet beta launch aims for a robust DeFi ecosystem, deploying over $2 billion spanning 100+ partners. The plan includes phased USDT migration and significant XPL rewards. The project focuses on market stability, implementing cooldown periods for user withdrawals to manage liquidity.

“This large-scale liquidity rollout is unprecedented,” elevating Plasma to the 8th largest blockchain by stablecoin reserves. The USDT migration process involves controlled transfers to Aave, balancing market needs and risk. Additional XPL incentives aim to boost depositor interest during this phase.

Crypto community observers are keenly watching Plasma’s strategic deployment, although official comments from industry leaders remain scarce. While the community engagement is evident through open campaigns, major public figures have not yet addressed the event directly.

Record-setting Day: Largest Stablecoin Rollout Surpasses Ethereum

Did you know? Plasma’s launch marks the largest day-one stablecoin liquidity deployment, surpassing historical benchmarks set by Ethereum and Solana.

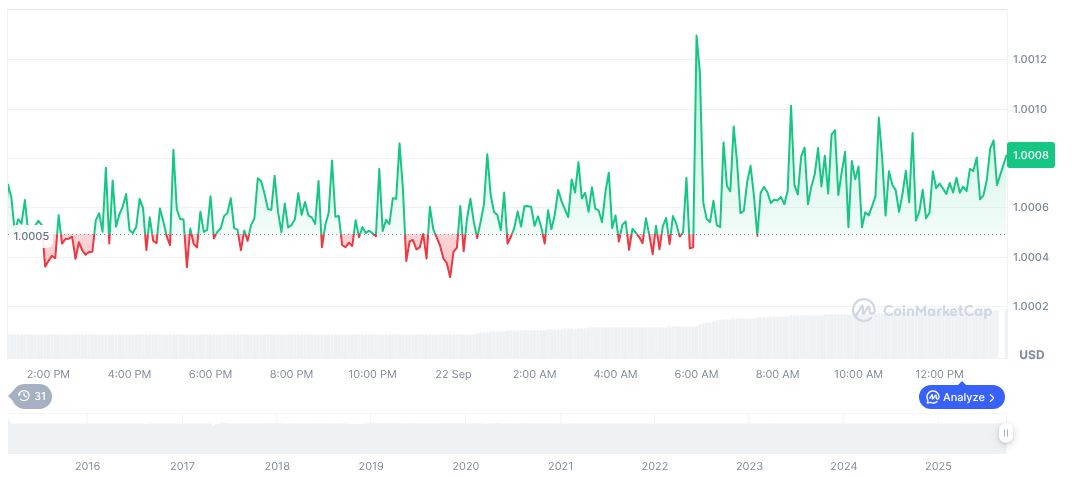

Tether USDt (USDT) holds its value at $1.00, with a market cap of $172.87 billion and a 4.43% market dominance as of September 23, 2025, according to CoinMarketCap. The 24-hour trading volume dropped by 14.20%, reflecting heightened market activity.

The Coincu research team identifies Plasma’s strategy as a potential blueprint for future DeFi projects. The balance of liquidity management and governance token incentives could influence broader adoption and integration into existing blockchain ecosystems. Plasma’s mainnet beta launch and its approach to liquidity management can serve as a guiding framework for newcomers in the DeFi space.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |