Key Points

- TON short liquidations near $1B suggest rising squeeze risk amid skewed positioning.

- Technical patterns show potential breakout above $2.78 with upside to $3.2050.

- Futures data shows strong long bias with Binance and OKX ratios exceeding 2.2 and 3.3.

Toncoin (TON) is showing signs of a potential rebound as market data indicates a sharp build-up of short positions. The token currently trades at $2.6666, with futures positioning and liquidation data pointing to an increasing risk of a short squeeze.

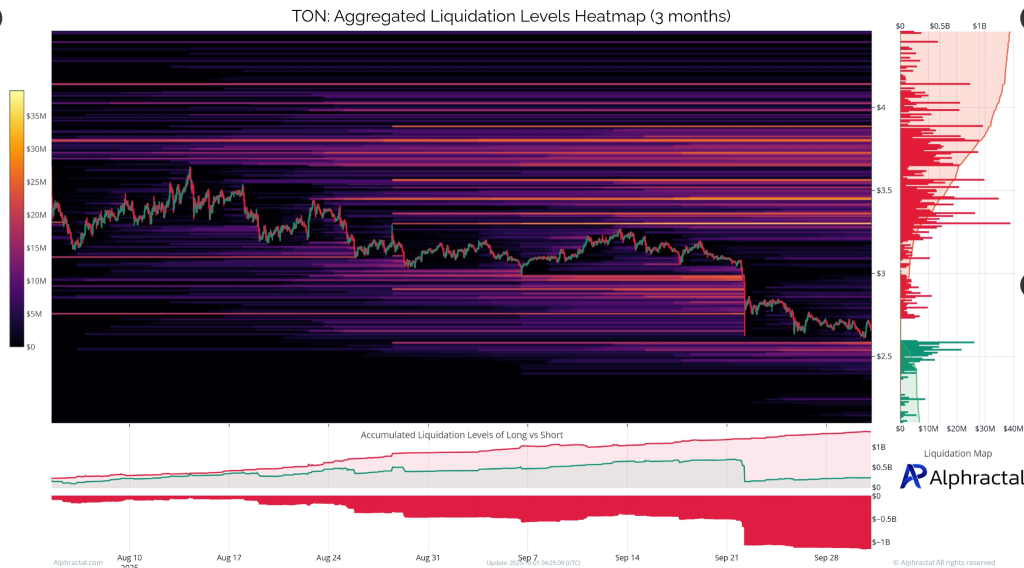

TON has fallen more than 50% year-to-date, dropping from $4.20 to $2.60 in the past three months. However, despite this decline, the market shows a strong imbalance in favor of shorts, creating a bullish setup if momentum shifts.

Liquidation maps reveal nearly $1 billion in accumulated short liquidations clustered between $3.50 and $4.00. In contrast, long liquidations remain below $0.5 billion, further reinforcing the skewed positioning.

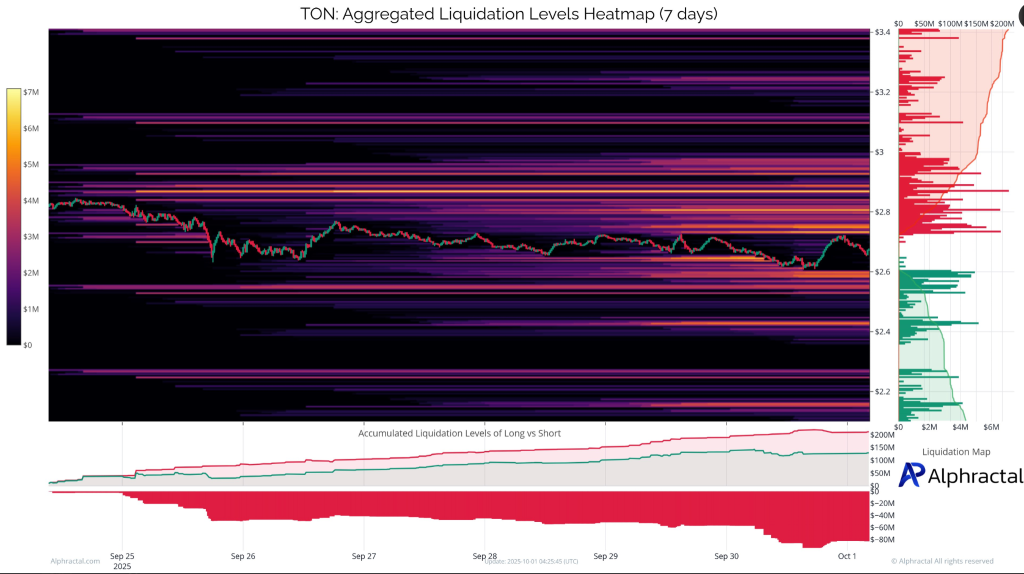

Over the past seven days, TON traded between $2.50 and $3.40, with heavy liquidation zones near $2.70 to $3.00. Short liquidations during this period surpassed $150 million, while long liquidations remained under $60 million.

Technical Indicators Suggest Potential Bullish Momentum

On the 4-hour chart, TON is trading within a symmetrical triangle following a sharp September drop. The price is hovering near $2.67, with support around $2.60 and resistance near $2.78.

A confirmed breakdown below $2.60 could extend losses toward $2.3650, while a breakout above $2.78 may push it to $3.2050. The RSI is around 45, suggesting weak momentum but room for improvement if it crosses 50.

The MACD remains below zero but shows signs of a potential bullish cross as bearish pressure flattens. If buyers regain control, short liquidations could accelerate, fueling further upward movement.

Despite negative performance across all major timeframes, long/short ratios show a strong bullish bias among traders. Binance and OKX both report long-dominant positions, with ratios above 2.2 and as high as 3.34.

Open interest sits at $283.64 million, while daily futures volume reached $160 million, indicating steady participation. If momentum shifts, the current setup favours bulls and increases the likelihood of a sharp short squeeze.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |