Key Insights:

- Ethereum’s price could reach $5,500-$6,000 by November, driven by strong volume.

- Ethereum could reach $ 10,000 with Wall Street and ETF involvement, citing past resistance levels and bullish patterns.

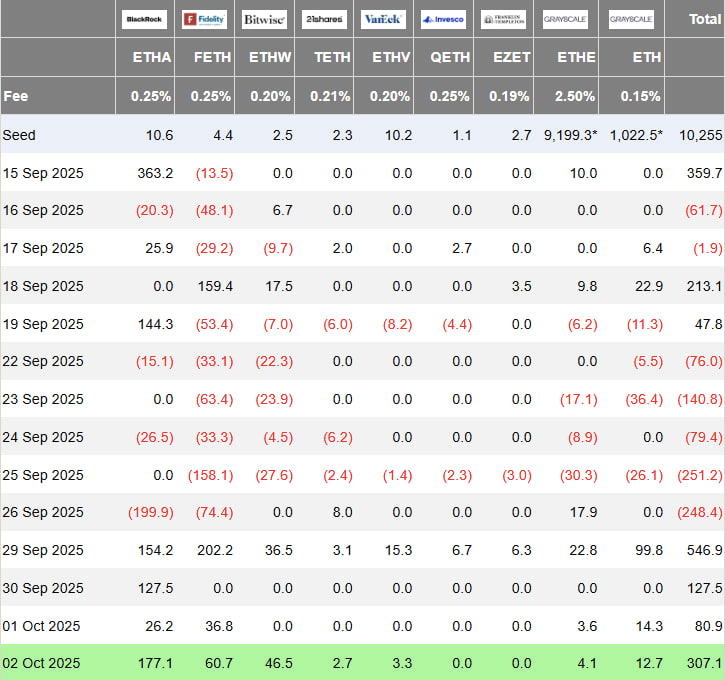

- Ethereum saw a $307M ETF inflow, with BlackRock investing $177M, highlighting institutional confidence.

Ethereum’s price is showing strong potential to reach $10,000, driven by institutional interest and the growing influence of exchange-traded funds (ETFs), according to several market analysts. Ethereum’s current upward momentum has sparked optimistic projections from experts who expect a sharp rise in value.

Strong Technical Indicators Support Ethereum’s Growth

Ethereum has been showing a solid recovery with increased momentum. Analyst Cas Abbé noted that Ethereum is undergoing a strong weekly retest, accompanied by healthy volume. Ethereum could retrace to the $4,100-$4,200 range before moving toward new all-time highs. He suggested that this price range could act as support before further price growth.

Abbé also projected a short-term price target between $5,500 and $6,000 by November, based on the current chart patterns. This outlook is supported by the substantial volume Ethereum has been experiencing. Volume activity often indicates price stability and potential for growth.

Merlijn The Trader’s Bullish $10K Prediction

Moreover, Merlijn The Trader has a more aggressive forecast for Ethereum. The Trader emphasized that Ethereum is showing bullish chart patterns that suggest a rise to $10,000. The Trader referenced past resistance levels, such as the skepticism around breaking past $1,500, $2,200, and $4,000. He pointed out that Ethereum is now on a stronger upward trajectory.

The Trader believes that the involvement of ETFs and Wall Street could drive Ethereum to new highs. “Cycles repeat, but this time ETFs and Wall Street send it nuclear,” The Trader noted. This shift could further boost Ethereum’s price as institutional players continue to enter the market.

Institutional Investment Boosts Ethereum’s Outlook

Ethereum is also receiving notable attention from institutional investors, as seen in the recent ETF inflow. Ethereum saw an ETF inflow of $307.1 million on the previous day, with BlackRock contributing $177.1 million of that total. This marks a significant shift, as institutional involvement has the potential to impact Ethereum’s price trajectory significantly.

This recent ETF inflow reflects an increasing trend of Wall Street players entering the Ethereum market. With such inflows, Ethereum’s price is likely to continue rising in the coming weeks. Ethereum was trading at $4,462.09, with a 24-hour trading volume of $44.4 billion. Ethereum is up 1.54% in the last 24 hours, signaling continued growth.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |