- Milan highlights critical role of data for Federal Reserve policy.

- Data access needed pre-FOMC meeting.

- Prospective views on interest rates impact policy decisions.

On October 3rd, the Federal Reserve’s Milan emphasized the need for crucial data access before the upcoming FOMC meeting, indicating a drop in neutral interest rates.

This highlights the Federal Reserve’s focus on forward-looking policy, which could influence cryptocurrency markets via interest rate adjustments and subsequent economic impacts.

Milan’s Call for Timely Data Access and Policy Impact

Milan emphasized the importance of timely data access to inform Federal Reserve policies. He noted that a lack of such access ahead of the next FOMC meeting could lead to inaccurate policy decisions. The statements highlighted concerns about reliance on outdated data.

Milan indicated that adjustments to interest rates may be considered, suggesting the neutral rate has declined. This perspective suggests potential shifts in monetary policy approaches, potentially influencing economic outlooks.

Market observers reacted to Milan’s comments with heightened attention to upcoming Federal Reserve announcements. Industry experts expressed interest, anticipating potential implications for financial stability and economic growth, while emphasizing the need for real-time data.

Bitcoin Market Insights Amidst Federal Reserve Announcements

Did you know? The Federal Reserve’s shift towards a lower neutral interest rate aligns with global trends, where central banks continuously adapt data analysis methods to maintain economic stability in dynamic markets.

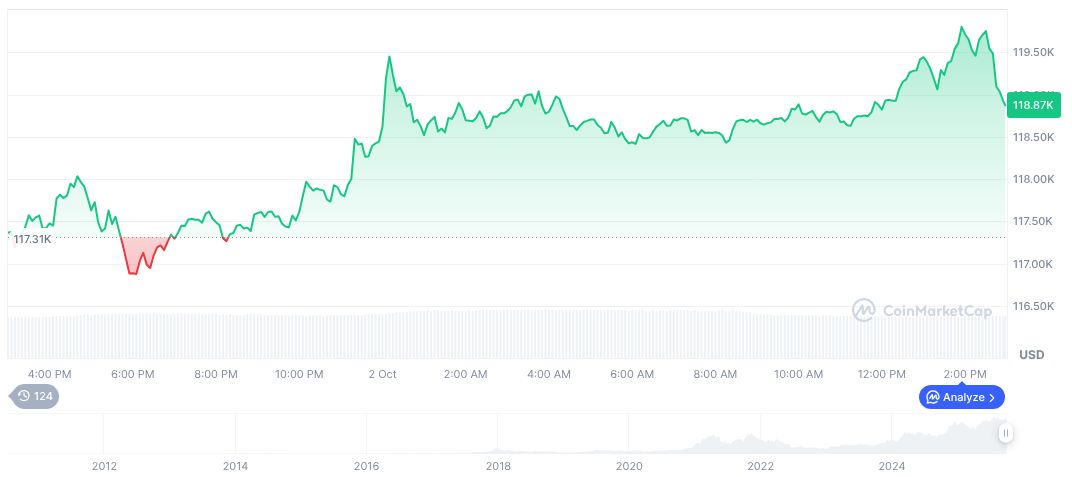

Bitcoin (BTC) is currently priced at $120,329.57, with a market cap of “2.40 trillion”. It commands a 58.16% market dominance amidst a 24-hour trading volume increase of 4.75% to $71.11 billion. The price of BTC has seen a 0.59% rise over the past day. Data from CoinMarketCap, UTC, October 3, 2025.

According to Coincu analysts, Milan’s focus on forward-looking policies may reflect broader shifts in financial regulation and technology. Historical trends suggest policymakers increasingly utilize real-time data analytics, enhancing proactive monetary strategies in evolving economic landscapes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |