Key Points

- Analyst Ted notes $200M in long liquidations stacked near the $200–$220 zone.

- Ali identifies $260 as the breakout level that could drive SOL toward $400–$520.

- Blockworks reports Solana DEX volume hit $325.48B in Q3, up 21% from Q2.

Solana faces over $200 million in long liquidations concentrated between the $200 and $220 range, according to analyst Ted. This cluster of liquidity may trigger liquidations if price sweeps into the zone, but the $200 level continues to act as a strong support base.

Ted notes that such a liquidity grab would not necessarily signal weakness, since market structure favors continuation once the zone is absorbed. This key support mirrors Ethereum’s $4,000 floor, where strong demand consistently reinforces bullish bias.

Meanwhile, analyst Ali observes Solana trading near $225.77 after weekly gains of 7.15%. He identifies $260 as the decisive resistance level, where a weekly close above could confirm a breakout toward $400–$440, with a potential extension to $520.

Support remains anchored at $200, which has repeatedly defended against sell pressure. Ali emphasizes that the $260 breakout trigger is essential for unlocking Solana’s next bullish leg.

Technical Strength and Ecosystem Growth

Furthermore, Crypto Crew University highlights Solana’s recovery from its $8 bear market low to a peak near $255 this year. The token currently trades above major moving averages, confirming bullish structure within its ascending channel, with support seen at $186.83 and $132.41.

If the channel holds, the next technical upside targets stand near $407 and $475. Momentum indicators also remain favorable, showing continuation potential as long as SOL sustains its position above critical support.

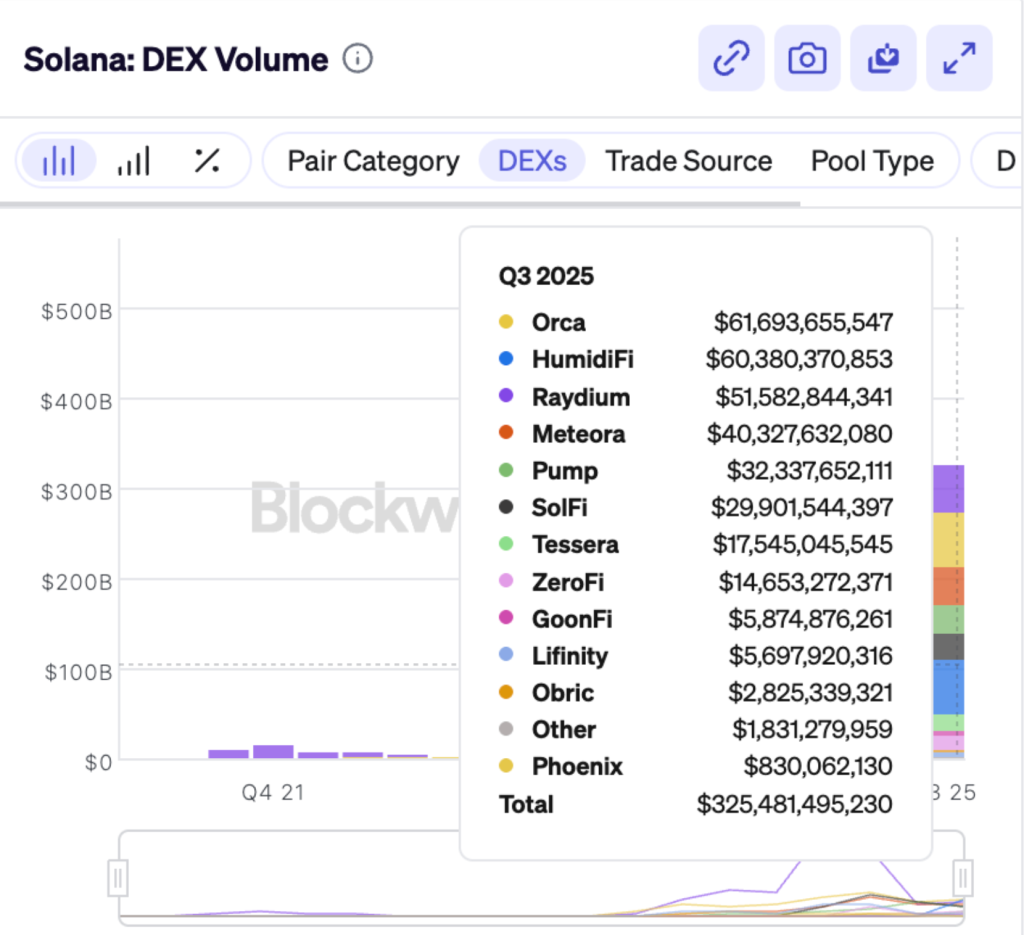

Beyond technicals, Blockworks reports Solana processed $325.48 billion in decentralized exchange volume during Q3 2025, a 21% increase from Q2. Orca, HumidiFi, and Raydium led trading activity with over $173 billion combined, while Meteora, Pump, and SolFi added further traction.

Smaller protocols including Lifinity, GoonFi, and Obric also contributed to ecosystem growth, reinforcing Solana’s rising dominance in decentralized trading. This expansion, coupled with strong technical structure, signals that Solana’s long-term trajectory remains bullish despite near-term liquidity risks.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |