In Brief

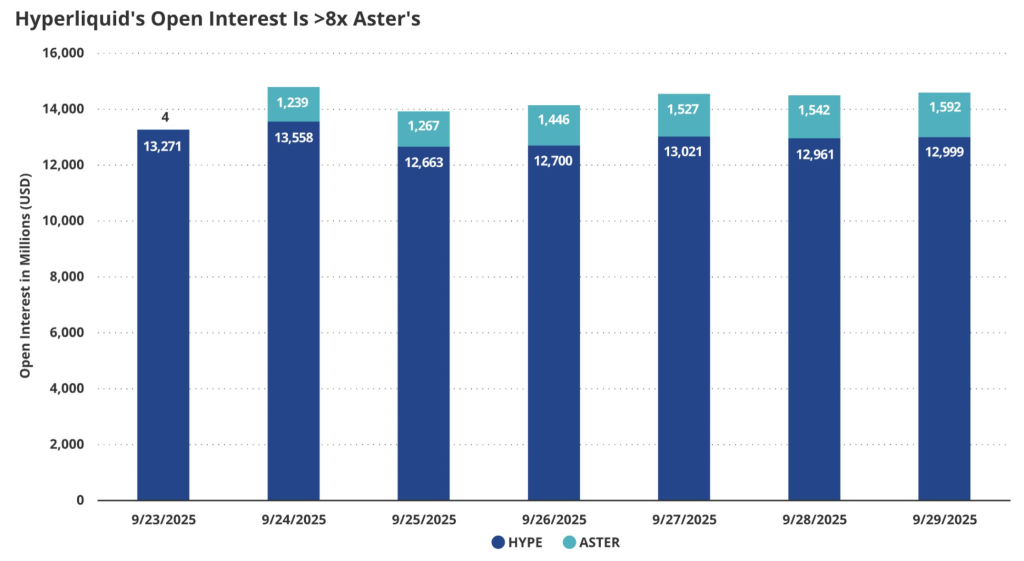

- HYPE’s open interest averages $13B, over 8× larger than ASTER’s $1.6B range.

- HYPE trades near $48.9 with a $16.46B cap, showing strong derivatives engagement.

- Total Hyperliquid ecosystem liquidity surpasses $2B across major DeFi protocols.

Hyperliquid ($HYPE) continues to dominate the DeFi derivatives sector, maintaining open interest levels over eight times higher than Aster ($ASTER). According to VanEck’s September report, Hyperliquid’s fundamentals remain stronger than Aster’s, supported by sustainable tokenomics and rising market confidence.

Data from DeFi Llama shows HYPE averaging $13.0–$13.5 billion in open interest, while ASTER trails between $1.2–$1.6 billion. This consistency reflects robust trader participation and deeper liquidity within the Hyperliquid ecosystem.

Over the week of September 23–29, HYPE’s open interest held steady near $13 billion, showing firm institutional engagement. In contrast, Aster’s open interest dropped 7.74% in the past 24 hours to $1.12 billion, suggesting a capital outflow.

VanEck’s comparison also emphasised HYPE’s tighter supply and stronger revenue backing from exchange activity. This gives Hyperliquid more predictable tokenomics and long-term sustainability compared to Aster’s higher supply and dilution risk.

Technical Setup and Market Performance Point to Short-Term Consolidation

According to Coinglass, HYPE trades around $48.91, marking a -2.1% daily decline with a market cap of $16.46 billion. Open interest stands at $2.41 billion, underscoring continued derivatives engagement despite minor price weakness.

On the 4-hour chart, HYPE has formed a bear flag pattern, indicating short-term consolidation. Support lies between $48.59 and $47.18, while resistance near $52.9 could confirm a breakout if buying momentum returns.

Despite near-term softness, RSI at 53.56 signals neutral momentum, leaving room for upward continuation. Over seven days, HYPE gained 9.25%, while its year-to-date performance shows a strong +104.72% rally.

Ecosystem growth continues as HyperLend ($623.45M TVL), Hyperliquid ($617.03M), and Hyperbeat ($376.95M) push total liquidity above $2 billion. Supported by robust fundamentals and consistent participation, HYPE remains a leading asset with bullish long-term prospects.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |