- Bitcoin and Ethereum maintain stability amid market declines.

- Experts suggest a bottom-building phase with possible upsides.

- Focus on strategic asset selection during realignment opportunities.

Kyle of DeFiance Capital has highlighted the current crypto market condition as resembling crisis periods like FTX’s collapse, noting surprising stability in BTC and ETH despite broader declines.

Market experts emphasize asset selection amid this cycle-ending event, as institutional actors and regulatory shifts could shape asset viability during this period of extreme volatility.

Historical Resemblance and Strategic Asset Focus

Recent market drop reintroduces concerns from historical crises, likening current events to the FTX and Celsius periods. BTC and ETH stability contrasts with altcoins’ sharp declines, described by Kyle from DeFiance Capital as a “cycle-ending event.”

Statements from experts cite a “bottom-building” phase, suggesting potential upsides despite continuing risks. Market reactions highlight a trend towards strategic asset selections during uncertainty and opportunity.

“This drop can basically be considered a cycle-ending event, but this time BTC and ETH are surprisingly stable. The evolution of the crypto industry complex is indeed astonishing, but altcoins are clearly repeating the same tragedy… Extreme panic has been released, and the market is building a bottom, although there may still be room for further declines. We are certainly closer to the bottom than to the top. Choosing assets right now is crucial, as many projects may never recover.”

Market Data and Insights

Did you know? The cycle-ending tendencies observed in the current market phase mirror significant historical events, reshaping investor focus towards stability within leading cryptocurrencies like BTC and ETH.

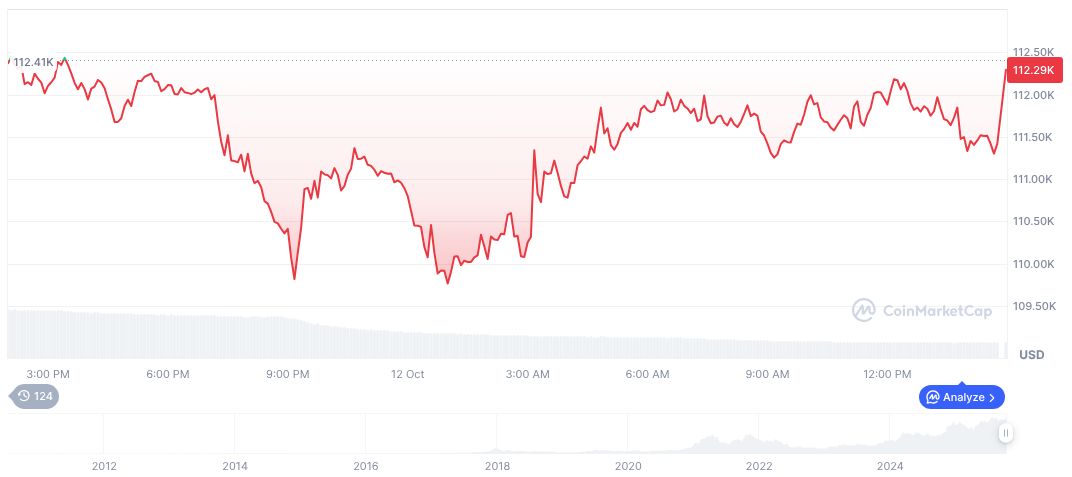

Bitcoin (BTC) is valued at $114,729.24 with a market cap of $2.29 trillion and market dominance of 58.83%. Trading volumes in the last 24 hours at $93.15 billion reflect a 5.01% change. Data by CoinMarketCap. BTC shows a slight drop across 7 days of -7.17%.

Insights from the Coincu research team highlight potential financial impacts from current market conditions. Regulatory outcomes remain critical, with technological shifts likely to redefine market strategies. Experts urge attention towards asset choices as the market stabilizes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |