- Main event: Bitcoin’s market shows resilience amid deleveraging, maintaining high ETF inflows.

- Bitcoin market structure remains intact despite recent volatility.

- Institutional demand continues with elevated trading volumes.

Glassnode’s recent report highlights Bitcoin’s resilience post-leverage flush, maintaining strong spot trading, persistent ETF inflows, and robust on-chain activity, indicating enduring institutional demand.

This suggests a stable market foundation despite sentiment shifts, signaling significant institutional interest and market activity, crucial for Bitcoin’s potential recovery and growth.

Resilience and Institutional Demand Bolster Bitcoin’s Market

According to the recent report by Glassnode, Bitcoin’s market structure remains fundamentally strong. High spot trading volumes are accompanied by persistent ETF inflows, signaling continued institutional interest. As Rafael Schultze-Kraft, CTO & Co-Founder, Glassnode, states, “Despite the severe impact of the crash event, the overall market structure remains intact. Bitcoin’s spot trading volume continues to be high, ETF inflows are ongoing, and the adjusted transfer volume indicates strong on-chain activity. These dynamics suggest that while leveraged participants have been forced to exit, structural capital and institutional demand still exist.” The overall sentiment reflects cautious optimism among investors following a significant deleveraging event.

Recent adjustments have cooled short-term speculation, leading to a more measured market phase. While speculative positions have reduced, market participation levels remain largely unchanged. The sector sees a cautious rebuilding of confidence with selective risk-taking in both spot and derivatives markets.

Historical Context, Price Data, and Expert Analysis

Did you know? A similar Bitcoin market reset occurred in the spring of 2021, where an excess leverage purge was followed by consolidation, reinforcing market structure and attracting new institutional investments.

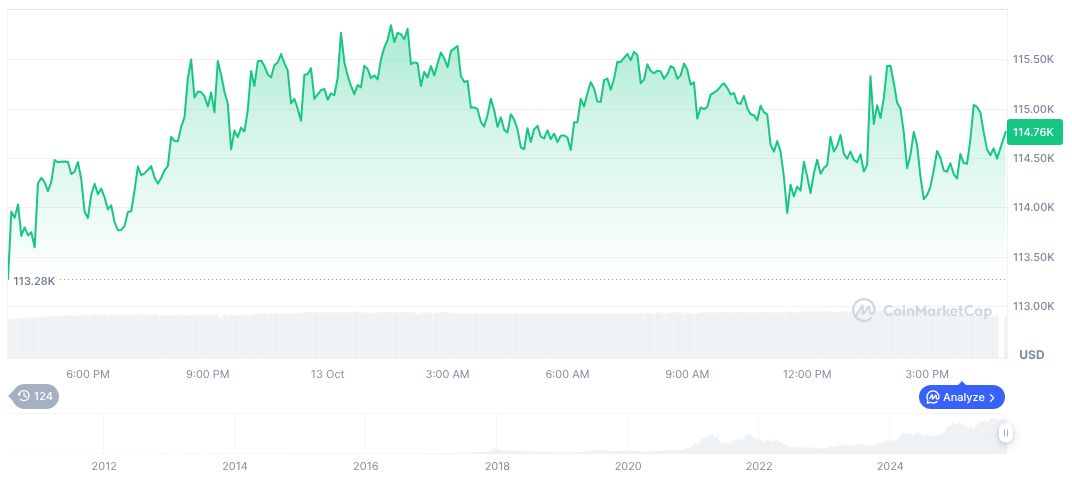

Bitcoin’s current price Bitcoin’s current price stands at $111,687.92, with a market cap of $2.23 trillion and dominance at 58.91%. Trading volume over 24 hours has decreased by 18.30%, while the price has declined by 3.13% in that period. (Source: CoinMarketCap)

The Coincu research team highlights that recent deleveraging could facilitate a long-term market stabilization by reducing speculative risk. Historical trends show that such market adjustments often lead to renewed investor confidence and provide stronger groundwork for future growth in the crypto sector.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |