In Brief

- Bitcoin’s regime score signals structural weakness, suggesting a possible drop toward $75K support

- Whale unrealized losses mirror past volatility zones, hinting at upcoming major market moves

- 90% of Binance altcoins below 200DMA, matching historical bottom accumulation patterns

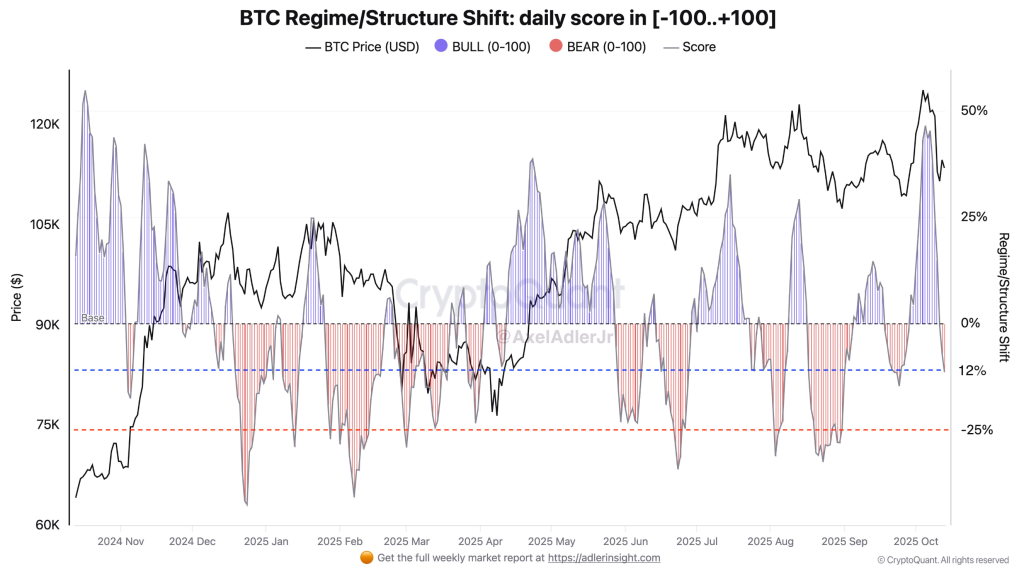

Bitcoin remains in the $90K–$105K range, but several metrics now point to a fragile bullish foundation forming. CryptoQuant analyst Axel Adler Jr highlights regime shifts between bullish and bearish zones, suggesting market instability.

The regime score has fluctuated from +50% to –25%, indicating strong volatility rather than a sustainable upward trend. Adler believes a more decisive correction toward $75K could reset sentiment and support a more durable bullish phase.

This view is supported by structural behaviour, where frequent transitions show investors lack conviction at current price levels. Therefore, without a stronger base, Bitcoin risks facing further downside before resuming any extended macro uptrend.

Whale Losses and Altcoin Capitulation Suggest Accumulation Phase Ahead

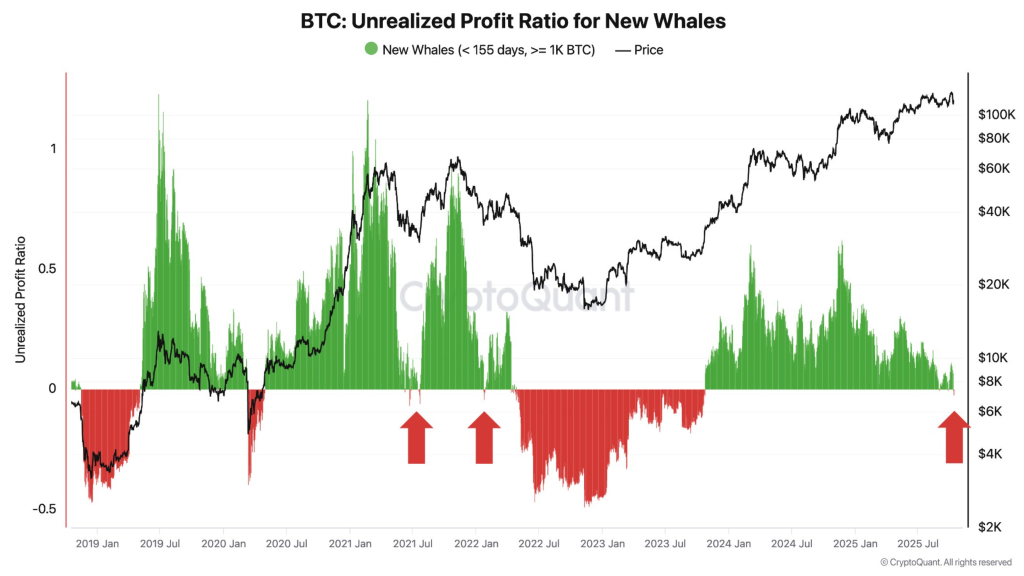

CryptoQuant’s Ki Young Ju notes that new whales, holding 1,000+ BTC for under 155 days, are now underwater. The unrealised profit ratio has turned negative, historically signalling major volatility and market inflexion points.

This metric previously marked sharp moves in 2021 and 2022, where similar conditions led to trend reversals. Although neutral in direction, it often signals whale repositioning, which tends to precede major price swings.

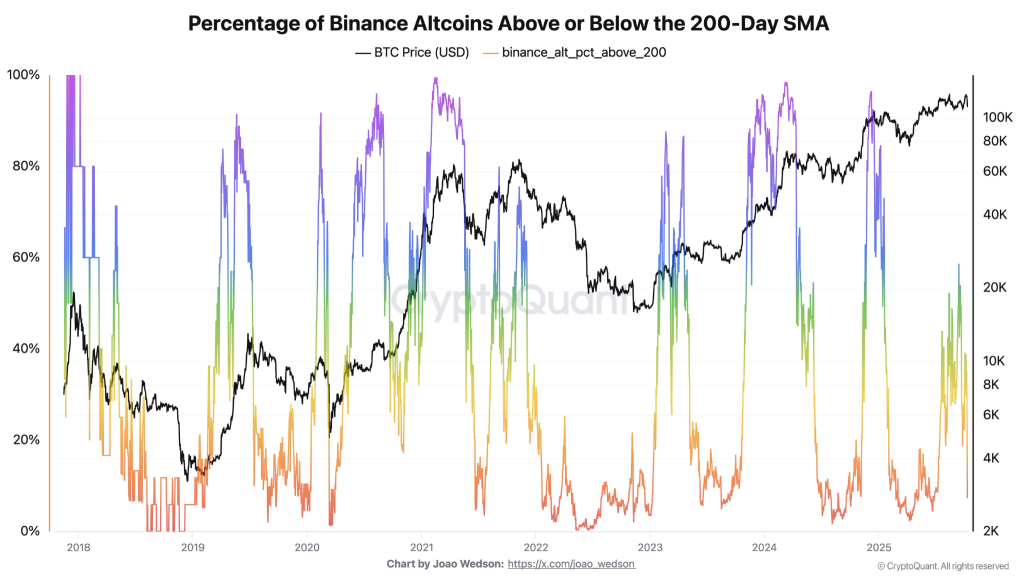

Meanwhile, CryptoQuant’s Darkfost reports only 10% of Binance-listed altcoins trade above their 200-day moving average. This 90% breakdown level reflects past capitulation zones seen in 2019, 2020, and mid-2022 before rallies began.

These levels often provide ideal accumulation conditions, as altcoins become significantly undervalued during broader market fear. Analysts suggest such conditions typically lead to medium-term bullish cycles once sentiment begins to stabilise.

Santiment also observes that recent spikes in crowd fear have closely preceded sharp short-term rebounds in Bitcoin. Historical patterns show that panic-driven sentiment often acts as a contrarian indicator, setting up favourable entry points.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |