In Brief

- Ethereum records $429M ETF outflows as price slips below key $4,060 support level.

- Analyst sees bullish triple-dip pattern signaling a potential breakout toward $8,000.

- Tom Lee’s Bitmine Immersion now holds over 3 million ETH, showing strong accumulation.

Ethereum (ETH) saw $429 million in spot ETF outflows on October 13, extending its three-day losing streak. Bitcoin spot ETFs also recorded $327 million in net outflows, though BlackRock’s IBIT posted a small net inflow.

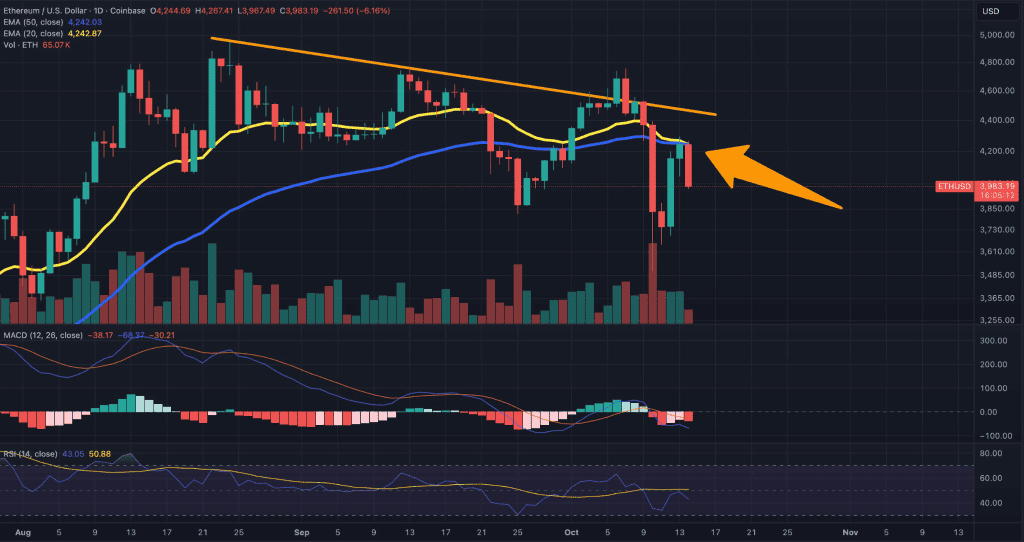

Ethereum is currently trading at $3,901.86, continuing its short-term downtrend across multiple timeframes. The asset has lost over 16% in the past week, showing persistent selling pressure and declining momentum.

Moreover, ETH recently lost the $4,060 support level, pushing it toward the next key zone between $3,400 and $3,600. Although the market shows weakness, ETH may rebound if it reclaims the $4,060 and $4,250 support levels.

Source: X

The 50-day EMA stands as a strong resistance at $4,250, and ETH must break above this to confirm a bullish shift. Until then, bearish control remains evident across major crypto charts, including BTC and SOL.

Institutional Accumulation and Chart Patterns Offer Bullish Hope

Despite short-term weakness, institutional investors continue accumulating ETH, signaling potential upside. Tom Lee’s Bitmine Immersion (BMNR) now holds over 3 million ETH as of October 14.

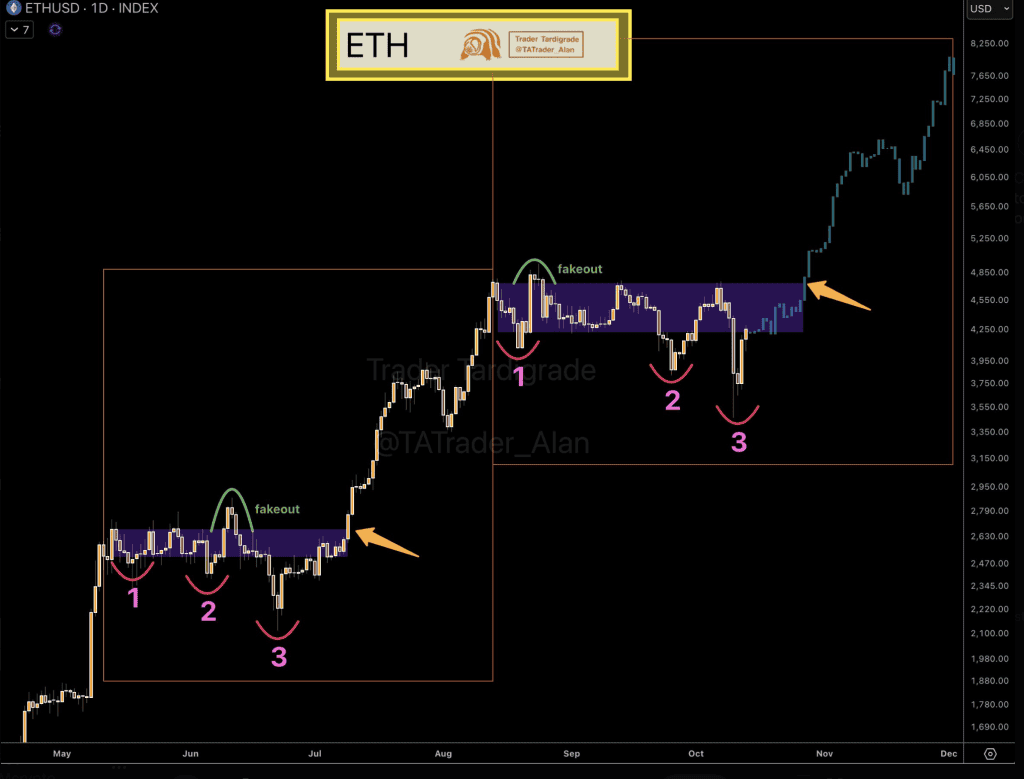

Moreover, the chart shared by analyst Trader Tardigrade shows a bullish pattern forming on the daily ETH/USD chart. The structure includes three rounded dips inside a consolidation zone, hinting at an upcoming breakout.

Source: X

This setup mirrors a previous rally that followed a similar pattern, suggesting a potential move toward the $7,500–$8,000 range. ETH has now returned to its consolidation zone, building momentum for the next move.

While near-term technicals remain uncertain, strong accumulation may limit downside risks and fuel the next major rally. A clean breakout above the 50-day EMA would shift momentum back to the bulls.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |