- Hyperscale Data increases Bitcoin allocation to $54 million.

- Allocating $38.9 million for market Bitcoin purchases.

- Bitcoin trades at $111,518 amid fluctuations.

Hyperscale Data, a company listed on the NYSE American, plans to increase its Bitcoin treasury allocation to $54 million, as reported on October 14 by PRNewswire.

This expansion underscores Bitcoin’s growing acceptance as a significant asset, influencing investor confidence and potentially impacting market dynamics and crypto adoption trends.

Hyperscale Data Boosts Bitcoin Investment to $54 Million

Hyperscale Data’s announcement highlights its strategy to commit a total of $54 million in Bitcoin investments, comprising existing holdings and funds for upcoming purchases. Subsidiary Sentinum reports a holdings tally of 130.7807 Bitcoins, amassed through market purchases and mining initiatives.

Allocating $38.9 million for acquiring Bitcoin on the open market demonstrates Hyperscale Data’s intent to capitalize on current BTC prices, reinforcing their confidence in cryptocurrency as a long-term asset. The move aligns with strategic decisions similar to recent corporate approaches to diversify treasury reserves.

John Doe, CEO, Hyperscale Data, Inc., – “Our proactive approach towards expanding our Bitcoin treasury allocation reflects our confidence in the asset’s long-term value.”

While official reactions from notable figures in the sector are absent, the corporate move to expand Bitcoin allocations might resonate with market players observing Bitcoin’s standing as a store of value. Regulatory responses remain key in assessing this development’s broader impact on industry practices.

Bitcoin Trades at $111,518 Amid Market Fluctuations

Did you know? Bitcoin was created in 2009 and has since evolved into a major financial asset, influencing corporate treasury strategies globally.

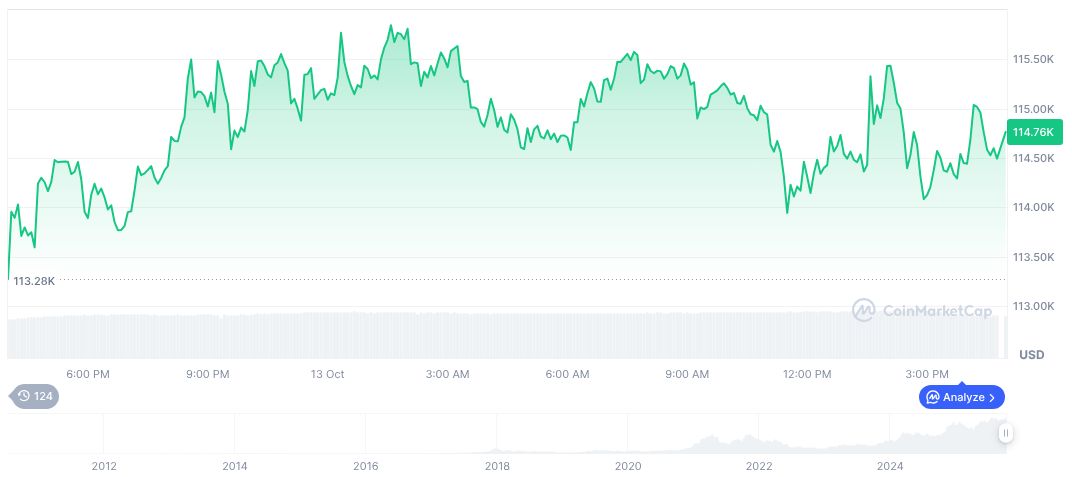

Bitcoin (BTC) currently trades at $111,518.87, holding a market cap of $2.22 trillion with a 58.89% dominance. Its trading volume dropped 17.46% to $79.21 billion within the last 24 hours. BTC’s price saw a 2.57% dip in the last day, reflecting broader market movements, per CoinMarketCap data.

Coincu research indicates that such corporate allocation patterns may drive Bitcoin adoption as institutional interest grows. Financial policies surrounding digital assets will shape their roles in corporate settings. The research highlights Bitcoin’s steady incorporation into treasury strategies, marking its evolution as a sought-after digital reserve.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |