- US government’s 127,000 BTC seizure questioned, lacks official confirmation.

- ZachXBT highlights possible wallet vulnerabilities.

- Market reaction hinges on further government statements.

On October 14, blockchain analyst ZachXBT revealed on X that approximately 127,000 Bitcoins seized by the US government were linked to vulnerable wallets flagged in a prior report.

The acquisition method raises questions about legality, lacking official confirmation or government statements, leaving the market to speculate on potential impacts.

US Government’s Potential 127,000 BTC Seizure Under Scrutiny

The US government allegedly seized approximately 127,000 Bitcoin worth around $14 billion, according to blockchain analyst ZachXBT. The wallets involved were flagged for security vulnerabilities in the Milky Sad Report two years ago, raising questions about the acquisition method.

Legal aspects of the reported seizure are under debate, given the lack of an official statement from the US Department of Justice. The suggestion that the BTC was ‘hacked’ back rather than legally seized adds complexity to the situation and poses potential arbitrariness concerns.

ZachXBT’s comments have sparked debate within the crypto community. Known for his reliable analyses, ZachXBT suggests a technical exploit by citing a lack of conventional official processes. As of yet, there is no confirmation from other key figures or regulatory bodies.

Largest Bitcoin Seizure Could Impact Market Dynamics

Did you know? The size of the alleged Bitcoin seizure would make it the largest in US history, exceeding the Silk Road-related historic $3.36 billion cryptocurrency seizure.

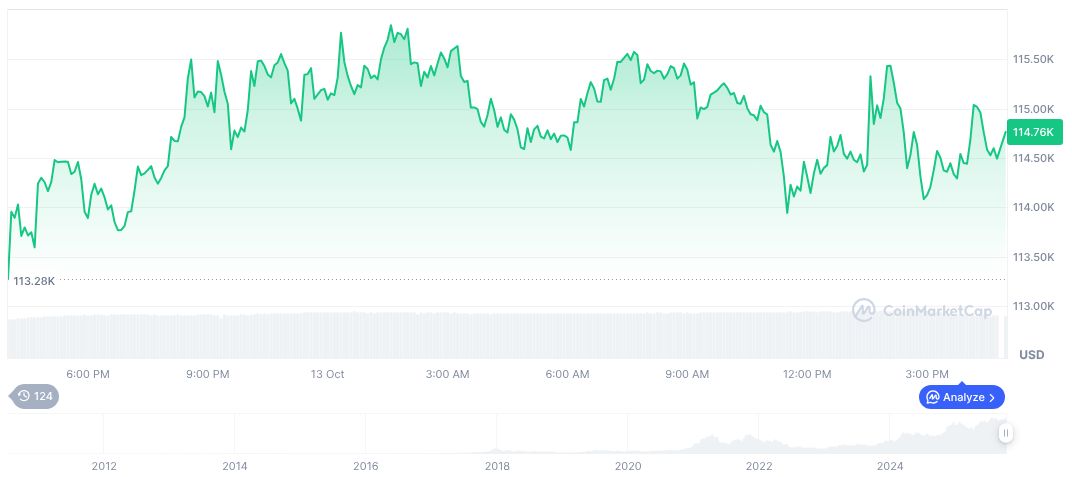

Bitcoin (BTC) is currently trading at $112,674.12, with a market cap of $2.25 trillion, representing a 58.72% share of the cryptocurrency market. According to CoinMarketCap, recent price movements show declines of 1.54% over 24 hours and 7.38% over the past week.

Experts from Coincu suggest that if the seizure gains official confirmation, it could shift financial dynamics significantly. A potential government liquidation could impact Bitcoin liquidity and investor confidence. Close monitoring of regulatory responses and potential technological improvements in security protocols remains essential.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |