In Brief

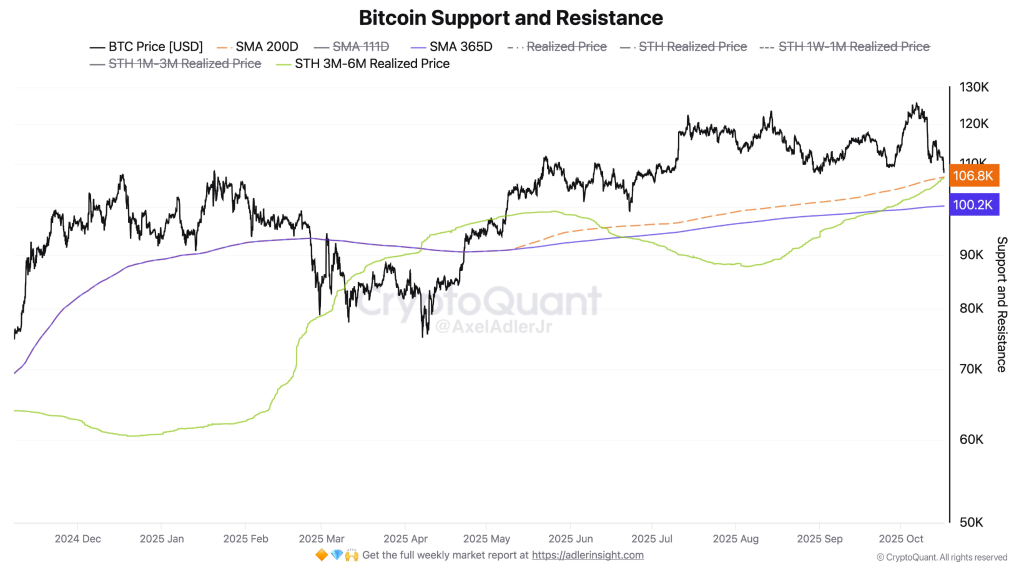

- Bitcoin holds above $106K support zone aligned with 200-day SMA and realized price.

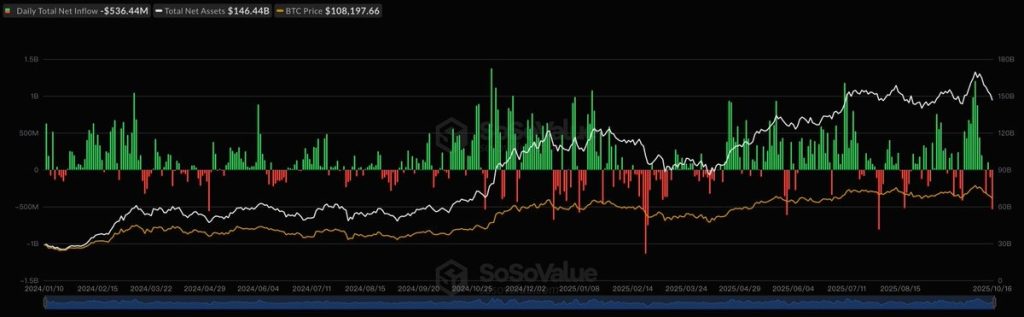

- ETF outflows hit $536M in a day, signaling institutional caution and profit-taking.

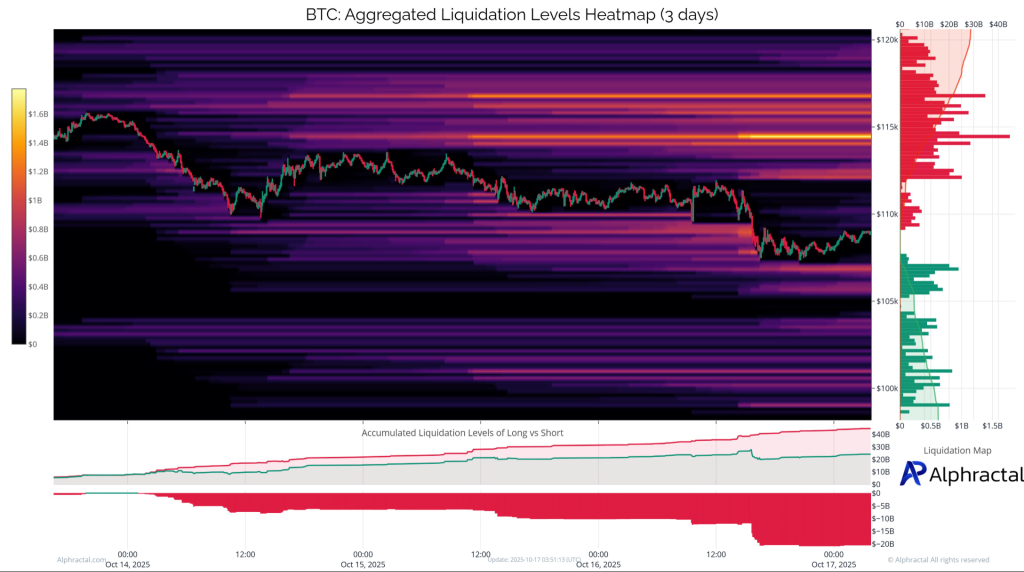

- Heatmaps show short squeeze potential with liquidation clusters near $115K–$117K.

Bitcoin is trading near a crucial support zone between $106,000 and $107,000, maintaining its medium-term bullish structure. This area aligns with the 200-day SMA and the short-term holder realized price range.

If this support fails, the next level lies around $100,200, near the 365-day SMA and the $100K psychological base. As long as Bitcoin holds above $100K, the broader uptrend remains intact despite current volatility.

Chart indicators show overlapping technical zones, which form a strong buffer to preserve Bitcoin’s upward momentum. However, downward pressure continues as price action weakens and sellers grow more active.

Binance futures data shows BTC dropped to $106,705 while the funding rate slid to 0.003%, suggesting weakening long interest. Despite this, open interest climbed to 236.1K BTC, showing traders are increasing positions.

Macro Headwinds and ETF Outflows Add to Pressure

U.S. spot Bitcoin ETFs recorded $536.4 million in net outflows on October 16, reflecting institutional profit-taking. BlackRock and Fidelity led the redemptions, contributing to the largest single-day withdrawal since July.

The market reacted with caution as macro risks from escalating U.S.-China tensions pushed investors away from risk assets like Bitcoin. China’s rare-earth export controls and U.S. tariff hikes deepened uncertainty in global markets.

Still, heatmaps show large short liquidation clusters near $115K–$117K, indicating the risk of a short squeeze rebound. Historical patterns from CryptoQuant also suggest strong late-October recoveries, supported by low exchange reserves and rising stablecoin flows.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |