- U.S. jobless claims decrease amid government shutdown.

- Claims drop from 234,000 to 215,000.

- Impact on economic stability and investor sentiment.

The U.S. saw a decrease in initial unemployment claims to 215,000 for the week ending October 11, amid a government shutdown delaying official Department of Labor reports.

Indicators like unemployment claims can shift financial market dynamics, impacting investor sentiment and economic stability, with potential ripple effects on digital asset markets.

U.S. Jobless Claims Fall to 215,000 Amid Shutdown

The U.S. unemployment claims data reported a decrease to 215,000 for the week ending October 11. This drop in claims is noted amid the federal government’s ongoing shutdown, affecting the release of official data. According to Bloomberg, missing data from select states was averaged using previous weeks’ numbers, ensuring greater data consistency.

The implications of the decreased claims suggest a potential shift in investor sentiment and economic forecasts. Average weekly claims from previous data were used to fill gaps, contributing to economic data stability in the absence of regular Department of Labor releases.

Market reactions have included cautious optimism, as a drop in unemployment claims typically signals a more robust labor market, although concerns over the shutdown’s impact on the broader economy persist. Market analysts continue to monitor these developments closely.

Crypto Market Eyes Economic Indicators Amid Lower Claims

Did you know? During the previous government shutdown in 2018-2019, U.S. jobless claims maintained relative stability, but investor anxiety contributed to downward pressure in various financial markets.

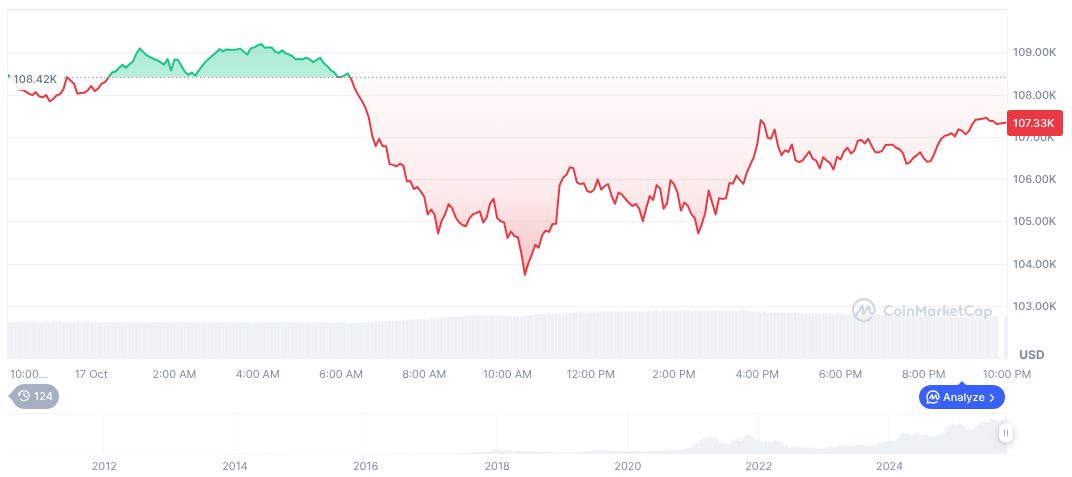

Bitcoin (BTC), trading at $106,942.98, has a market cap of $2.13 trillion and dominance at 58.82%, reported CoinMarketCap. Trading volume reached $95.34 billion, with a slight 0.07% decrease in 24 hours. Supply remains at 19,936,237 out of a 21 million max limit.

Coincu researchers highlight that the current economic environment may lead to increased scrutiny of regulatory policies affecting cryptocurrencies. Unemployment claims data, reflective of broader economic health, could sway financial markets and prompt shifts in regulation focus.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |