Key Insights:

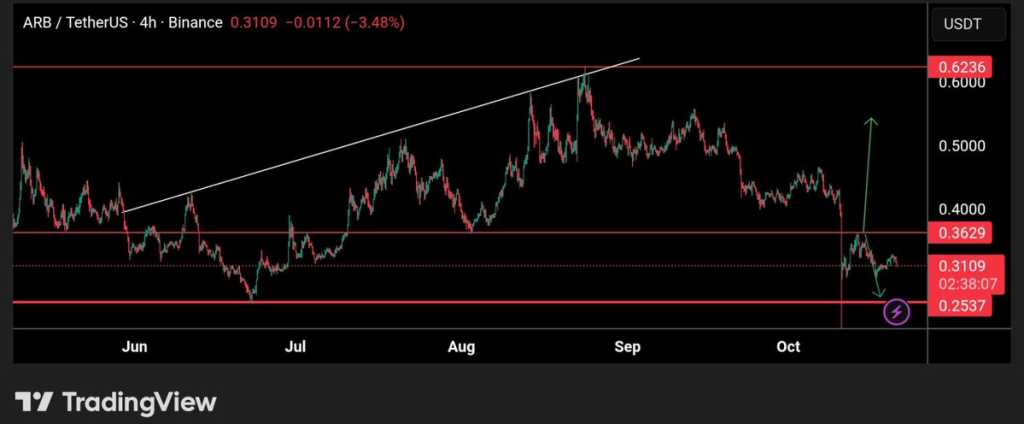

- ARB rejected at $0.36, traders eye $0.25 support for a possible short-term rebound opportunity.

- Arbitrum trades inside the $0.25–$0.60 range, signaling continued accumulation by market participants.

- Breakout above $0.36 may open a path to $0.40 and $0.56 if buying pressure returns.

Arbitrum (ARB) has moved lower after failing to break a key resistance level near $0.36. The price is now approaching a known support area, raising questions about whether the $0.25 level can hold as the next defense zone.

At the time of writing, ARB is priced at $0.3154, down 3.1% in the last 24 hours and 4.1% over the past week. Daily trading volume stands at approximately $136.9 million.

Rejection from Resistance at $0.36

The ARB/USDT 4-hour chart shows that ARB faced strong rejection at $0.3629. After testing this resistance, the price turned downward and began a slow descent toward lower levels. This movement confirmed that sellers are active around the $0.36 zone, which has capped recent upside attempts.

Analyst Zia ul Haque commented, “If the price breaks above $0.36 we may see an upward movement,” but until such a breakout occurs, this zone continues to serve as a short-term ceiling. The rejection signals that bullish strength was not enough to sustain a move higher at this stage of the trend.

ARB is now approaching a previously tested support zone around $0.2537. This area has held firm in earlier trading periods and could again attract buying interest. A bounce from this zone may lead the price back toward mid-range levels, but failure to hold could open the door for further declines.

According to Zia ul Haque, “This could be a good opportunity to buy,” referencing the price nearing support.

ARB in Long-Term Accumulation Phase

MacroStrategic shared that ARB remains in a wide accumulation range between $0.25 and $0.60. This structure has been held since early 2025, with multiple tests of both the upper and lower boundaries. The price has shown repeated rebounds from the $0.25 level, indicating that participants may still be building positions within this channel.

Analysts agree that a confirmed move above $0.36 would likely pave the way toward $0.40 and possibly $0.56. Until then, the asset is expected to trade within the existing range, with potential for volatility as it approaches either boundary.

Market Outlook

Volume remains stable, and the sideways price action suggests that large participants may be accumulating ARB. The outcome near the $0.25 support zone will likely shape the next directional move. Traders watching ARB are focused on whether the price can hold this key area or break down toward uncharted levels.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |